Crypto Industry News:

The United Kingdom, as part of Prince Charles' speeches at the ceremonial opening of the parliament, presented two bills regarding both the support and the takeover of cryptocurrencies.

In a publication issued by the Chancellery of the Prime Minister of the United Kingdom, the government announced that it would deal with the regulation of cryptocurrencies in the country by introducing the Act on Financial Services and Markets and the Act on Economic Crime and Corporate Transparency. The former aims to strengthen the country's financial services industry, including by supporting "safe cryptocurrency adoption." Under the proposed Financial Services Act, the measure will "reduce bureaucracy in the financial sector", attracting investors to the UK.

The Crime Act proposed to "create powers to hijack and recover cryptographic assets faster and easier" to reduce the risk for people who are targeted by ransomware attacks. The publication stated that the social and economic costs of financial crime were estimated at £ 8.4 billion per year.

Yesterday's opening of parliament was the first one that the Queen was unable to attend since 1963. Despite this, the Prime Minister's Chancellery continued to refer to the legislative agenda dealing with economic issues, crime, the ongoing pandemic and leadership as "Speeches by the Queen." Prince William and the Duchess of Cornwall were also present.

Technical Market Outlook:

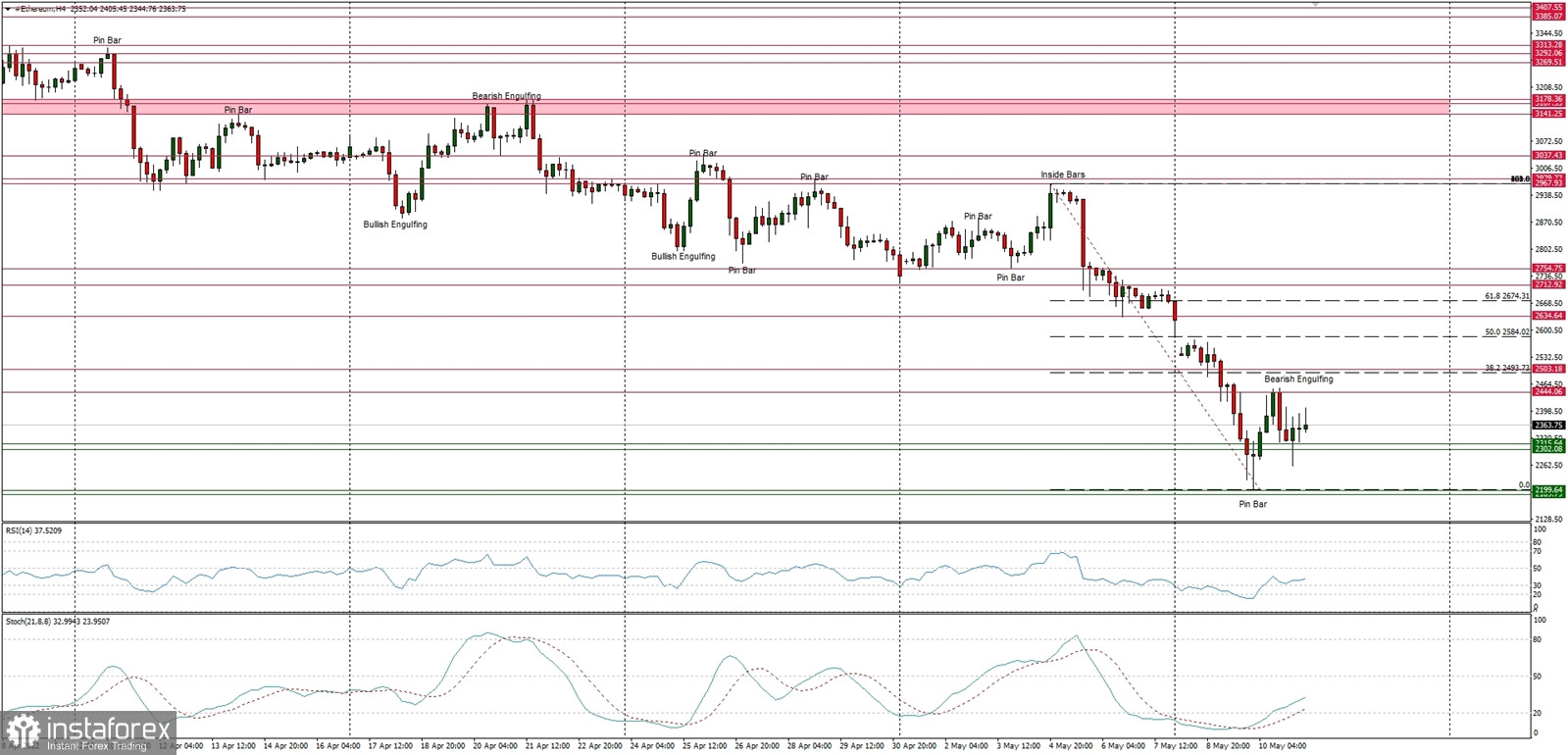

The ETH/USD pair had found a temporary bottom at the level of $2,199 and is currently trying to bounce higher. The nearest technical resistance is seen at $2,444 and $2,503. The bulls were rejected from the $2,444 technical resistance level and are reversing lower. The weak and negative momentum supports the short-term bearish outlook with a new target for bears seen at the level of $2,000. The market keeps making lower lows and lower highs on the H4 time frame chart, so the down trend is intact.

Weekly Pivot Points:

WR3 - $3,235

WR2 - $3,103

WR1 - $2,780

Weekly Pivot - $2,614

WS1 - $2,276

WS2 - $2,128

WS3 - $1,807

Trading Outlook:

The down trend on the H4, Daily and Weekly time frames had broken below the key long term technical support seen at the level of $2,646 and continues to make new lower lows with no problems whatsoever. So far every bounce and attempt to rally is being used to sell Ethereum for a better price by the market participants, so the bearish pressure is still high.