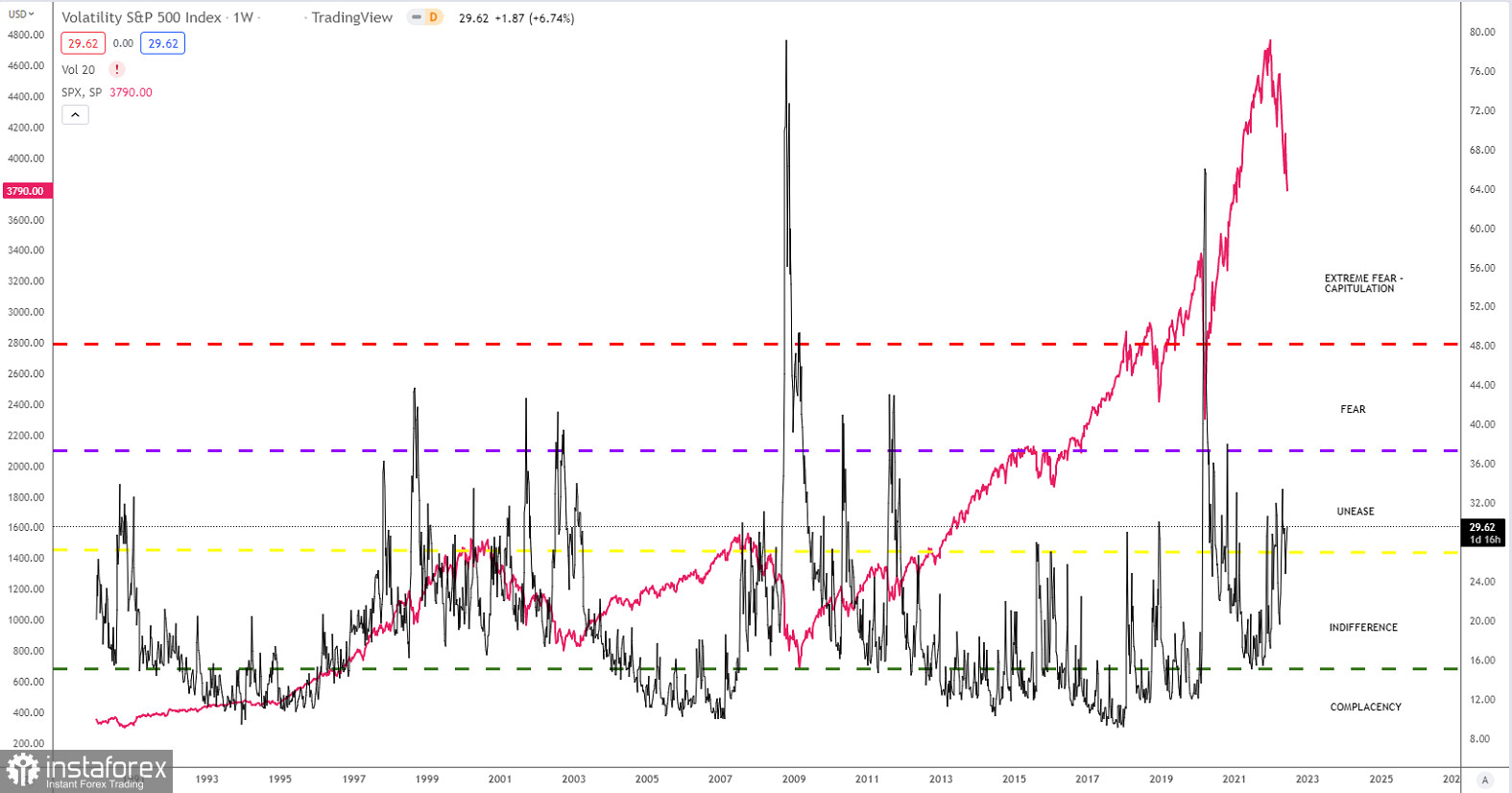

Despite a decline of almost 20%, the market remains more or less flat. In March 2020 as Covid - 19 broke out, the S&P 500 saw a decline of close to 30% in a few days, but the VIX-Index moved directly into extreme fear and capitulation. This time it's different. In 2020, major central banks provided liquidity. This time, the Fed is hiking interest rates due to high inflation. The stock market remains more or less indifferent. This could lead to downside pressure in the weeks ahead.

Only a move into at least the "Fear area" for the VIX could indicate a temporary rally. Be careful and don't overtrade in hope of a new all-time high in the coming two years, because that would be a highly unlikely scenario. The risk in the S&P 500 remains to the downside.