USD/JPY is trading at its highest level in the last 20 years. Early in the American session, it reached the level of 134.37 which was last seen on February 1, 2002. A technical correction is expected in the next few hours due to the strong overbought signal on the 4-hour chart.

On June 7, the governor of the Bank of Japan (BoJ), Haruhiko Kuroda, said that the weakness of the yen in a short term is negative for the economy. This data could favor a technical correction in the next few days and could send the price back to the psychological level of 130.00.

The Federal Reserve is likely to continue with its aggressive tightening plan after the June 3 Payrolls. Employment data was slightly above expectations. The Japanese yen is expected to continue to weaken and could reach an all-time low of 135.08 as the US regulator will continue to raise interest rates in the coming months.

On Friday, June 10, the CPI inflation report for May will be published, which will be the most important data of the week. There could be strong volatility in the Japanese yen as it is directly influenced by what is happening in the US economy.

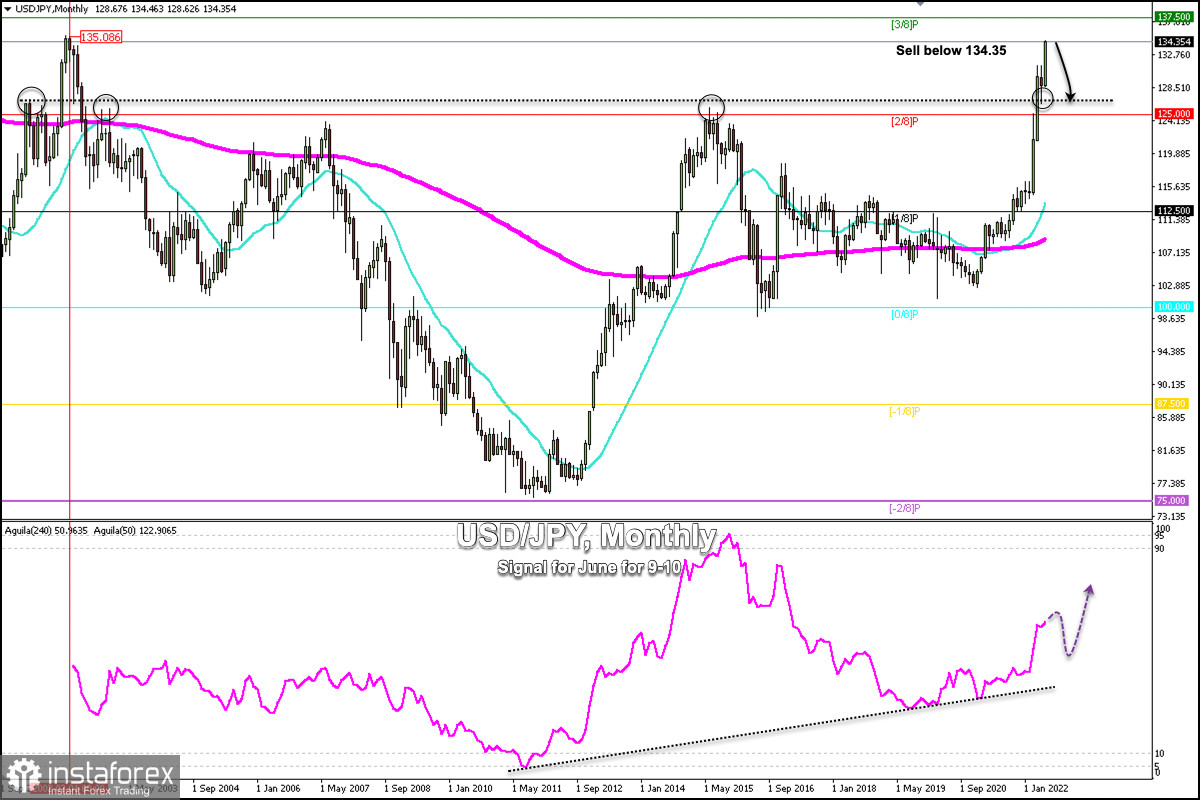

According to the monthly chart, we can see that the Japanese yen has reached a key level that coincides with a zone of resistance from February 2002 around 135.08. In the last hours, the yen reached 134.37, and it is likely that the upward trend will continue up to the key level of 135.00.

On the other hand, the daily chart and the 4-hour chart show an overbought signal, and a technical correction is expected in the coming days. So the price could reach the area of 132.20 and 131.33 which has become strong support and a monthly high in June.

On the contrary, should the yen continue to rise, it could reach the area of 135.08 which represents strong resistance and could be an opportunity to sell below this level.

If the USD/JPY pair consolidates below 134.37, it will be an opportunity to sell in the coming hours. The eagle indicator on the 4-hour chart is giving an overbought signal which supports our bearish strategy.