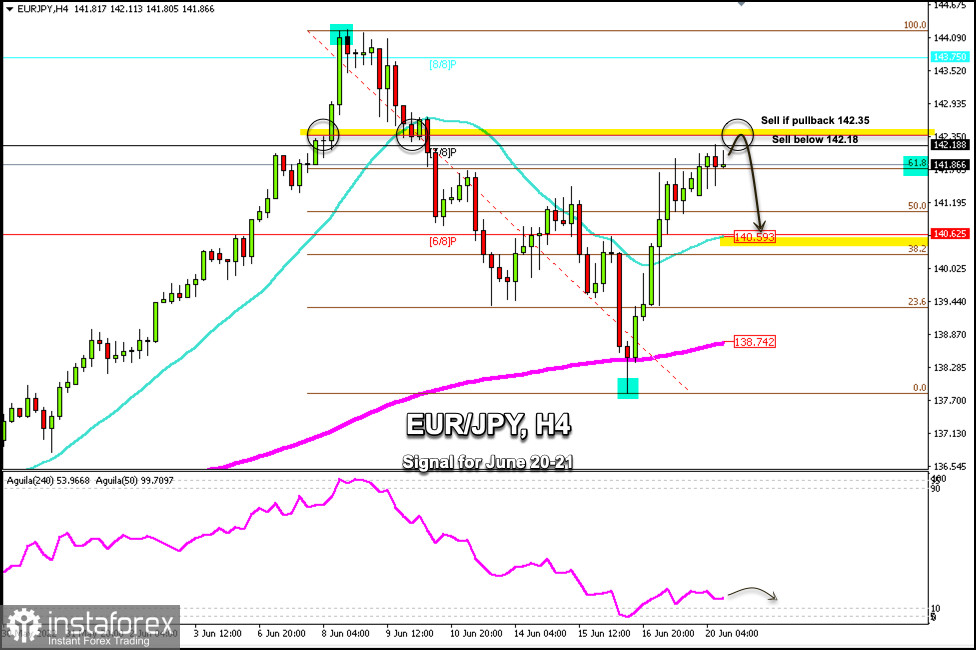

EUR/JPY has reached the 61.8% Fibonacci at around 141.86. It is currently trading around this area but could continue its rise due to strong resistance at 142.35.

The currency pair received strong support after falling towards the 200 EMA located at 138.74. Above this level, it rebounded strongly returning to 142.00.

USD/JPY is reaching extremely overbought levels, trading above 135.00. If a technical correction occurs in the next few hours, it could be a negative signal for EUR/JPY and its price could fall below 7/8 Murray and could reach the 21 SMA located at 140.59.

Technical indicators are showing an overbought signal on the 1-hour chart. If the pair consolidates below the 61.8% Fibonacci at 141.86, a technical correction may occur and the price could reach 200 EMA at 138.74.

On June 16, the EUR/JPY pair hit the low at 137.82. From this level, the Euro has been bouncing. A technical correction is likely to follow in the next few hours if it fails to consolidate above 142.35.

On June 16, the eagle indicator reached the extremely oversold level. Since then, the euro has been bouncing and is now in a key resistance zone. The 142.35 level could be a barrier for a drop to occur.

Our trading plan for the next few hours is to sell EUR/JPY if it consolidates below 142.18. If there is a pullback towards the strong resistance at 142.35, it will be a signal to sell with targets at 141.10 (50% Fibonacci) and 140.59 (6/8 Murray).