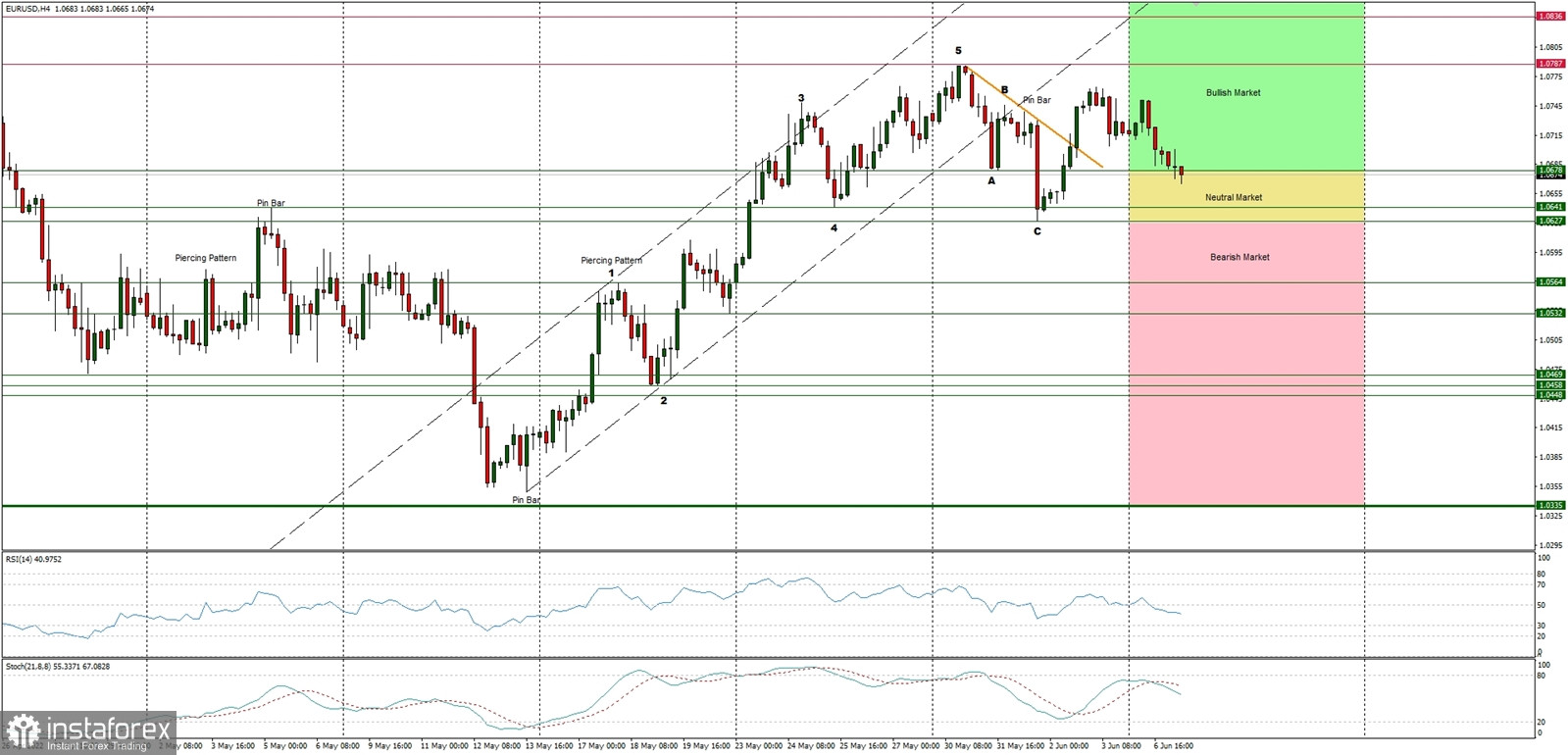

Technical Market Outlook:

The EUR/USD pair has bounced from the level of 1.0621 which was a key short-term technical support and the target level for the wave C of the overall ABC simple corrective cycle. The bulls managed to break through the short-term trend line resistance, entered the bullish zone, however they failed to rally. The level of 1.0751 is the lower high on the H4 time frame chart as the market revered lower and is approaching the neutral zone border seen at 1.0678. This level might be violated and in that situation the next target for bears is seen at 1.0641 and 1.0627. The market is coming off the overbought conditions and the momentum is now below the level of fifty.

Weekly Pivot Points:

WR3 - 1.0954

WR2 - 1.0872

WR1 - 1.0789

Weekly Pivot - 1.0707

WS1 - 1.0623

WS2 - 1.0551

WS3 - 1.0480

Trading Outlook:

The market had bounced from the key long-term technical support located at the level of 1.0336 and is heading higher. The up trend can be continued towards the next long-term target located at the level of 1.1186 only if bullish cycle scenario is confirmed by breakout above the level of 1.0726, otherwise the bears will push the price lower towards the next long-term target at the level of 1.0336 or below.