Crypto Industry News:

Terraform Labs and Do Kwon face increasing legal problems following the collapse of the Terra ecosystem. Following early reports of a possible Congressional hearing and investigation by the Grim Reapers financial crime unit, the crypto firm has now come under the radar of the national tax agency.

According to a report in Naver News, South Korea's national tax agency struck Terraform Labs and its co-founder with $ 78 million in tax evasion allegations.

The report highlighted that Kwon had been dissatisfied with the country's cryptocurrency taxation since last December and tried to shut down Terra's domestic business just before the infamous Terra crash.

Terraform Labs reportedly first came under the radar of tax authorities last June over suspicions of corporate and income tax avoidance. An investigation into Terraform Labs and its various subsidiaries revealed that the company was incorporated in the Virgin Islands and Singapore.

Although both subsidiaries were incorporated abroad, the "place of de facto management" was South Korea itself. According to the Korean Corporate Income Tax Act, for tax purposes, the place of effective management is taken into account, not the country of incorporation.

Tax authorities were alerted after Terraform Labs dispatched LUNA from Terra Singapore to the LUNA Foundation Guard (LFG) to avoid taxation or to compensate for protocol losses.

Technical Market Outlook:

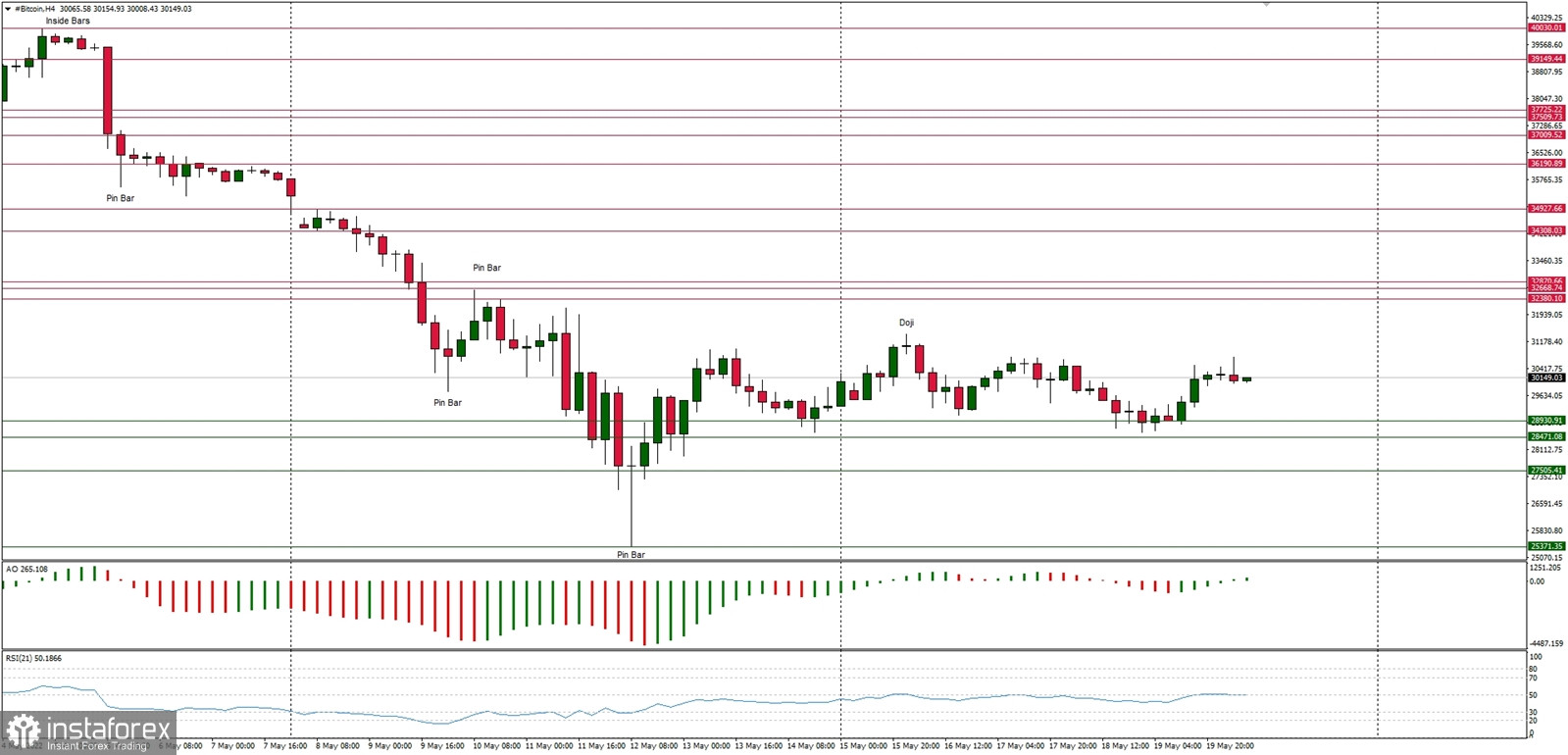

The BTC/USD pair has been seen consolidating the recent gains made from the bounce from the low located at the level of $25,371. The bulls keep trying to bounce higher and so far successfully bounced from the range lower level seen at $28,980 again. The local high was made at the level of $31,190 so far, but bulls are not that keen to continue the bounce anymore. The weak and negative momentum supports the short-term bearish outlook with a new target for bears seen at the level of $20,000. The market keeps making lower lows and lower highs on the H4 time frame chart, so the down trend is intact.

Weekly Pivot Points:

WR3 - $44,348

WR2 - $39,422

WR1 - $35,469

Weekly Pivot - $30,396

WS1 - $26,266

WS2 - $21,367

WS3 - $17,368

Trading Outlook:

The down trend on the H4, Daily and Weekly time frames continues. So far every bounce and attempt to rally is being used to sell Bitcoin for a better price by the market participants, so the bearish pressure is still high. The key long term technical support is seen at the round psychological level of $20,000.