Crypto Industry News:

Despite the fact that it has still not made a final decision on the launch of the "digital shekel", the Israeli central bank said that public opinion about the project was mostly positive.

According to Reuters, the Bank of Israel summarized this week the results of the public consultation on the central bank's digital currency (CBDC) plans. It received 33 responses from a variety of sectors, half of which were from overseas and 17 from the domestic fintech community. Noting that the final decision on the fate of the project had not yet been made, he stated:

'All responses to the public consultation show support for further research on various implications for the payments market, financial and monetary stability, legal and technological issues and more.

While the public reportedly believes that a digital shekel would encourage competition in the payments market, the issue of privacy has proved controversial once again. The bank mentions that some commentators prefer the future currency to be fully anonymous, while others say the fight against money laundering and the black market makes anonymity impractical. The Bank of Israel is committed to continuing research and "fruitful dialogue with all stakeholders at all stages of research and development."

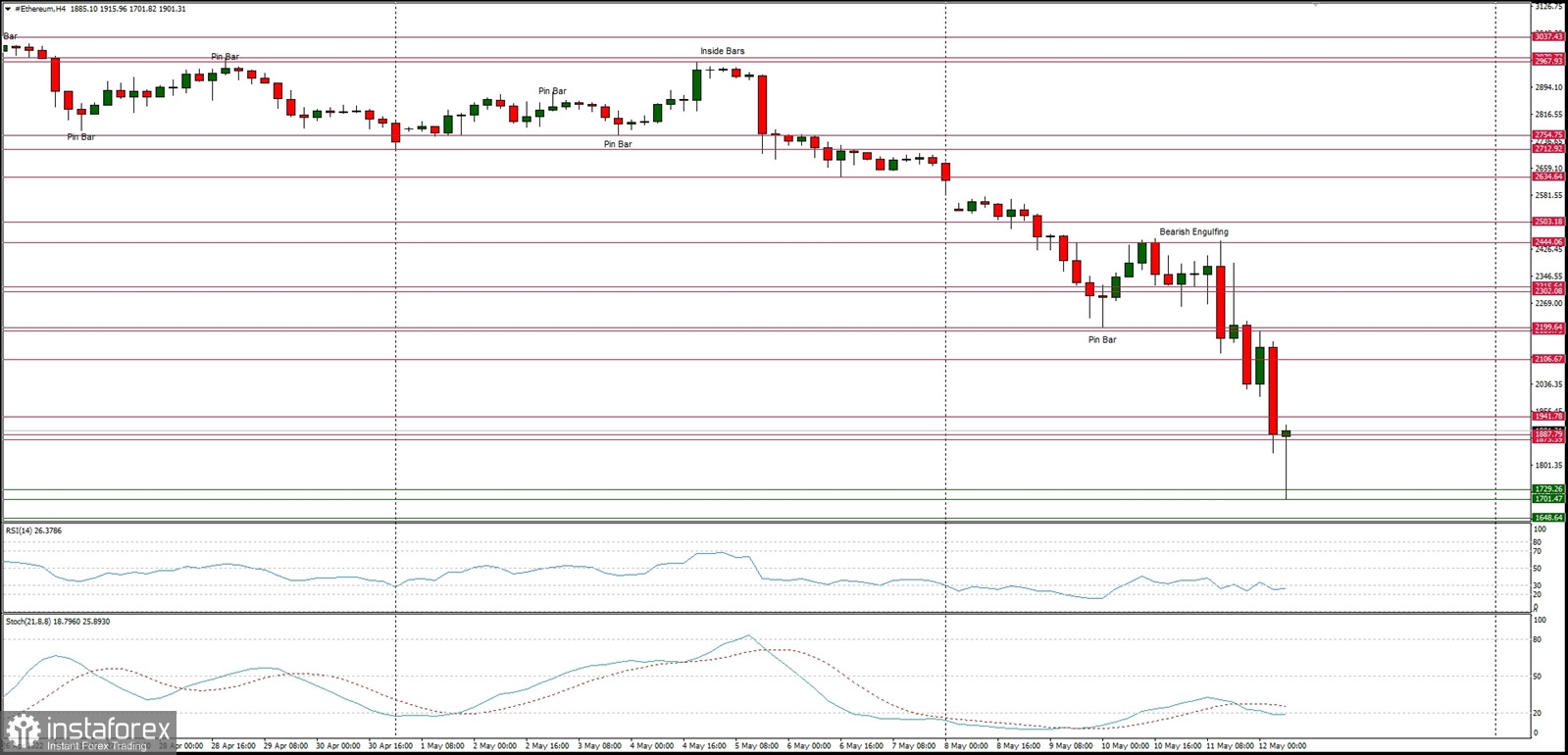

Technical Market Outlook:

The ETH/USD pair had clearly violated the temporary bottom at the level of $2,199 and made a new swing low at the level of $1,700. The nearest technical resistance is seen at $1,877 and $2,000, but the panic sell-off of ETh continues. The weak and negative momentum supports the short-term bearish outlook with a new target for bears seen at the level of $1,420. The market keeps making lower lows and lower highs on the H4 time frame chart, so the down trend is intact.

Weekly Pivot Points:

WR3 - $3,235

WR2 - $3,103

WR1 - $2,780

Weekly Pivot - $2,614

WS1 - $2,276

WS2 - $2,128

WS3 - $1,807

Trading Outlook:

The down trend on the H4, Daily and Weekly time frames had broken below the key long term technical support seen at the level of $2,000 and continues to make new lower lows with no problems whatsoever. So far every bounce and attempt to rally is being used to sell Ethereum for a better price by the market participants, so the bearish pressure is still high. The next target for bears is located at the level of $1,420.