Crypto Industry News:

GEM Mining CEO John Warren said he and other miners now view New York City as an unfriendly place where they probably wouldn't want to open a business:

"Miners will not consider going there after the ban has become part of the discussion," he said.

Environmental sustainability was at the heart of the New York State Government's argument against PoW mining. A controversial mining ban law would ban any new mining operations in the state for the next two years. It would also refuse to renew licenses to those already operating in the state, unless they use 100% renewable energy.

GEM Mining recently stated that the bill will not only miss its goal but will also deter new miners using renewable energy sources from operating in the state. Warren said his operation is already 97% carbon neutral.

GEM Mining is a South Carolina-based Bitcoin mining operation that has been supplying 1.92 EH / s of power to the Bitcoin network since May.

Likewise, the CEO of Swedish cryptocurrency mining company White Rock Management, Andy Long, also believes that Bitcoin mining "is going in the right direction towards using fossil-free energy."

The company can boast a 100% hydroelectric dependency for its hash rate contribution of 712 PH / s.

According to the Cambridge Bitcoin Electricity Consumption Index (CBECI), around 10% of the hash rate power in the United States comes from New York City. This makes it the fourth largest producer in the country. As of April, miners indicated in a survey by the Bitcoin Mining Council that around 58% of the energy used for mining comes from sustainable sources.

Technical Market Outlook:

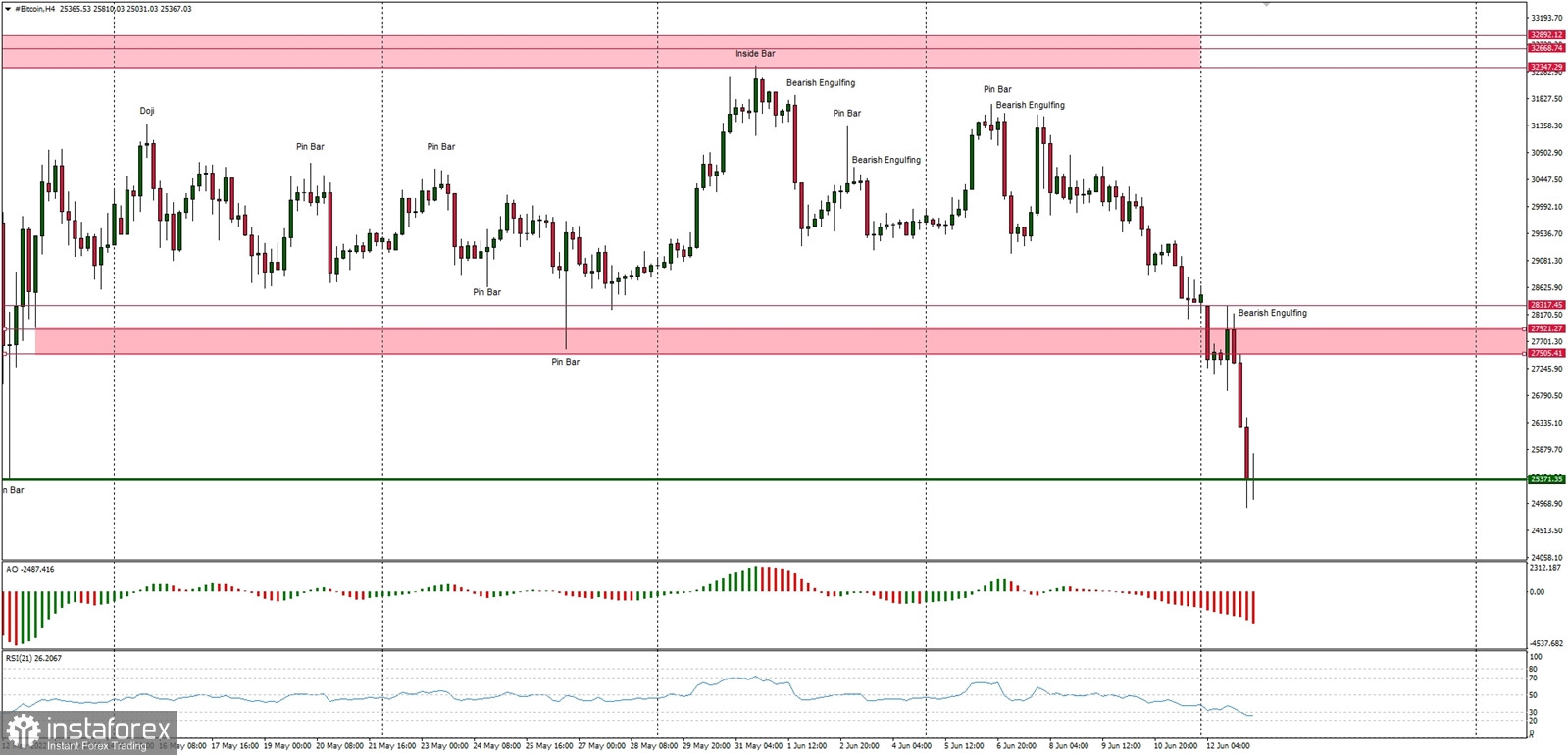

The BTC/USD pair has been testing the key long-term technical support during the weekend and made a new swing low at the level of $24,893 (at the time of writing the analysis). The key long-term technical support is located at $25,371 and this is the low from May 12, 2022. The market is under the bearish pressure and the next target for bears is seen at the level of $20,000. The nearest technical resistance is located at $25,806, but in order to change the sentiment to more bullish, the market must break through the level of $27,921 again.

Weekly Pivot Points:

WR3 - $34,537

WR2 - $33,170

WR1 - $29,508

Weekly Pivot - $28,238

WS1 - $24,813

WS2 - $23,432

WS3 - $20,071

Trading Outlook:

The down trend on the H4, Daily and Weekly time frames continues. So far every bounce and attempt to rally is being used to sell Bitcoin for a better price by the market participants, so the bearish pressure is still high. The key long term technical support is seen at the round psychological level of $20,000.