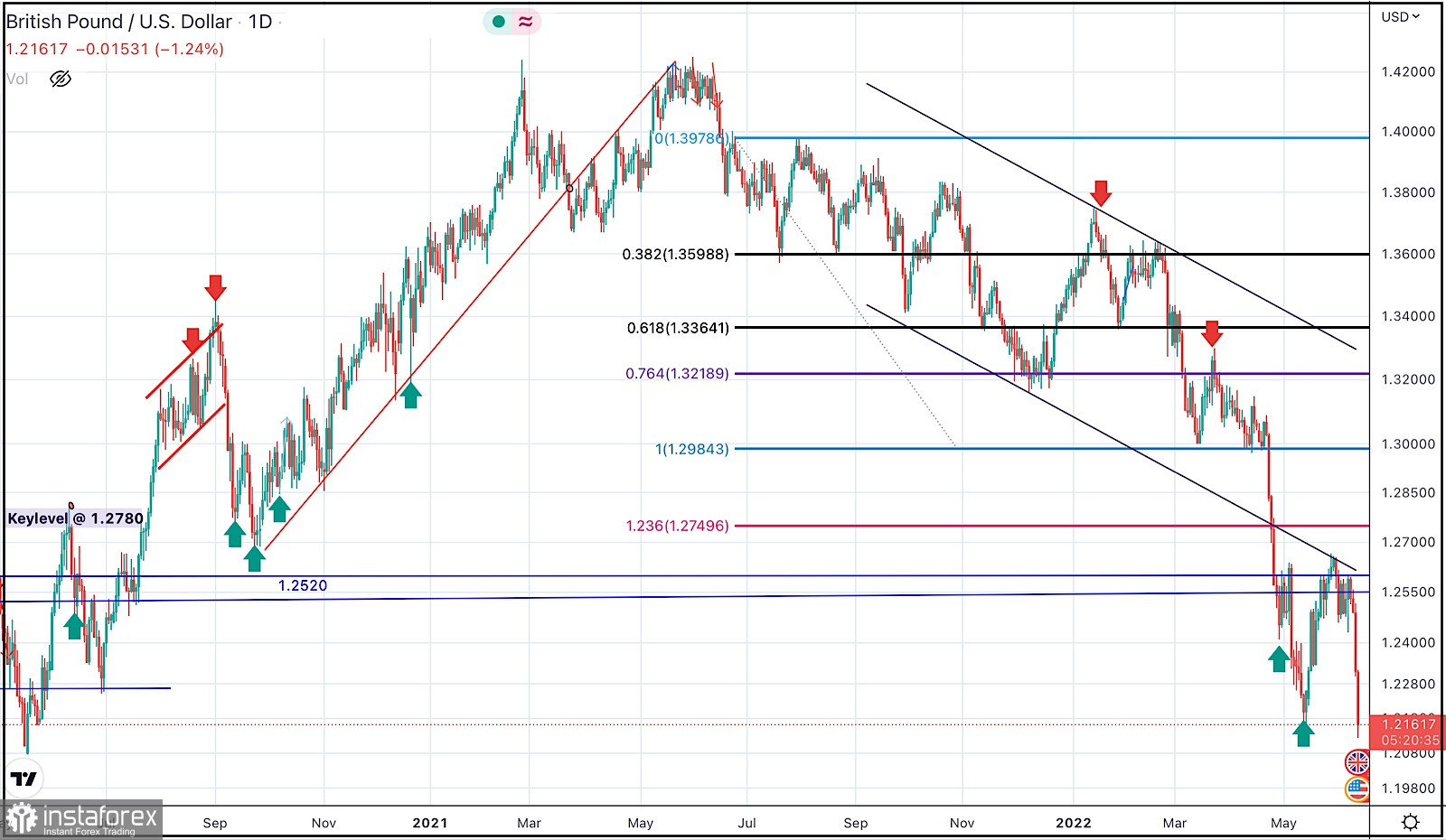

The short-term outlook turned bearish when the market went below 1.3600. This enhanced the bearish side of the market initially towards 1.3360 then 1.3200 which initiated a strong bullish movement towards 1.3600 for another re-test.

The recent bullish pullback towards 1.3600 was considered for SELL trades as it corresponded to the upper limit of the ongoing bearish channel. This led to an aggressive bearish movement towards 1.2980 - 1.3000.

The price level of 1.3000 stood as intraday Support where a short-term consolidation movement existed. This happened just before two successive bearish dips could take place towards 1.2550 and 1.2160.

Considerable bullish rejection was expressed around 1.2200. Hence, bullish persistence above 1.2550 was needed to abolish the short-term bearish scenario for sometime.

Quick bullish advancement was executed towards 1.2650 where some bearish resistance was encountered.

The GBP/USD pair remains under bearish pressure to challenge the new low around 1.2150 again.

Price action around the current price levels of 1.2150 should be watched for a possible intraday BUY entry. Otherwise, further bearish continuation may pursue towards 1.2000