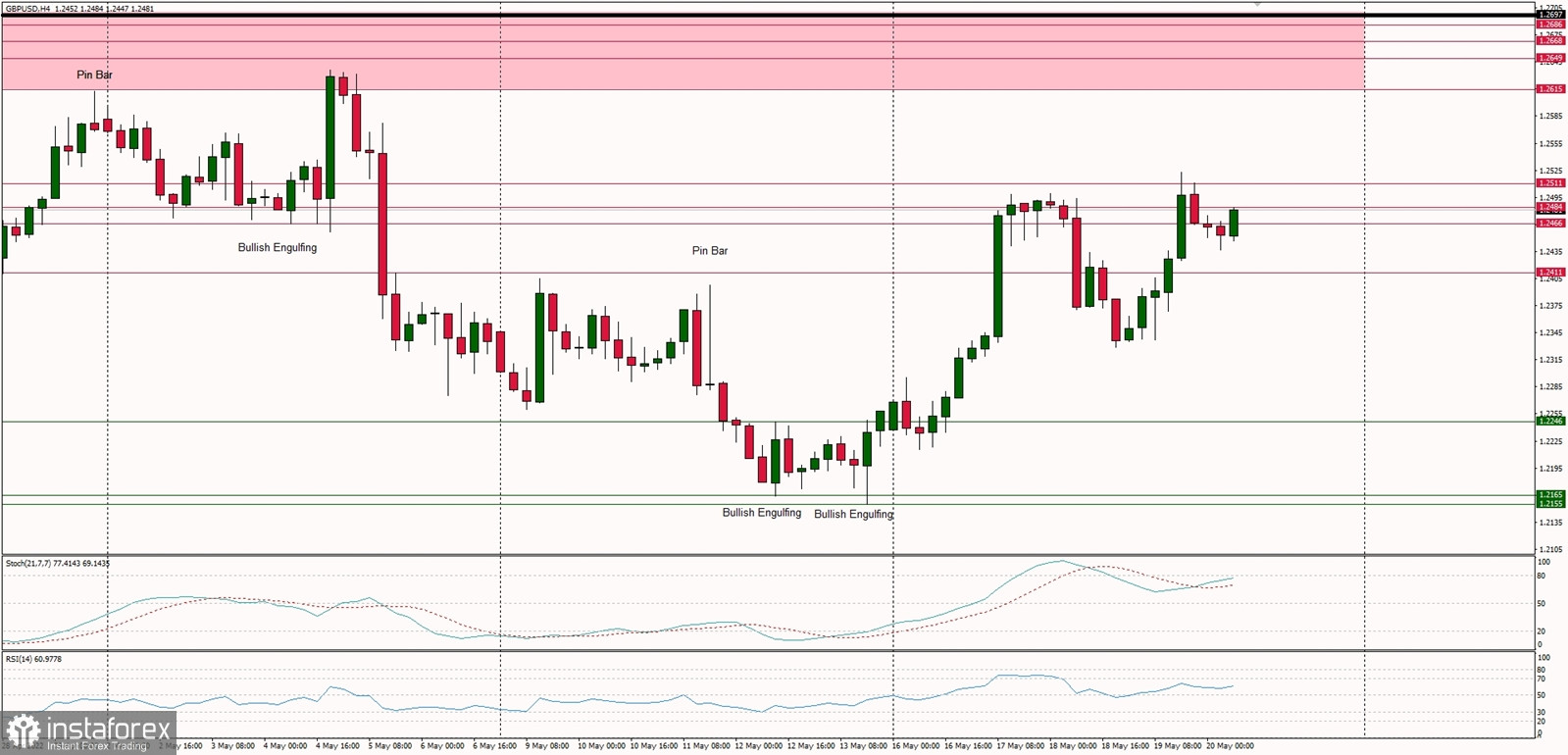

Technical Market Outlook:

The GBP/USD pair has been seen bouncing from the local low located at the level of 1.2328 and bulls had broken through the immediate intraday technical resistance at 1.2411. Nevertheless, the bulls were rejected from the technical resistance located at the level of 1.2511 (any breakout above this level will open the road towards 1.2615 - 1.2697 zone). Despite the oversold market conditions on the Daily and Weekly time frame charts there is no indication of trend termination or reversal just yet, so any move up must be seen only as a corrective cycle during the down trend. The bearish pressure will likely resume soon and the next technical support is seen at the level of 1.2165 and 1.2072.

Weekly Pivot Points:

WR3 - 1.2621

WR2 - 1.2514

WR1 - 1.2371

Weekly Pivot - 1.2267

WS1 - 1.2119

WS2 - 1.2008

WS3 - 1.1859

Trading Outlook:

The price broke below the level of 1.3000, so the bears enforced and confirmed their control over the market in the long term. The Cable is way below 100 and 200 WMA , so the bearish domination is clear and there is no indication of trend termination or reversal. The next long term target for bears is seen at the level of 1.1989. Please remember: trend is your friend.