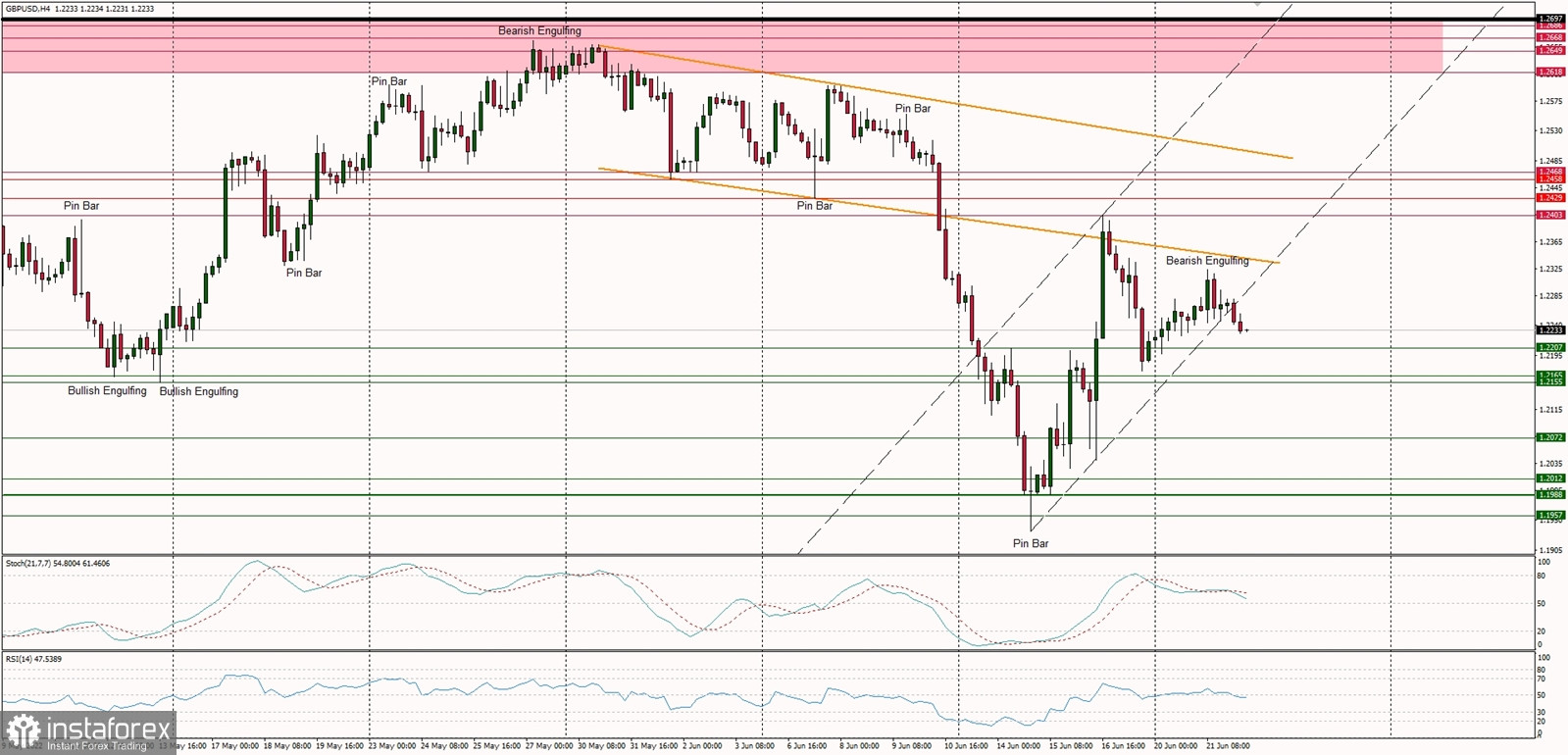

Technical Market Outlook:

The GBP/USD pair has been seen steadily moving towards the technical resistance located at the level of 1.2468, just where the main channel lower line is located. The bulls managed to hit the level of 1.2323 and then the Bearish Engulfing candlestick pattern occurred and soon after that the price fell out of the acceleration channel. The nearest technical support is seen at the level of 1.2207 and 1.2165. Nevertheless, the supply zone located between the levels of 1.2618 - 1.2697 is still the main obstacle for bulls that needs to be broken if the rally is expected to be continued.

Weekly Pivot Points:

WR3 - 1.2922

WR2 - 1.2665

WR1 - 1.2442

Weekly Pivot - 1.2193

WS1 - 1.1971

WS2 - 1.1712

WS3 - 1.1494

Trading Outlook:

The price broke below the level of 1.3000 quite long time ago, so the bears enforced and confirmed their control over the market in the long term. The Cable is way below 100 and 200 WMA , so the bearish domination is clear and there is no indication of trend termination or reversal. The bulls are now trying to start the corrective cycle after a big Pin Bar candlestick pattern was made last week. The next long term target for bears is seen at the level of 1.1989. Please remember: trend is your friend.