Crypto Industry News:

Just days after opening its first over-the-counter Bitcoin derivatives to institutional clients, Japan's largest investment bank Nomura has doubled its cryptocurrency-based services by launching a new digital asset unit for institutional investors.

The financial giant will host digital asset companies with its newly formed subsidiary, which will hire 100 employees by the end of next year.

The report revealed that the new branch will be led by the CEO of Nomura, pointing out that most of the new employees will be recruited from outside, and fifteen of the company's current employees will be transferred to the new unit. One of Nomura's executives expressed the urgent need for a recent entry into cryptocurrency-based services tailored for institutions, adding that the inflation environment was a key factor in accelerating the company's new growth.

Any asset class that currently has a discounted cash flow is under enormous stress in the inflationary environment. However, I think many managers will be looking and thinking about potential allocation towards blockchain technology and its possibilities.

A few days ago, when Nomura made headlines with Bitcoin OTC futures and options available to institutional clients, the wider crypto market hit a deep ditch. The prime example is the collapse of Terra, when LUNA fell to almost $ 0 in a matter of days, and the recent wild volatility did not stop the cryptocurrency giant's ambition. Nomura's Executive Director Rig Karkhanis saw the move as a response to "growing customer demand".

The bank expects the crypto sector to mature and become better regulated over time, which would make it more attractive to institutional clients.

Technical Market Outlook:

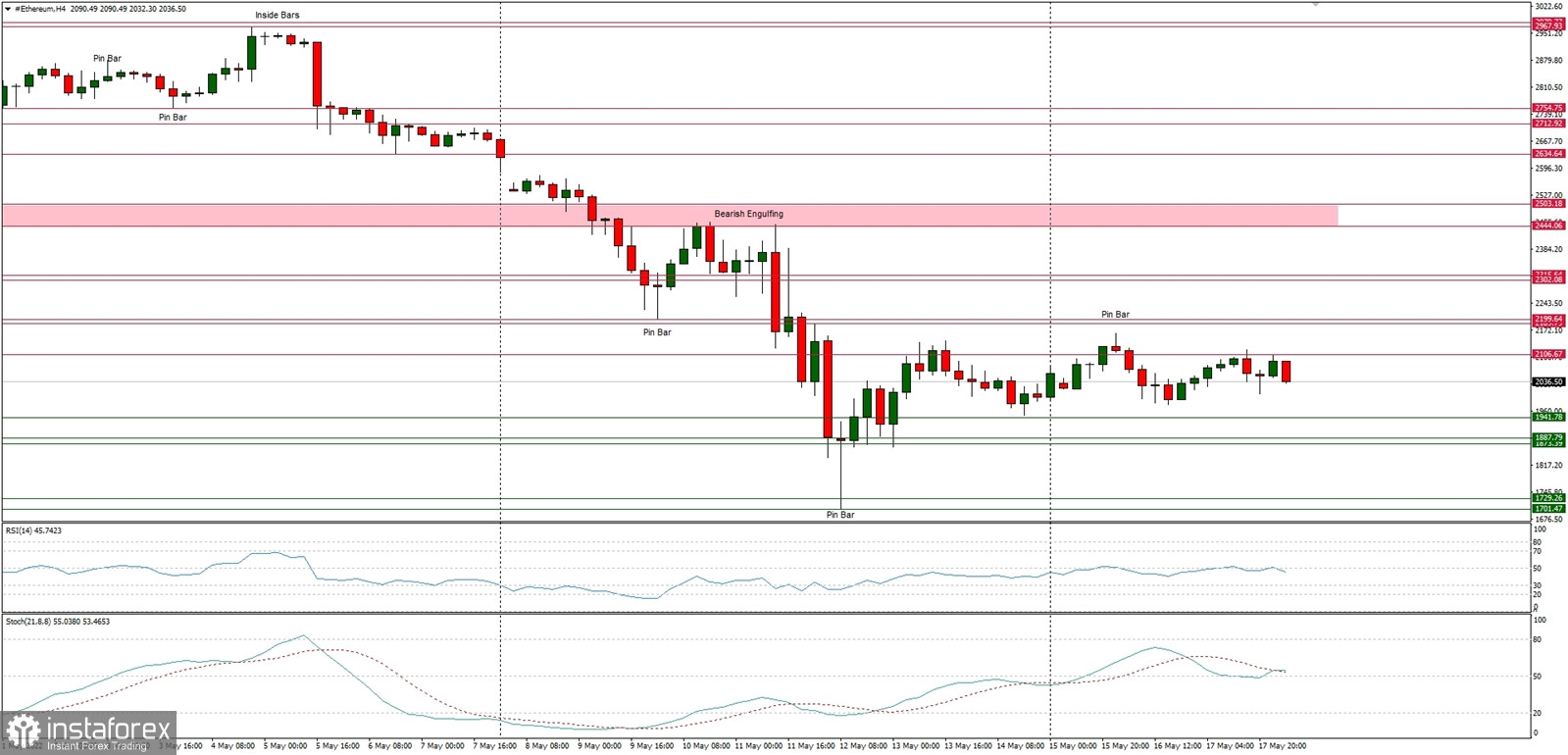

The ETH/USD pair has bounced from the new swing low at the level of $1,700 and is currently trading around the level of $2,100 as the bulls consolidate the recent gains. The recent up move might have been terminated at the level of $2,163 as the Shooting Star candlestick pattern was made at this level. The nearest technical resistance is seen at $2,199, but the weak and negative momentum supports the short-term bearish outlook with a new target for bears seen at the level of $1,420. The market keeps making lower lows and lower highs on the H4 time frame chart, so the down trend is intact.

Weekly Pivot Points:

WR3 - $3,385

WR2 - $2,946

WR1 - $2,555

Weekly Pivot - $2,120

WS1 - $1,688

WS2 - $1,275

WS3 - $820

Trading Outlook:

The down trend on the H4, Daily and Weekly time frames had broken below the key long term technical support seen at the level of $2,000 and continues to make new lower lows with no problems whatsoever. So far every bounce and attempt to rally is being used to sell Ethereum for a better price by the market participants, so the bearish pressure is still high. The next target for bears is located at the level of $1,420.