The EUR/USD pair is trading at 1.0585 at the time of writing, below 1.0598 today's high. In the short term, the bias is bullish as the Dollar Index resumed its corrective phase. The price is strongly bullish but it remains to see how it will react around the 1.0593 static resistance.

The Euro appreciated even if the Eurozone Current Account dropped unexpectedly from 15.7B to -1.6B, even if the specialists expected a potential growth to 20.3B. The pair rallied only because the DXY dropped and not because the Euro is very strong. Fundamentally, the USD Unemployment Claims, Existing Home Sales, CB Leading Index, and the Philly Fed Manufacturing Index reported worse than expected data today.

EUR/USD Amazing Rally!

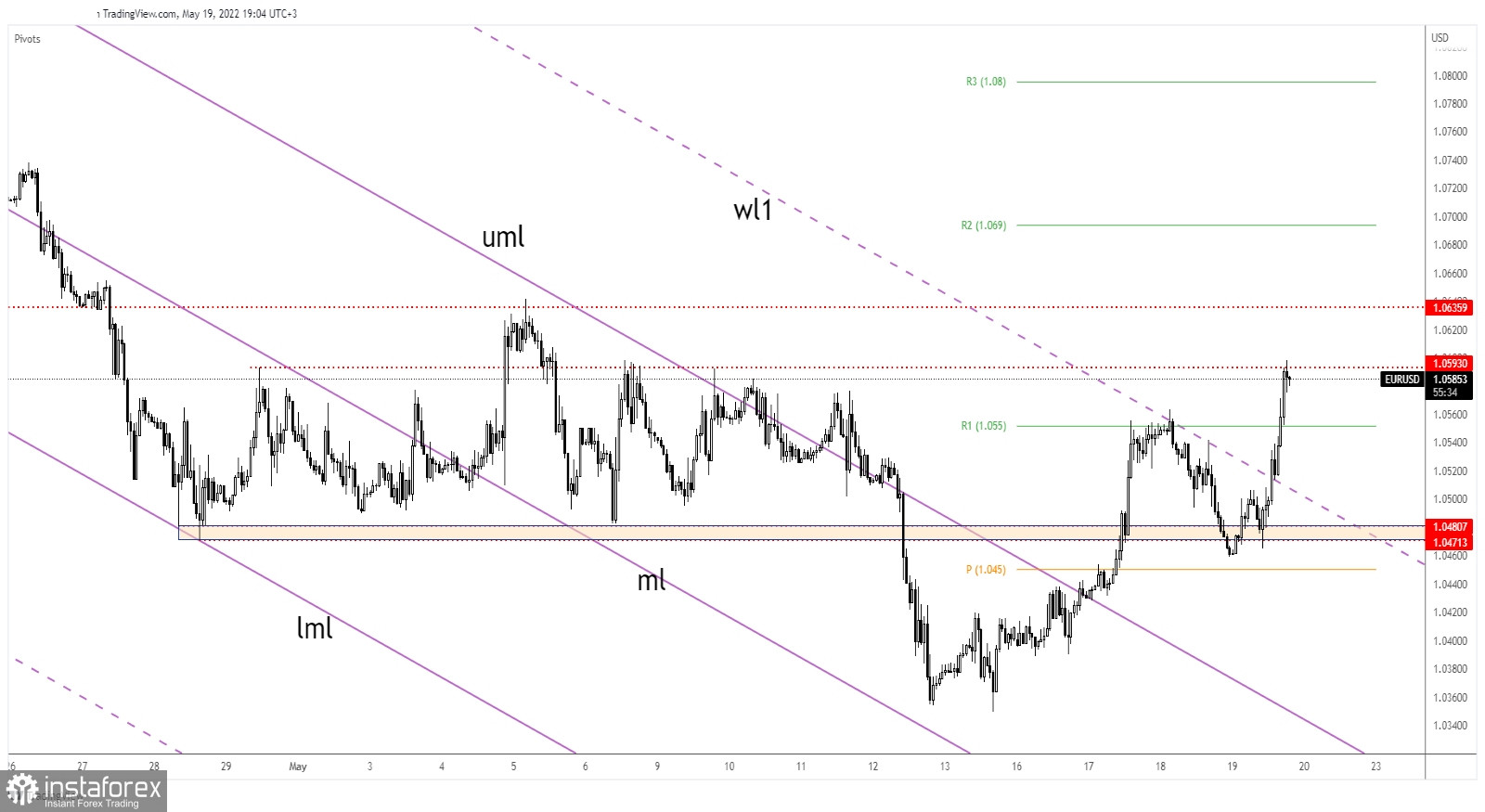

EUR/USD dropped a little after testing and retesting the warning line (wl1) of the descending pitchfork but it has failed to stabilize below the 1.0471 - 1.0480 support area (resistance turned into support).

Today, it has registered a valid breakout through the warning line (wl1) signaling potential further growth. Now, it is challenging the 1.0593 key level. As you can see on the H4 chart, the price was stopped by this level in the past.

EUR/USD Forecast!

Its aggressive breakout through the R1 (1.0550) signaled potential further growth at least till the 1.0593. After its strong rally, we cannot exclude a temporary retreat. This scenario could take shape only if the Dollar Index rebounds.

A valid breakout above 1.0593 may signal further growth towards 1.0635. A strong consolidation above 1.0593 could bring long opportunities.