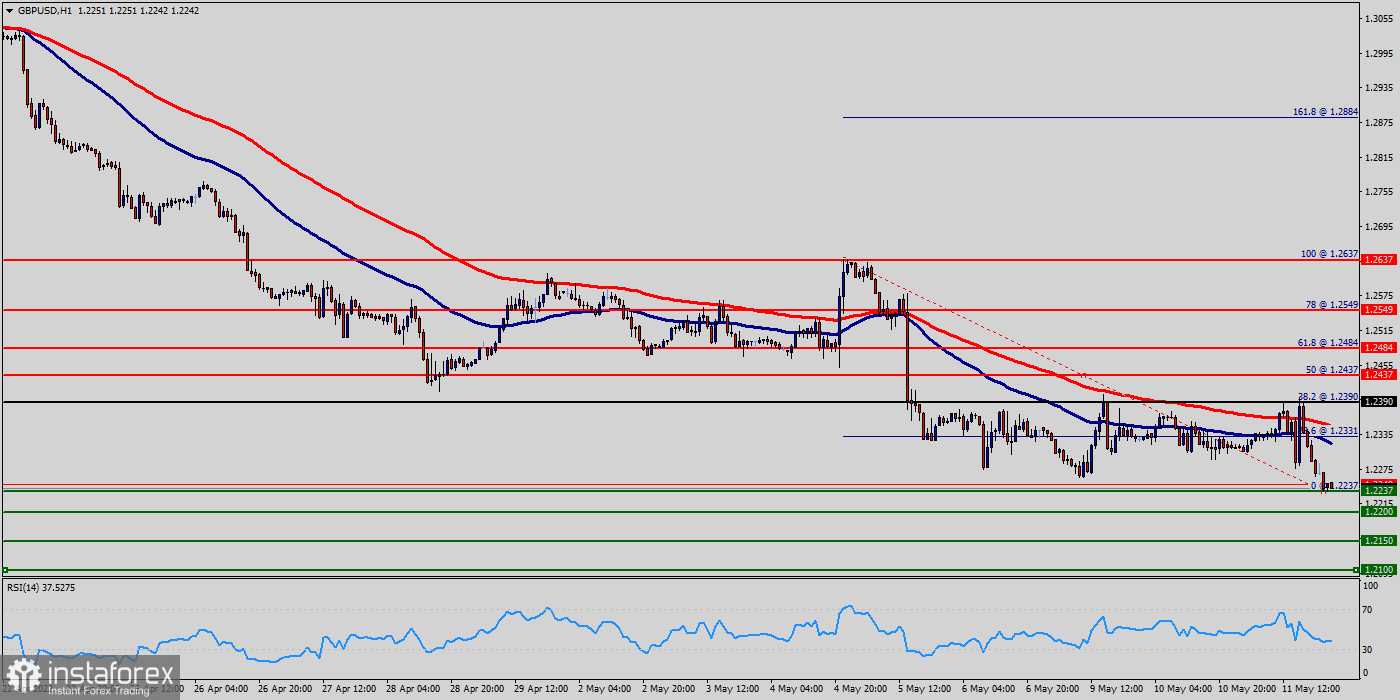

The GBP/USD pair has broken support at the level of 1.2390 which acts as a resistance now.

According to the previous events, the GBP/USD pair is still moving between the levels of 1.2390 and 1.2200.

Therefore, we expect a range of 190 pips in coming two days. The trend is still below the 100 EMA for that the bearish outlook remains the same as long as the 100 EMA is headed to the downside.

Hence, the price spot of 1.2390 remains a significant resistance zone. Equally important, the RSI is still calling for a strong bearish market as well as the current price is also below the moving average 100.

Consequently, there is a possibility that the GBP/USD pair will move downside. The structure of a fall does not look corrective.

In order to indicate a bearish opportunity below 1.2390, sell below 1.2390/1.2250 with the first target at 1.2200.

Besides, the weekly support 1 is seen at the level of 1.2150. However, traders should watch for any sign of a bullish rejection that occurs around 1.2150 (major resistance).

The level of 1.2390 coincides with 38.2% of Fibonacci, which is expected to act as a major resistance today. Since the trend is below the 38.2% Fibonacci level, the market is still in a downtrend. Overall, we still prefer the bearish scenario.