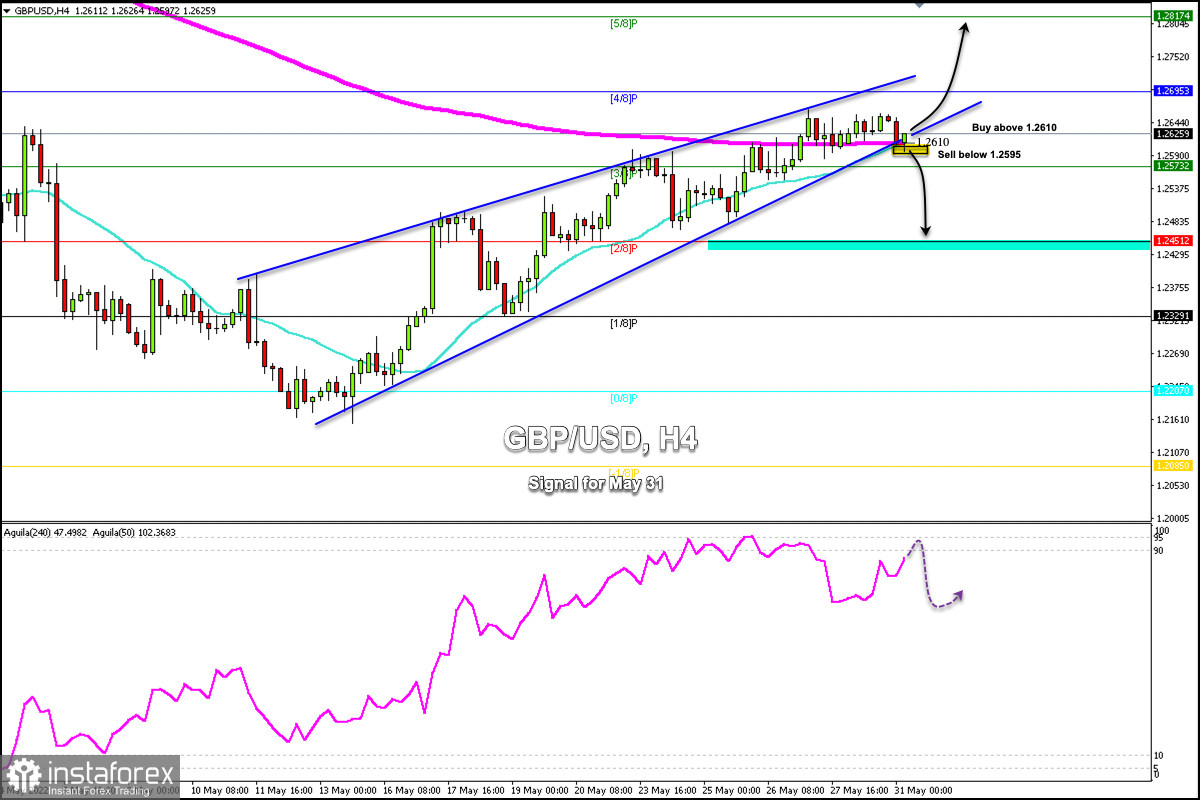

Early in the Asian session, the British pound was trading at around 1.2625. It is falling after finding strong resistance around 1.2658.

The pound has support at around 1.2610. In this area, the 21 SMA and the 200 EMA converge which adds a strong bottom to the British pound. If in the next few hours, GBP/USD continues to trade above this level, it could give it a strong bullish push. The price could break the resistance at 1.2658 and reach 4/8 Murray at 1.2695.

The British pound is being supported by comments from the Fed who said they would pause the interest rate hike cycle after the end of July in order to prevent the economy from slipping into recession.

On the other hand, risk appetite is putting downward pressure on the US dollar, which favors the recovery of the British pound. If this trend continues, the pound is likely to reach the zone of resistance 5/8 Murray at 1.2817 in the coming days.

According to the 4-hour chart, we can see that the pound has touched the bottom of the 200 EMA and is currently bouncing above it. If it manages to stay trading above 1.2610, it will be a clear signal to buy with targets at 1.2658, 1.2695 (4/8) and 1.2817 (5/8).

On the contrary, if in the next few hours, the pound breaks down and consolidates below the 200 EMA and below the rising wedge pattern, we could expect a decline towards the support 3/8 Murray at 1.2573 and could even reach 2/8 Murray at 1.2451.

The eagle indicator is overbought. Any bullish momentum is likely to be seen as a selling opportunity only if GBP/USD trades below 1.2695 (4/8 Murray).