Crypto Industry News:

The president of El Salvador, Nayib Bukele, in response to massive BTC sales, spoke about investing in Bitcoin.

Since El Salvador accepted Bitcoin last September as legal tender alongside the US dollar, it has purchased 2,301 Bitcoins. However, as Bitcoin's price fell, El Salvador's investment reportedly lost 50% of its value, or more than $ 50 million.

"I see some people are worried or concerned about the market price of Bitcoin. My advice: stop looking at the chart and enjoy your life. If you have invested in BTC, your investment is safe and its value will rise enormously after a bear market. Patience is the key" - Bukele wrote on Twitter.

Many people have expressed their concerns about the fiscal health of El Salvador due to the large amount of Bitcoin in the country's balance sheet.

Salvadoran finance minister Alejandro Zelaya addressed concerns last week, saying that "fiscal risk is extremely minimal". He also added:

"When they tell me that the fiscal risk of El Salvador due to Bitcoin is really high, all I can do is smile".

Some share Bukeke's optimism, including Bitcoin supporter Michael Saylor and Skybridge Capital founder Anthony Scaramucci.

Technical Market Outlook:

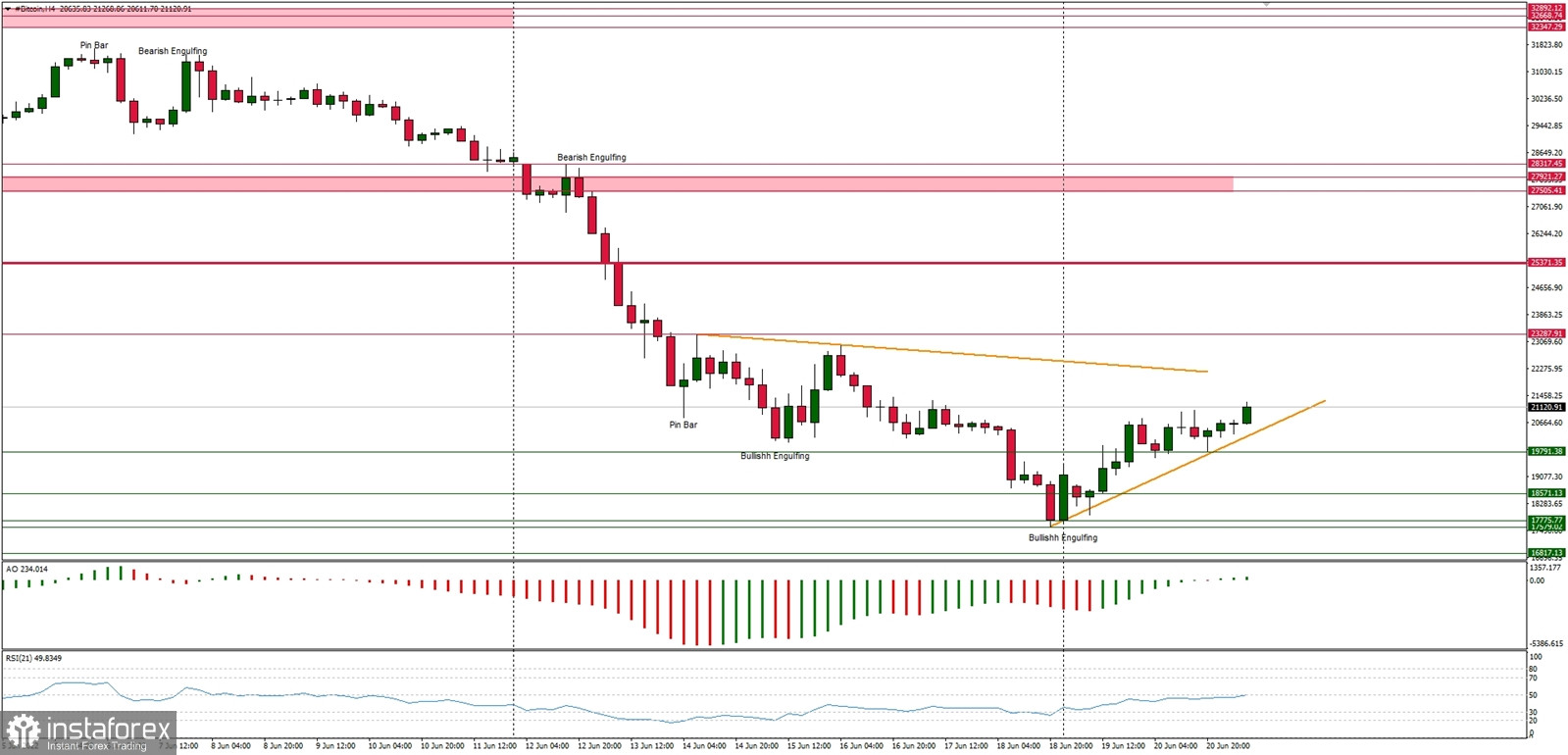

The BTC/USD pair has bounced back above $21,000. The bulls are bouncing from the extremely oversold market conditions, so the next target for bulls is seen at the level of $23,287. Any failure to hit and/or break above this level will likely result in another wave down towards the recent lows. The nearest technical support is seen at the level of $19,789. The larger time frame outlook for Bitcoin remains bearish, however, we have unconfirmed Bullish Engulfing pattern on the Daily time frame chart, so please stay focused and keep an eye on the key levels this trading week.

Weekly Pivot Points:

WR3 - $35,385

WR2 - $31,310

WR1 - $25,552

Weekly Pivot - $21,486

WS1 - $15,559

WS2 - $11,561

WS3 - $5,781

Trading Outlook:

The down trend on the H4, Daily and Weekly time frames continues. So far every bounce and attempt to rally is being used to sell Bitcoin for a better price by the market participants, so the bearish pressure is still high. The key long term technical support at the round psychological level of $20,000 had been violated, the new swing low was made at $17,600 and if this level is violated, then the next long-term target for bulls is seen at $13,712.