Crypto Industry News:

Bitcoin ATM installations around the world have seen a sharp decline this year, with just 202 new bitcoin ATMs reported in May, which was last three years.

Over the past five months, Bitcoin ATM installations have experienced a gradual slowdown since January, ultimately falling 89.75% compared to new installations in December 2021. However, data from Coin ATM Radar shows a clear increase in the number of installations where 817 new Bitcoin ATMs were installed worldwide in June in just the first five days.

Some of the key factors contributing to the slowdown in crypto ATM installation include geopolitical tensions around the world, unclear or anti-cryptographic regulations, market saturation and business impact due to the ongoing coronavirus pandemic.

Coin ATM Radar data confirms that the United States has 87.9% of all crypto ATM worldwide. Europe, as a continent, has a network of 1,419 ATMs, which accounts for 3.8% of global installations.

While real-world challenges may have a temporary impact on the physical expansion of BTC via ATMs, in fact, the Bitcoin network continues to surpass its previous records in securing, decentralizing and accelerating an impenetrable peer-to-peer (P2P) network.

Technical Market Outlook:

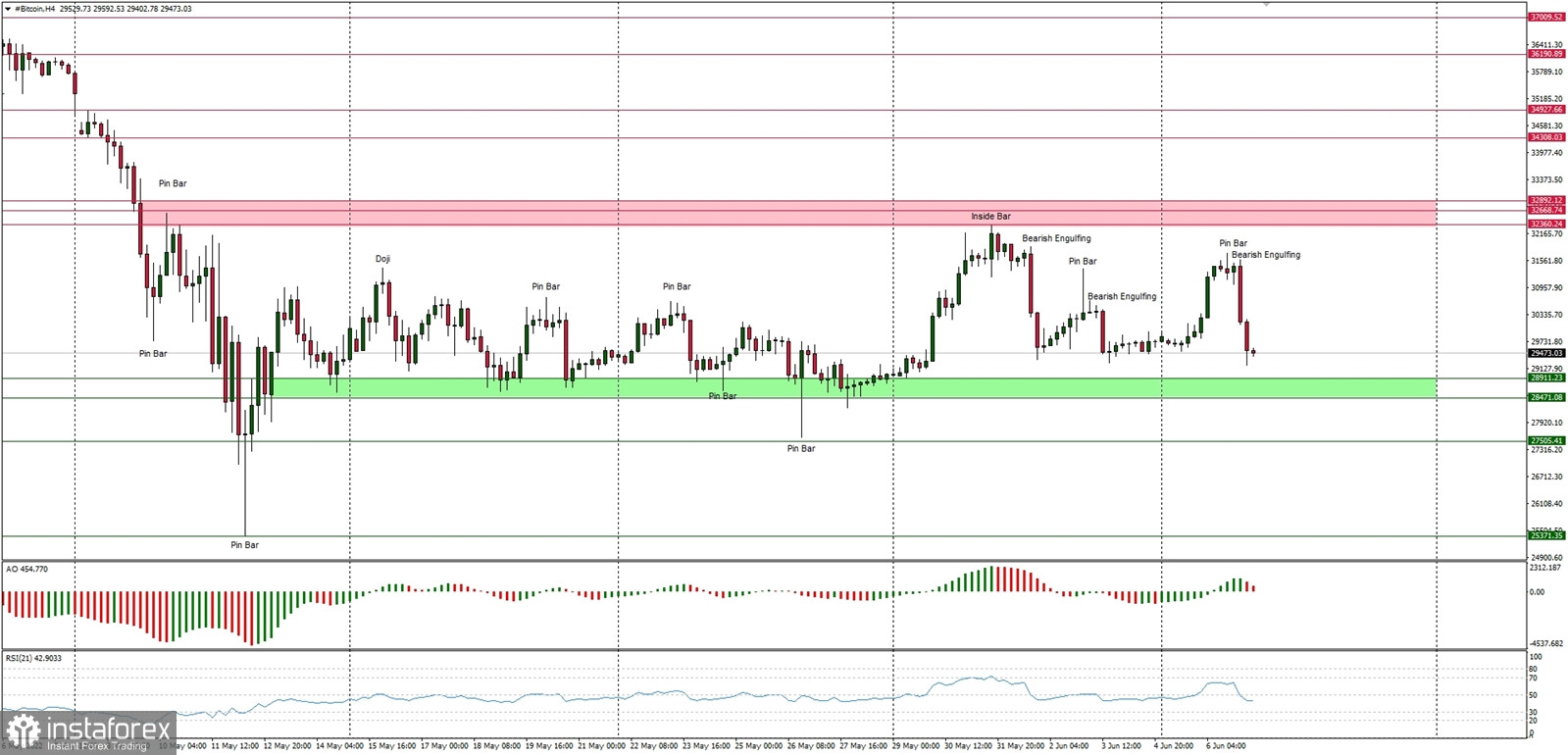

The BTC/USD pair has been under pressure after the recent selling wave pushed the price to the level of $29k. The whipsaw trading conditions are still being developed, full of fake-outs and blow-outs and false movements. The market participants has still not decided whether the down trend should be continued or terminated and keep trading in a narrow range between the levels of $32,892 - $28,741. The first indication of the deeper correction would be a clear breakout above the range high located at the level of $32,892, however all the current attempts to rally are being faded and the Pin Bar candlesticks inside the range zone are present already.

Weekly Pivot Points:

WR3 - $34,666

WR2 - $33,580

WR1 - $31,452

Weekly Pivot - $30,233

WS1 - $28,222

WS2 - $27,019

WS3 - $24,877

Trading Outlook:

The down trend on the H4, Daily and Weekly time frames continues. So far every bounce and attempt to rally is being used to sell Bitcoin for a better price by the market participants, so the bearish pressure is still high. The key long term technical support is seen at the round psychological level of $20,000.