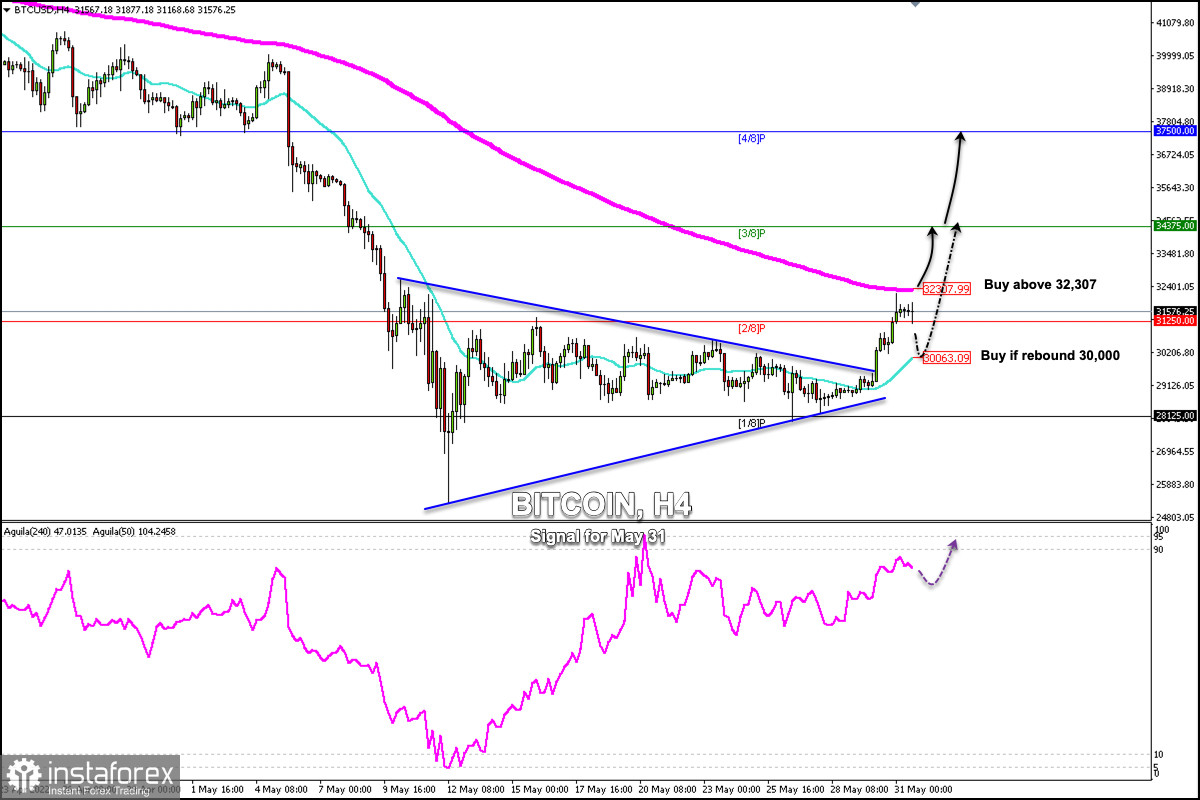

From the low of 27,940 reached on May 26, until today May 31, BTC has recovered more than 15% in about 5 days. On Tuesday morning, the positive momentum persisted with the price rising above 32,000, returning to the price level of May 11.

BTC is currently trading at 31,576 above the 21 SMA on the 4-hour chart and above the 2/8 Murray located at 31,250.

The short-term outlook for Bitcoin looks bullish on the condition that it should break the 200 EMA located at 32,307. If the price settles above this level, it could change the market sentiment and accelerate BTC's upward movement.

A sharp break on the 4-hour chart and a daily close above 32,300 could accelerate the bullish move and the price could hit 3/8 Murray at 34,375 and could even hit 4/8 Murray at 37,500,

As long as Bitcoin trades below the 200 EMA, there is a likelihood of a technical correction towards the 21 SMA around 30,000.

Since May 9, Bitcoin has formed a symmetrical triangle pattern. As it was already broken yesterday, the crypto is likely to reach its target in the zone of 37,500 (4/8 Murray).

Therefore, above the psychological level of 30,000 will be an opportunity to buy, with targets at 32,307 and even up to 37,500. The sentiment for risk appetite is on the rise which could favor BTC, and it could reach the psychological level of 40,000 in the next few days.

The outlook could change in case Bitcoin trades below 29,500. Hence, it might resume the bearish move.