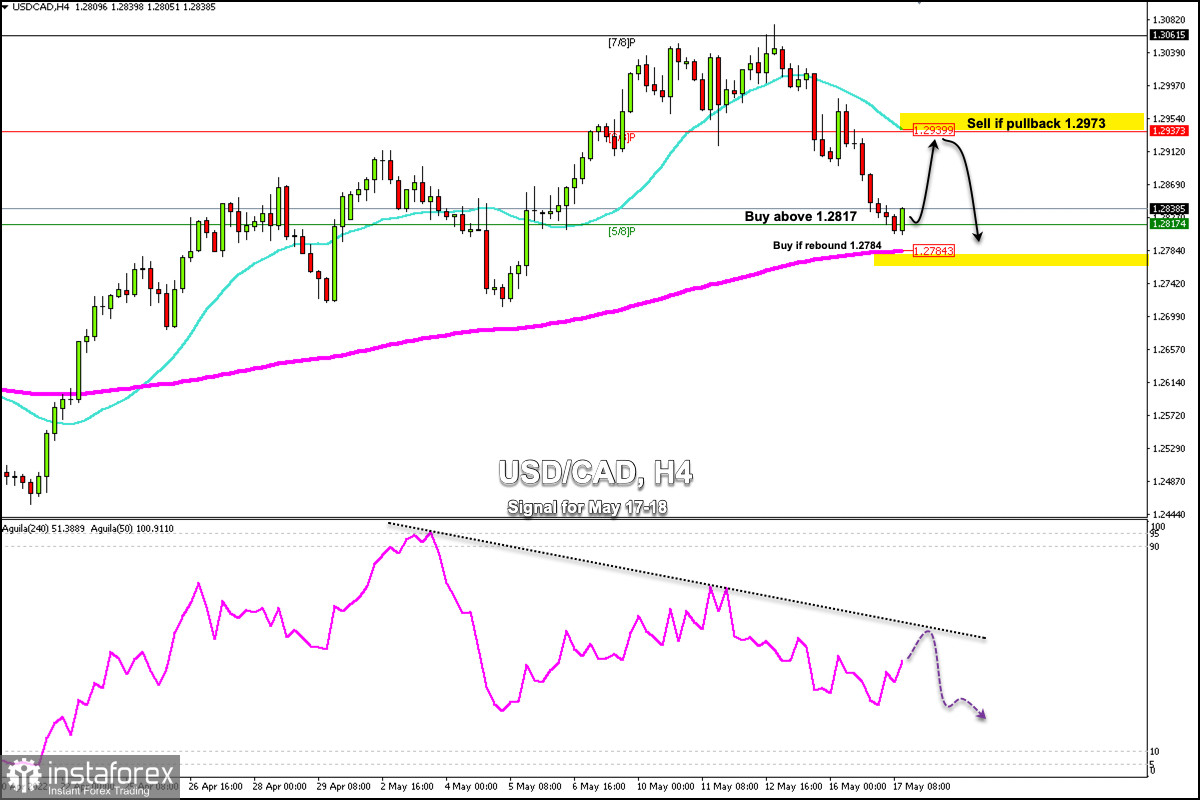

Early in the American session, the Canadian dollar (USD/CAD) is showing signs of a technical bounce, and is trading above 5/8 Murray and below 21 SMA.

Having reached the psychological level of 1.30 on May 11, the loonie started a strong technical correction and is likely to find support around the 200 EMA located at 1.2784.

Investors believe that the Fed will continue with its interest rate increases at a pace of at least 0.50% in its next meetings. The markets have already priced in this scenario and the US dollar is likely to make a technical correction in the coming days which could set the stage for the strengthening of the Canadian dollar.

The short-term trend for the USD/CAD pair is bearish. However, we can expect a technical bounce so that the pair could reach the 21 SMA or 6/8 Murray around 1.2937.

The bottom line would be to wait for the USSD/CAD pair to decline to 1.2939. So, we could sell with targets at 1.2817 and the 200 EMA at 1.2784.

Additionally, a sharp break and a daily chart close below 1.2784 will mean that the Canadian dollar has entered a bearish phase and any momentum will be seen as an opportunity to sell with short-term targets at 1.2500.

Our trading plan for the next few hours is to buy the Canadian dollar above 1.2817 or in the event of a technical bounce around 1.2784 (200 EMA) with targets at 1.2890 and 1.2939 (21 SMA).