Crypto Industry News:

In discussions with the International Monetary Fund (IMF), T Rabi Sankar, deputy chairman of the Indian Reserve Bank (RBI), made an anti-crypto stance when he spoke of India's ability to ban the cryptocurrency ecosystem and blockchain technology.

Rabi Sankar kicked off the conversation by highlighting the success of Unified Payments Interface (UPI), India's in-house peer-to-peer payment system, which has seen average uptake and transaction growth of 160% annually over the past five years.

According to Rabbi Sankar:

"Blockchain, which was introduced six or eight years before UPI was launched, is even today defined as a potentially revolutionary technology. [Blockchain] use cases have not really been tied to the speed initially expected. "

However, an RBI official confirmed that a large population in India still does not have access to UPI-based banking due to the unavailability of smartphones. To counter this, the Indian government is working on offline payment platforms, some of which have started reaching the masses.

On May 28, the Indian central bank, the RBI, proposed a three-step, step-by-step approach to introducing CBDC with "little or no disruption" in the traditional financial system.

India's Finance Minister Nirmala Sitharaman unveiled for the first time a plan to launch CBDC in 2022-23 to provide a "big boost" to the digital economy. The RBI report revealed that the central bank is currently experimenting to develop a CBDC that addresses a wide range of problems within the traditional system.

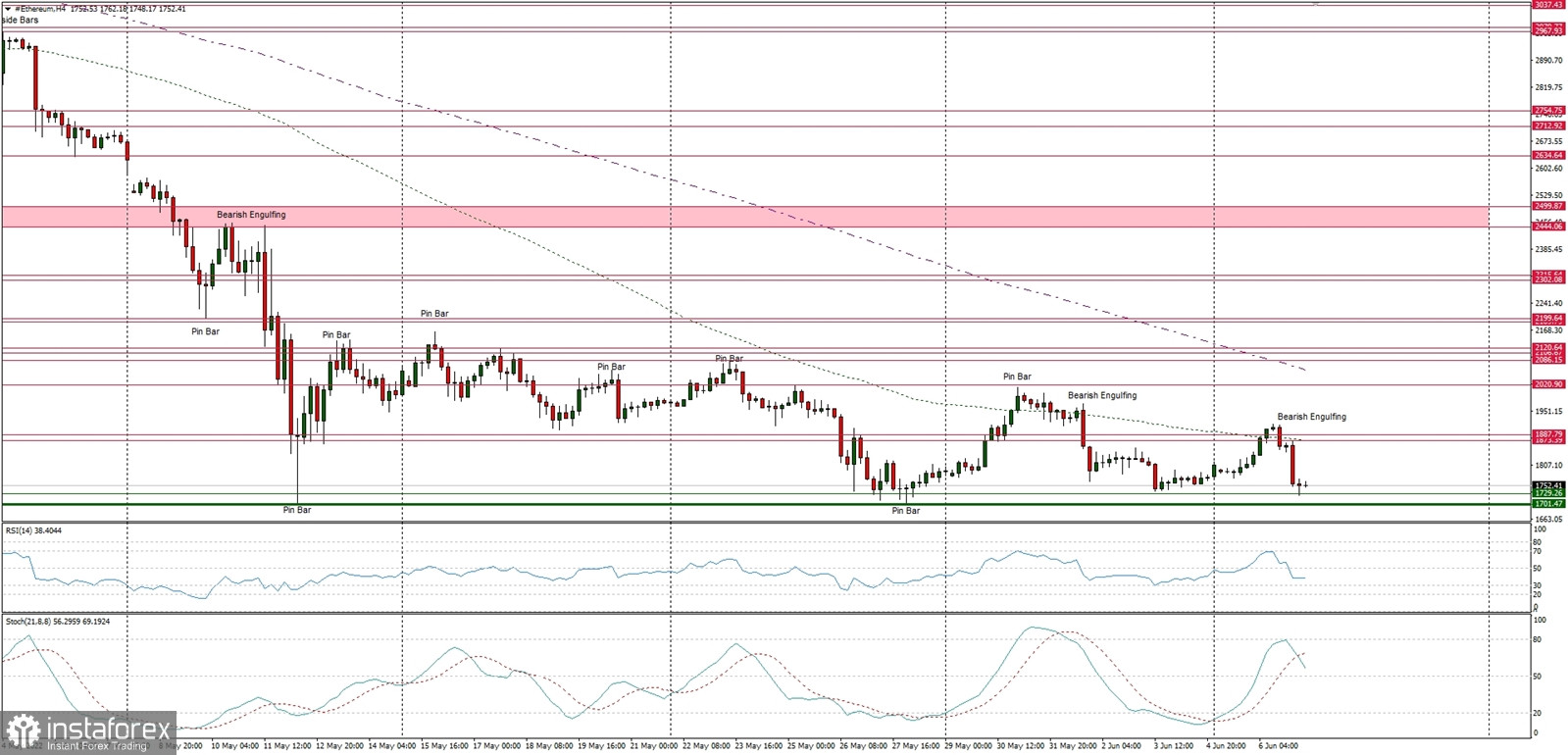

Technical Market Outlook:

The down trend on the ETH/USD pair is still intact on the larger time frames like Daily and Weekly and on the lower time frames, like H4, the bears are approaching the last week low located at the level of $1,701. In a case of a breakout lower, the next target for bears is seen at the level of $1,420. In order to terminate the down trend, the bulls must break through the key short-term technical resistance located at the level of $2,199. The nearest technical resistance is located at $1,863 and $1,916.

Weekly Pivot Points:

WR3 - $2,200

WR2 - $2,120

WR1 - $1,939

Weekly Pivot - $1,827

WS1 - $1,666

WS2 - $1,570

WS3 - $1,388

Trading Outlook:

The down trend on the H4, Daily and Weekly time frames had broken below the key long term technical support seen at the level of $2,000 and bears continue to make new lower lows with no problem whatsoever. So far every bounce and attempt to rally is being used to sell Ethereum for a better price by the market participants, so the bearish pressure is still high. The next target for bears is located at the level of $1,420.