Crypto Industry News:

The co-founder and former CEO of the BitMEX cryptographic platform has been sentenced to two years' probation, with the first six months spent in house solitary confinement.

In late 2020, the Commodity Futures Trading Commission (CFTC) accused the company's co-founders Arthur Hayes, Benjamin Delo and Samuel Reed of operating a digital asset trading system without implementing the relevant anti-money laundering laws.

BitMEX had to pay a fine of $ 100 million, while the three co-founders stepped down from their functions. Recently, Hayes, through his lawyers, filed a leniency application, scheduled for yesterday.

The ruling became final on Friday, with US District Judge John Koeltl acceding to Hayes's request. Instead, he was given a two-year suspended sentence and will have to spend the first six months under house arrest.

The verdict became a reality even as several US prosecutors argued that Hayes's punishment should be more severe and should send a signal to the entire crypto industry. In yesterday's hearing, U.S. assistant attorney Samuel Raymond told a federal judge that it was a "very serious crime" and added:

"There were real consequences. When people like Mr. Hayes operate platforms without anti-money laundering or KYC programs, they become a money laundering magnet for people."

Hayes took full responsibility for his actions and promised to be "ready to close the chapter and start over."

Technical Market Outlook:

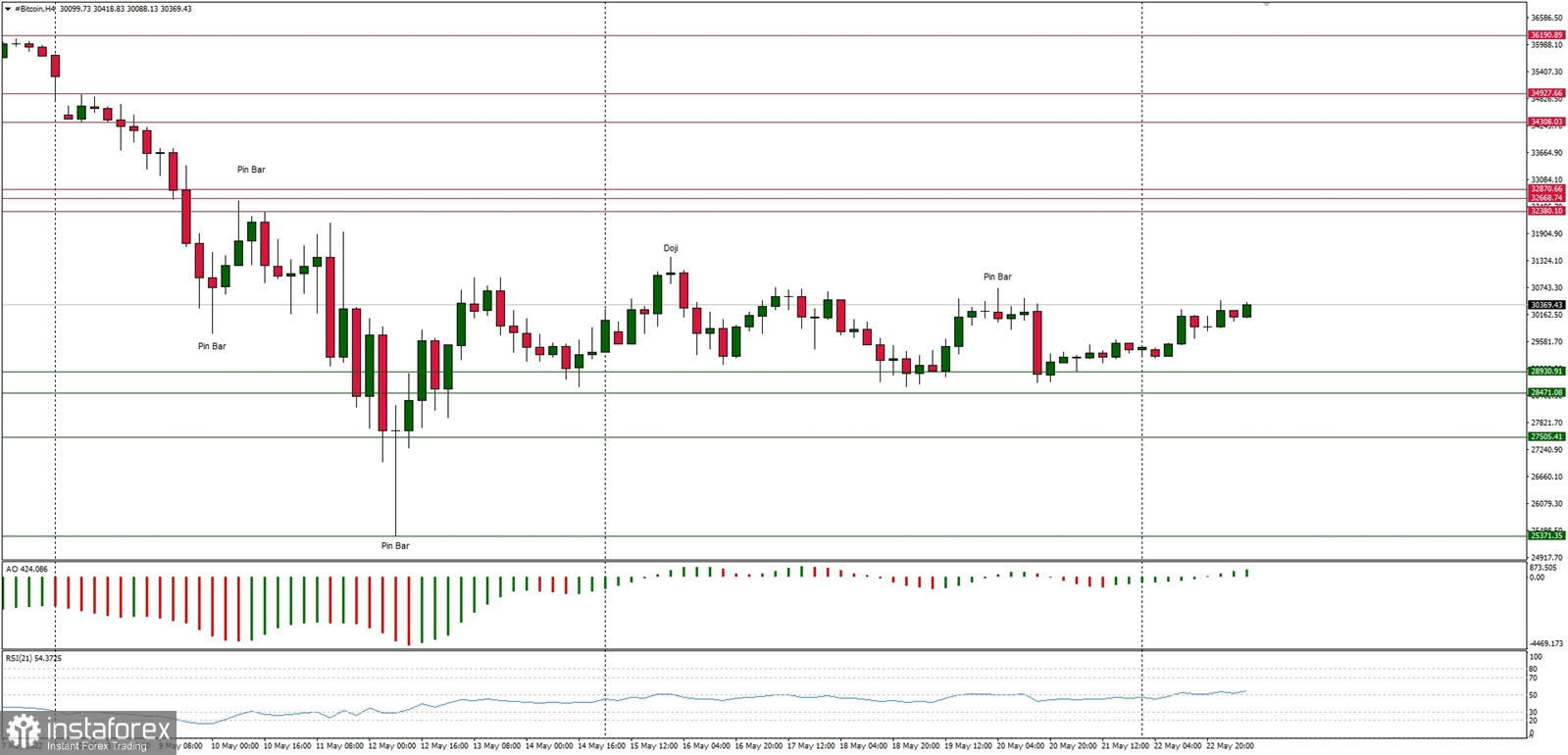

The BTC/USD bulls keep trying to bounce higher and so far successfully bounced from the range lower level seen at $28,980 again. The local high was made at the level of $31,190 so far, but bulls are not that keen to continue the bounce anymore. The weak and negative momentum supports the short-term bearish outlook with a new target for bears seen even at the level of $20,000. The market keeps making lower lows and lower highs on the H4 time frame chart, so the down trend is intact. The first indication of the deeper correction would be a clear breakout above the range high located at the level of $32,870.

Weekly Pivot Points:

WR3 - $33,847

WR2 - $32,649

WR1 - $31,169

Weekly Pivot - $29,902

WS1 - $28,296

WS2 - $27,028

WS3 - $25,668

Trading Outlook:

The down trend on the H4, Daily and Weekly time frames continues. So far every bounce and attempt to rally is being used to sell Bitcoin for a better price by the market participants, so the bearish pressure is still high. The key long term technical support is seen at the round psychological level of $20,000.