The GBP/USD pair rallied at the time of writing and the Dollar Index plunged. It was traded at 1.2478 at the time of writing right below the 1.2498 key resistance level. After its previous rally, the pair retreated a little but the bias remains bullish in the short term as long as the Dollar Index is in a corrective phase.

Fundamentally, the British Pound received a helping hand from the CBI Industrial Production which increased from 14 points to 26 points, the traders expected a potential drop to 11 points. On the other hand, USD took a hit from the Unemployment Claims and from the Philly Fed Manufacturing Index which reported worse than expected data.

Also, the Existing Home Sales dropped from 5.75M to 5.61M below 5.65M estimates, while the CB Leading Index dropped by 0.3% versus 0.0% growth expected.

GBP/USD Sell-Off Ended!

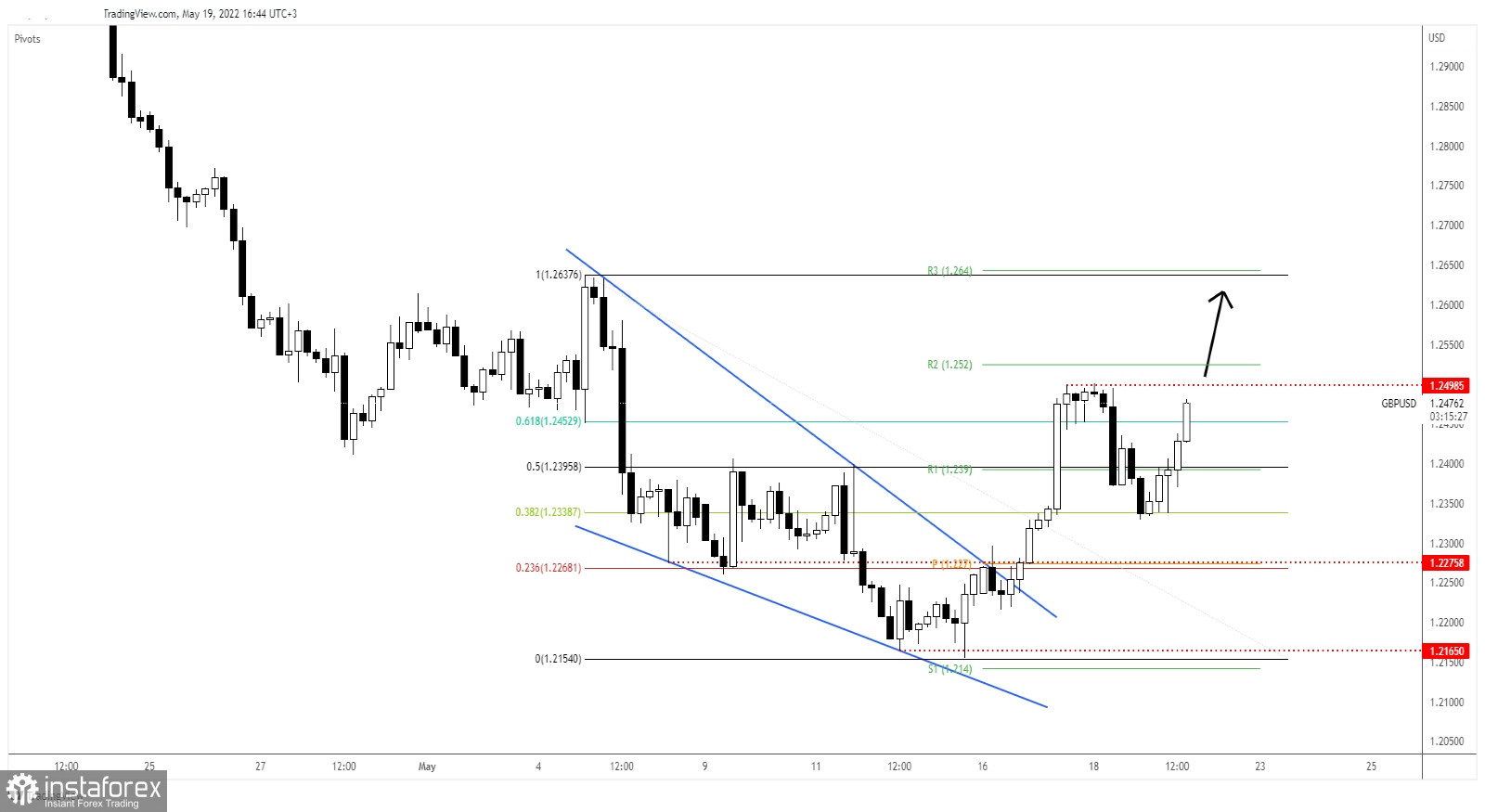

GBP/USD found support at the 38.2% Fibonacci level (1.2338) and now it has passed far above the 61.8% Fibonacci retracement level (1.2452). At the time of writing, the price challenges the 1.2498 former high which represents a static resistance.

As you already know, the currency pair was somehow expected to develop an upside reversal after escaping from the Falling Wedge pattern. In the short term, it has retreated trying to attract more buyers before resuming its growth.

GBP/USD Outlook!

Closing and stabilizing above 1.2498, a valid breakout could confirm an upside continuation and could bring new long opportunities with a potential target at 1.2637 former high.