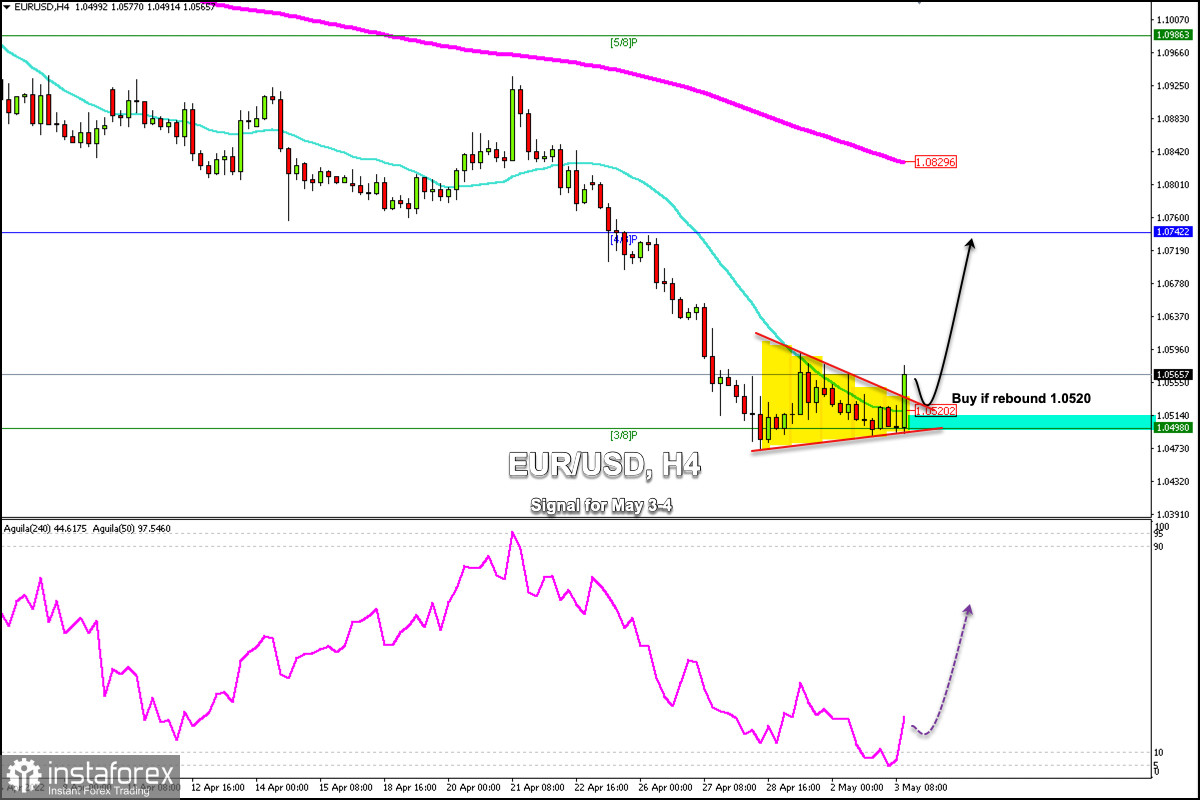

According to the 4-hour chart, the Euro has formed a symmetrical triangle pattern and is trading above the 21 SMA showing a positive signal.

This pattern break should be confirmed by a pullback towards the area 1.0520. If it bounces above 1.0520, the euro is expected to reach 1.0756 in the next few days, where 4/8 Murray is located.

On May 3, the eagle indicator reached the zone 5-point which represents an extremely oversold level. EUR/USD is likely to resume a technical rebound in the next few days.

In recent days, the 3/8 Murray level has acted as a strong bottom and has become strong support, limiting the loss of the euro and allowing it to consolidate above this area.

Therefore, if the euro remains above 1.0498 in the coming days, it is likely to bounce and recover gradually part of the losses. Hence, EUR/USD could reach the EMA 200 located at 1.0829.

This week will be decisive to know the future of the euro with the Fed's decision on interest rates that will be published tomorrow. The non-farm payrolls are due on Friday. The market is likely to react with strong volatility. We expect to buy the EUR/USD pair only if it consolidates above 1.0500.

The market always reacts contrary to the announcement as it is likely that the increase of 0.50% has been already priced in. The impact on the market will come with the speech by Powell and the announcements related to the Fed's balance sheet and the portfolio.

Our trading plan is to buy the euro if it bounces around 1.0520, with targets at 1.0637 and 1.0742. If the bullish force prevails, EUR/USD could reach the 200 EMA located at 1.0829. Conversely, if the euro falls below 1.0490, we should avoid buying.