Pair : EUR/USD.

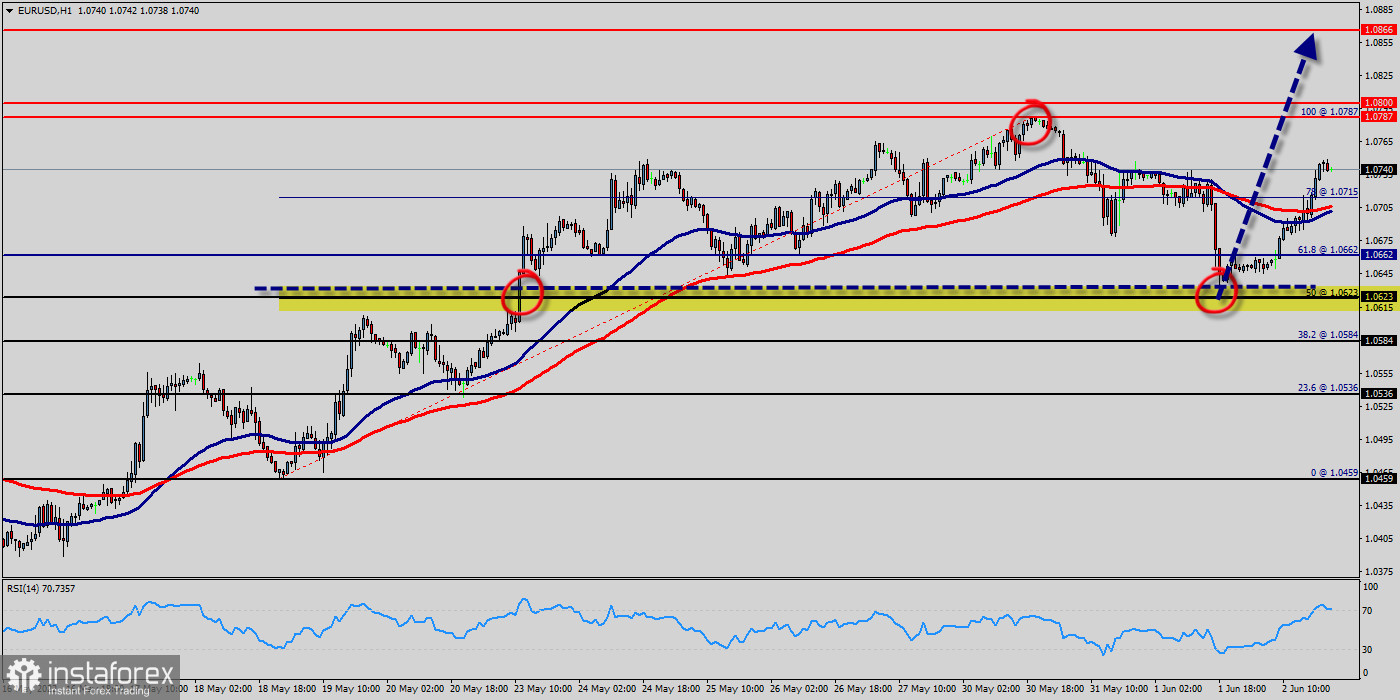

Pivot : 1.0662.

The 100-day moving average has been a key level in keeping the upside momentum going from a technical point of view while dollar weakness remains the key driver pushing the pair higher from the levels of 1.0623 and 1.0662.

The main range is 1.0623 to 1.0787. Its retracement zone at 1.0787 to 1.08000 is resistance. This zone stopped the rally at 1.0745 on the 2nd of June 2022.

The minor trend is up. It turned up on Wednesday, shifting momentum to the upside from the levels of 1.0623 and 1.0662 on the hourly chart.

On the H1 chart. the level of 1.0662 coincides with 61.8% of Fibonacci, which is expected to act as minor support today. Since the trend is above the 61.8% Fibonacci level, the market is still in an uptrend.

Therefore, strong support will be found at the level of 1.0662 providing a clear signal to buy with a target seen at 1.0787.

If the trend breaks the minor resistance at 1.0787, the pair will move upwards continuing the bullish trend development to the level 1.0800 in order to test the daily resistance 1.

The EUR/USD pair is showing signs of strength following a breakout of the highest level of 1.0800.

The market is indicating a bullish opportunity above the above-mentioned support levels, for that the bullish outlook remains the same as long as the 100 EMA is headed to the upside. Furthermore, the trend is still showing strength above the moving average (100).

On the other hand, if the EUR/USD pair fails to break out through the resistance level of 1.0800; the market will decline further to the level of 1.0662 (daily pivot).