Crypto Industry News:

Do Kwon, CEO and co-founder of the infamous Terra and TerraUSD ecosystems, denied the allegation of paying $ 80 million a month for nearly three years.

On June 11, there were numerous unconfirmed reports claiming that Kwon had participated in pre-crash LUNA and UST funds to purchase US dollar-anchored stablecoins such as Tether.

Rumors that Kwon had withdrawn their LUNA and UST reserves followed a Twitter thread from @FatManTerra sharing alleged details on how Kwon and Terra influencers managed to raise funds by artificially maintaining liquidity.

The trader, on the other hand, advised the crypto community to refrain from fueling rumors until proven:

"It should be obvious, but the claim that I have withdrawn $ 2.7 billion on anything is categorically false," he said.

Sharing his opinion, Kwon said the recent rumor of a $ 80 million monthly payment contradicts claims that it still owns most of its LUNA assets, acquired during the dump. Moreover, Kwon reiterated that his income over the past two years was just a monetary salary from TerraForm Labs.

Technical Market Outlook:

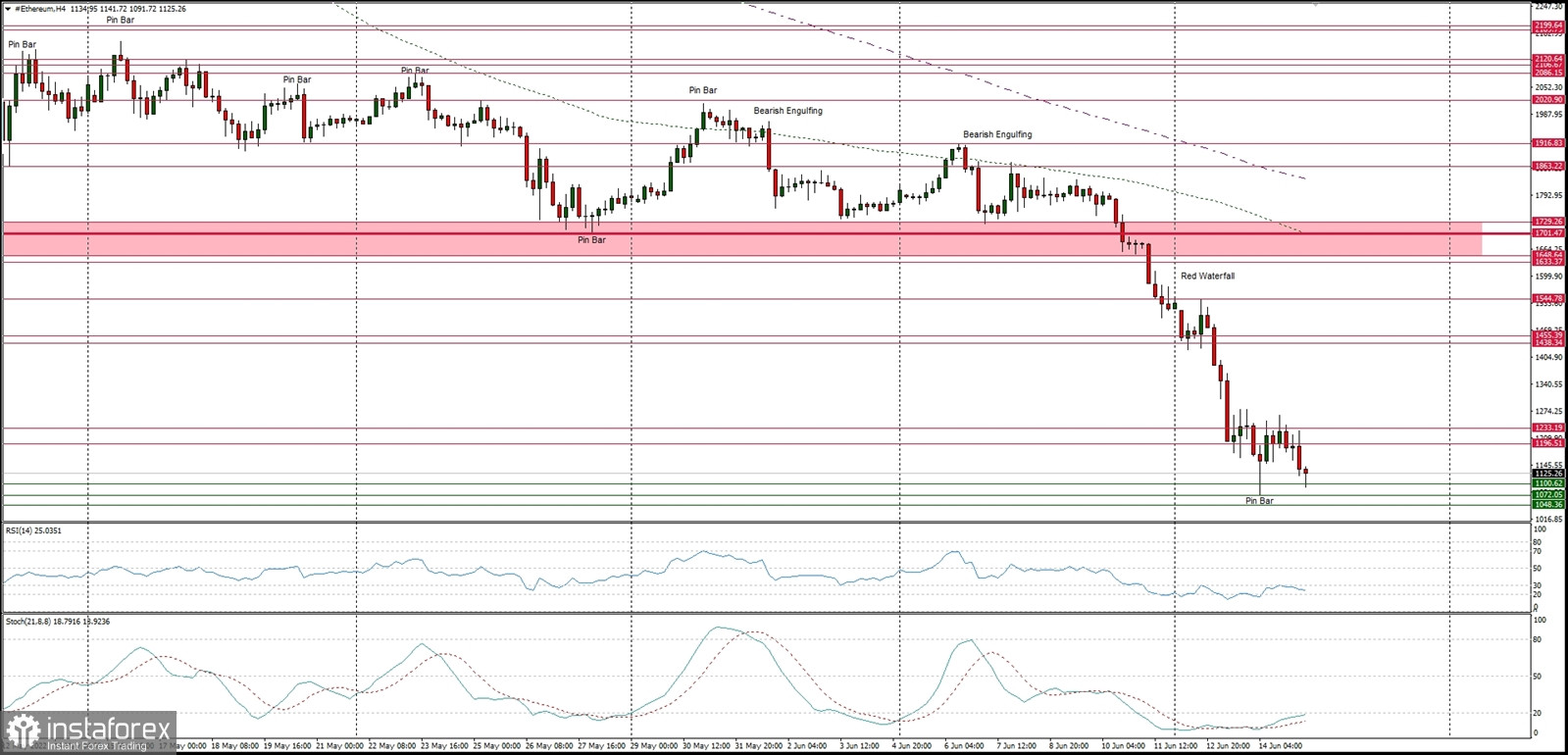

The ETH/USD pair had found a temporary support at the level of $1,070, but the market is under the bearish pressure and the next target for bears is seen at the level of $1,000 or below. Currently, the relief bounce had been terminated around the level of $1,265 after the Pin Bar candlestick formation was made at the H4 time frame chart. The nearest technical resistance is located at $1,233, but in order to change the sentiment to more bullish, the market must break through the level of $1,729 again.

Weekly Pivot Points:

WR3 - $2,216

WR2 - $2,047

WR1 - $1,722

Weekly Pivot - $1,562

WS1 - $1,222

WS2 - $1,054

WS3 - $747

Trading Outlook:

The down trend on the H4, Daily and Weekly time frames had broken below the key long term technical support seen at the level of $1,729 and bears continue to make new lower lows with no problem whatsoever. So far every bounce and attempt to rally is being used to sell Ethereum for a better price by the market participants, so the bearish pressure is still high. The next target for bears is located at the level of $1,000.