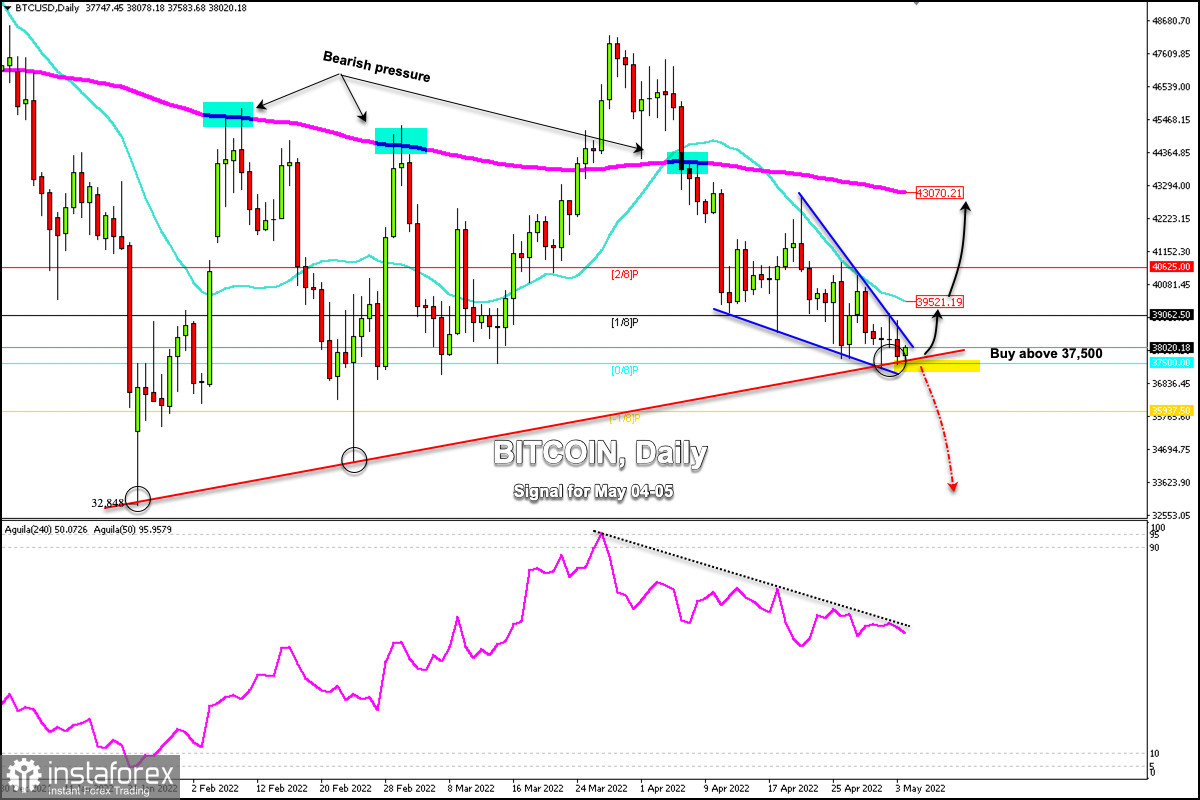

Since April 9, Bitcoin (BTC/USD) has been forming a symmetrical triangle pattern. It is currently trading below the 21 SMA and below the 200 EMA, with a strong bearish bias.

Since February 21, Bitcoin has been trying to break the EMA 200. However, the attempt was unsuccessful and it has been retracing and forming an uptrend channel.

Today in the European session, Bitcoin is at a turning point around 37,500. A technical bounce above 0/8 Murray could accelerate the bullish move and reach the resistance of the dynamic moving average at 39.521 (21 SMA).

A daily close above the psychological level of $40,000 could be a factor supporting the bullish momentum and we could expect it to reach the 200 EMA zone around 43,070 as its next target.

Conversely, a daily close and break below 37,500 could weaken BTC and it could reach the price levels of January 21, around 32,848.

Analysts believe that Bitcoin could continue its downward trend due to the decision of FOMC on an interest rate hike. Bitcoin price could retest the 28,000 level if it fails to stay above 37,500.

In general, an increase in interest rates negatively affects technology stocks and it is reflected in the main indices. This could cause investors to err on the side of caution and withdraw their capital from risk assets.

This week will be decisive for BTC, so we must be very cautious due to the expected high volatility.