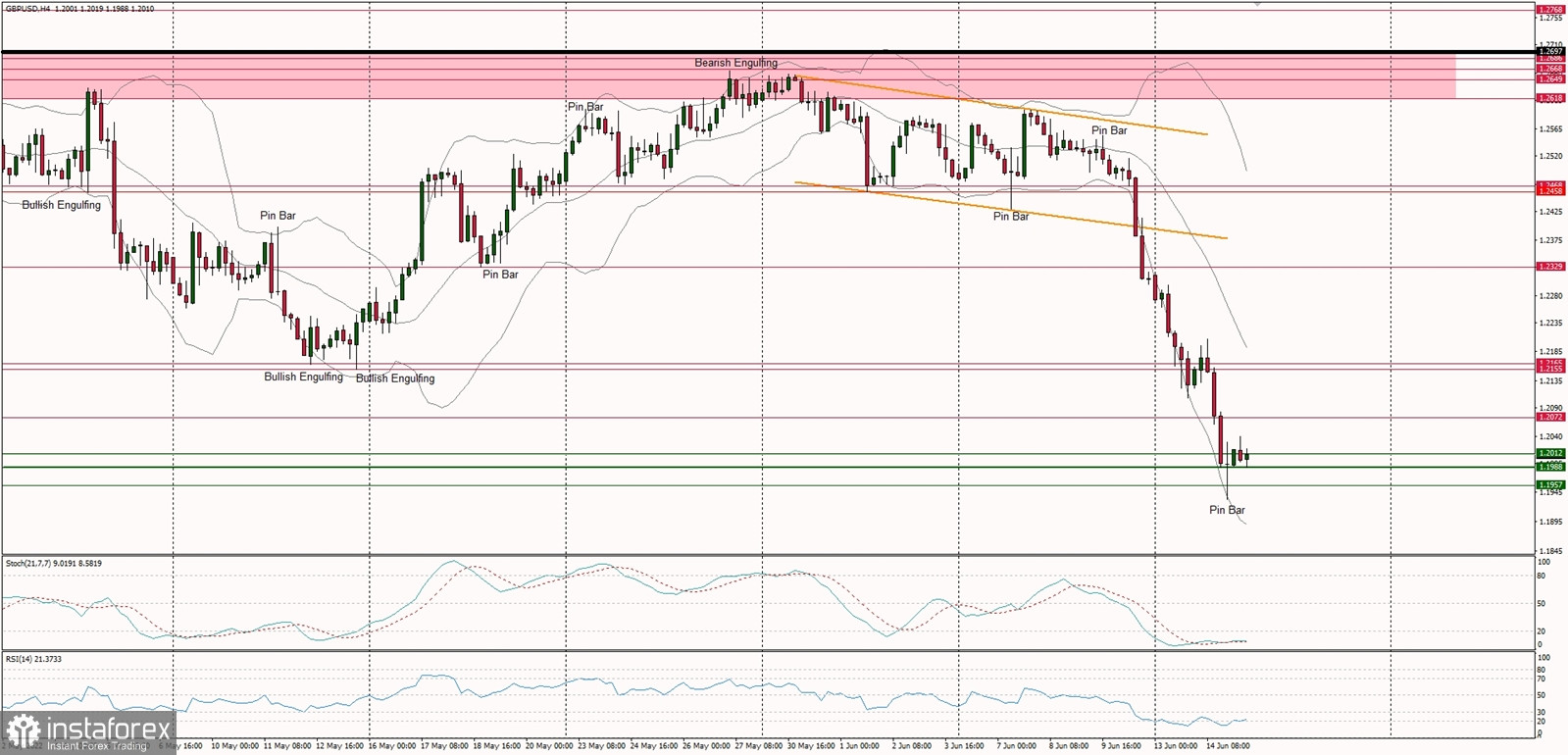

Technical Market Outlook:

The GBP/USD pair had made a new swing low at the level of 1.1933, so the down trend is still intact, however the last down wave had ended up with a Pin Bar candlestick. The bulls might be ready for the pull-back or even a bounce higher. The nearest technical resistance is seen at the level of 1.2246 and the next technical support is located at 1.2072 and 1.2012. Any violation below this level would likely accelerate the sell-off towards the level of 1.2000. The weak and negative momentum supports the short-term bearish outlook for Cable, however, due to the extremely oversold market conditions on the H4 time frame chart, the bounce towards the technical resistance is on table.

Weekly Pivot Points:

WR3 - 1.2751

WR2 - 1.2671

WR1 - 1.2451

Weekly Pivot - 1.2374

WS1 - 1.2159

WS2 - 1.2081

WS3 - 1.1851

Trading Outlook:

The price broke below the level of 1.3000 quite long time ago, so the bears enforced and confirmed their control over the market in the long term. The Cable is way below 100 and 200 WMA , so the bearish domination is clear and there is no indication of trend termination or reversal. The bulls are now trying to start the corrective cycle, which is welcome after eight weeks of the down move. The next long term target for bears is seen at the level of 1.1989. Please remember: trend is your friend.