Crypto Industry News:

NFT of some of the most popular blockchain networks for the crypto art will be coming to Instagram with the pilot announcement next week.

According to unofficial information, the social media tycoon owned by Meta plans to integrate non-exchangeable tokens for Ethereum, Polygon, Solana and Flow. These networks handle the vast majority of digital collector's items trading, and Ethereum and its Bored Apes are leaders in terms of market capitalization.

The pilot will include a small group of NFT enthusiasts from the USA.

Instagram intends to support widely used crypto wallets such as MetaMask. By connecting them, users will be able to prove NFT ownership, showcase them on their profiles, and tag the creators who created them.

According to media sources, Instagram will not charge users for posting and sharing NFT, as Twitter initially did, for its hexagonal NFT profile photos in January.

The decision likely marks an inflow of new cultural "blood" to the NFT. Instagram has over a billion monthly active users, and many of them use the platform to promote and sell their art.

Technical Market Outlook:

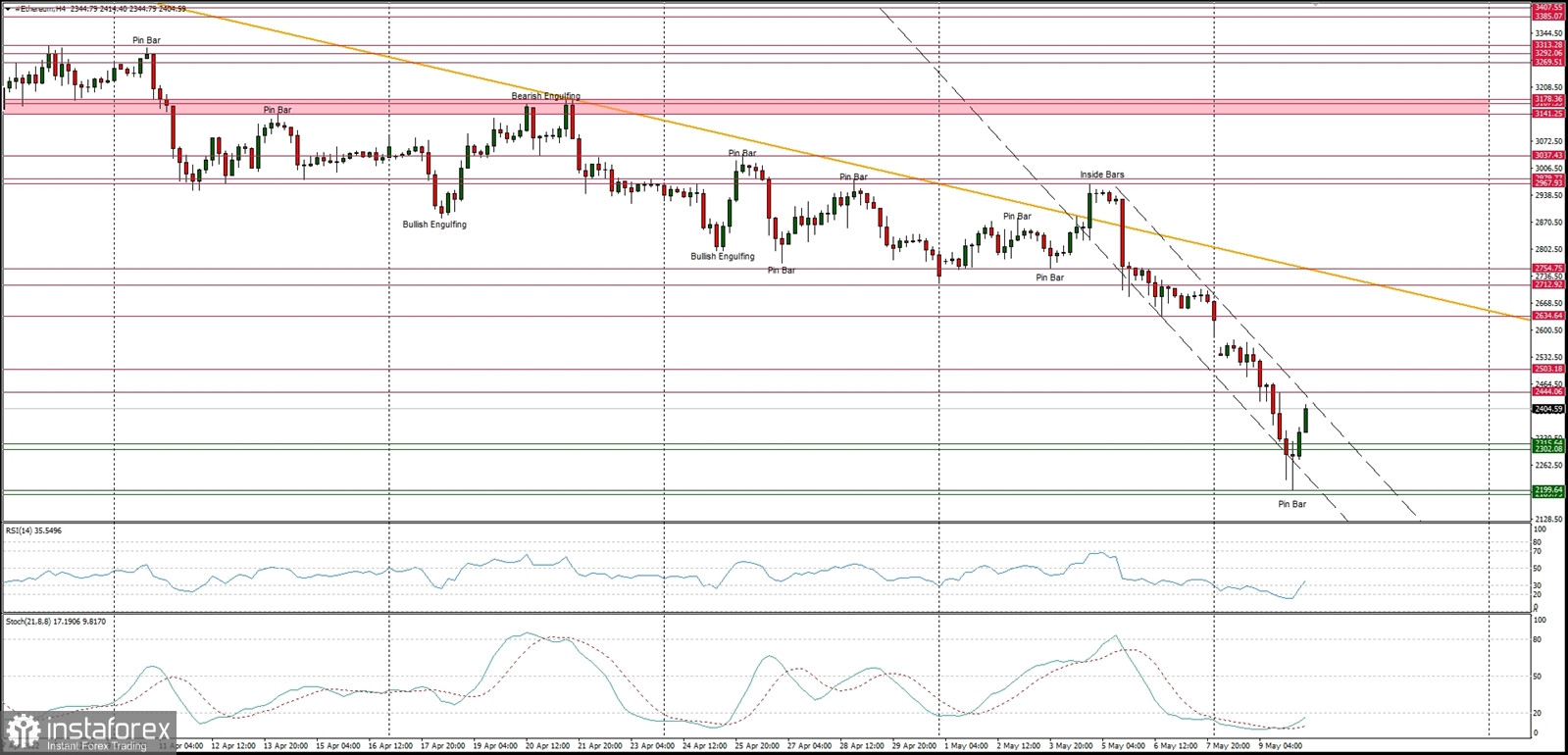

The ETH/USD pair had found a temporary bottom at the level of $2,199 and is currently trying to bounce higher, however, is still trading inside the acceleration channel. The nearest technical resistance is seen at $2,444 and $2,503. The weak and negative momentum supports the short-term bearish outlook with a new target for bears seen at the level of $2,000. The market keeps making lower lows and lower highs on the H4 time frame chart, so the down trend is intact.

Weekly Pivot Points:

WR3 - $3,235

WR2 - $3,103

WR1 - $2,780

Weekly Pivot - $2,614

WS1 - $2,276

WS2 - $2,128

WS3 - $1,807

Trading Outlook:

The down trend on the H4, Daily and Weekly time frames had broken below the key long term technical support seen at the level of $2,646 and continues to make new lower lows with no problems whatsoever. So far every bounce and attempt to rally is being used to sell Ethereum for a better price by the market participants, so the bearish pressure is still high. The long term target for bears is located at $2,000.