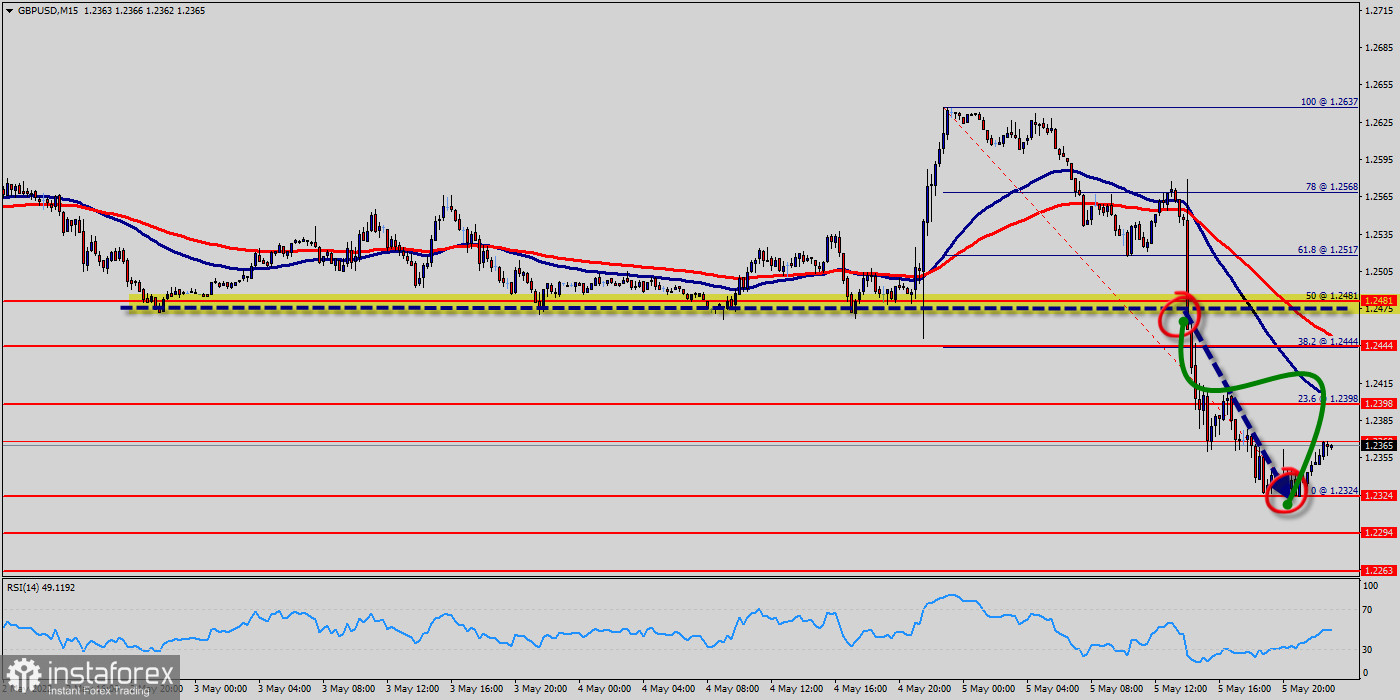

The GBP/USD pair reached a new minimum at the price of 1.2324. So, today the price may reach one more minimum around the spot of 1.2324.

Today, the GBP/USD pair is challenging the psychological resistance at 1.2444 , which coincides with the ratio of 38.2% Fibonacci retracement levels.

So, the resistance is seen at the level of 1.2444 in the M15 time frame. The level of 1.2517 coincides with a golden ratio (61.8% of Fibonacci), which is expected to act as major support today.

The Relative Strength Index (RSI) is considered oversold because it is below 70. The RSI is still signaling that the trend is upward as it is still strong below the moving average (100).

This suggests the pair will probably go down in coming hours. If the GBP/USD pair fails to break through the resistance level of 1.2444, the market will decline further to 1.2340.

This would suggest a bearish market because the RSI indicator is still in a positive area and does not show any trend-reversal signs.

We expect the GBP/USD pair to continues moving in a downtrend below the level of 1.2444 towards the first target at 1.2324, while major resistance is found at 1.2517 (61.8% Fibonacci Expansion).

On the downside, a clear break at the level of 1.2324 could trigger further bearish pressure testing 1.2294, which represents the major support today.