Crypto Industry News:

Less than a week after Voyager Digital froze its clients' funds and blocked withdrawals, the Toronto-based company filed for bankruptcy in a New York City court. According to Voyager's petition, the company has more than 100,000 creditors, with a total investment of between $ 1 billion and $ 10 billion. The largest of the creditors is Alameda Reaserch, which issued an unsecured loan of $ 75 million.

Voyager Digital CEO Stephen Ehrlich explained on his Twitter that the court recognition of bankruptcy and bankruptcy would be beneficial for the company's creditors and customers. This is to help establish a financial plan to address current problems, pay off lenders and "restructure" Voyager.

Ehrlich also mentioned that "the company's management expresses the hope that the venture will provide Voyager Digital with an efficient and fair mechanism to deal with challenges" - whatever that means.

The main reason for Voyager Digital's collapse was too much exposure to the previous loser in the current bear market, namely the Three Arrows Capital fund. Voyager has borrowed 3AC 15,250 BTC (approximately $ 307 million) and $ 350 million in cash, for a total loan of approximately $ 657 million. Today we know that 3AC did not meet its repayment obligation and dragged its lender to the bottom like a concrete block.

Technical Market Outlook:

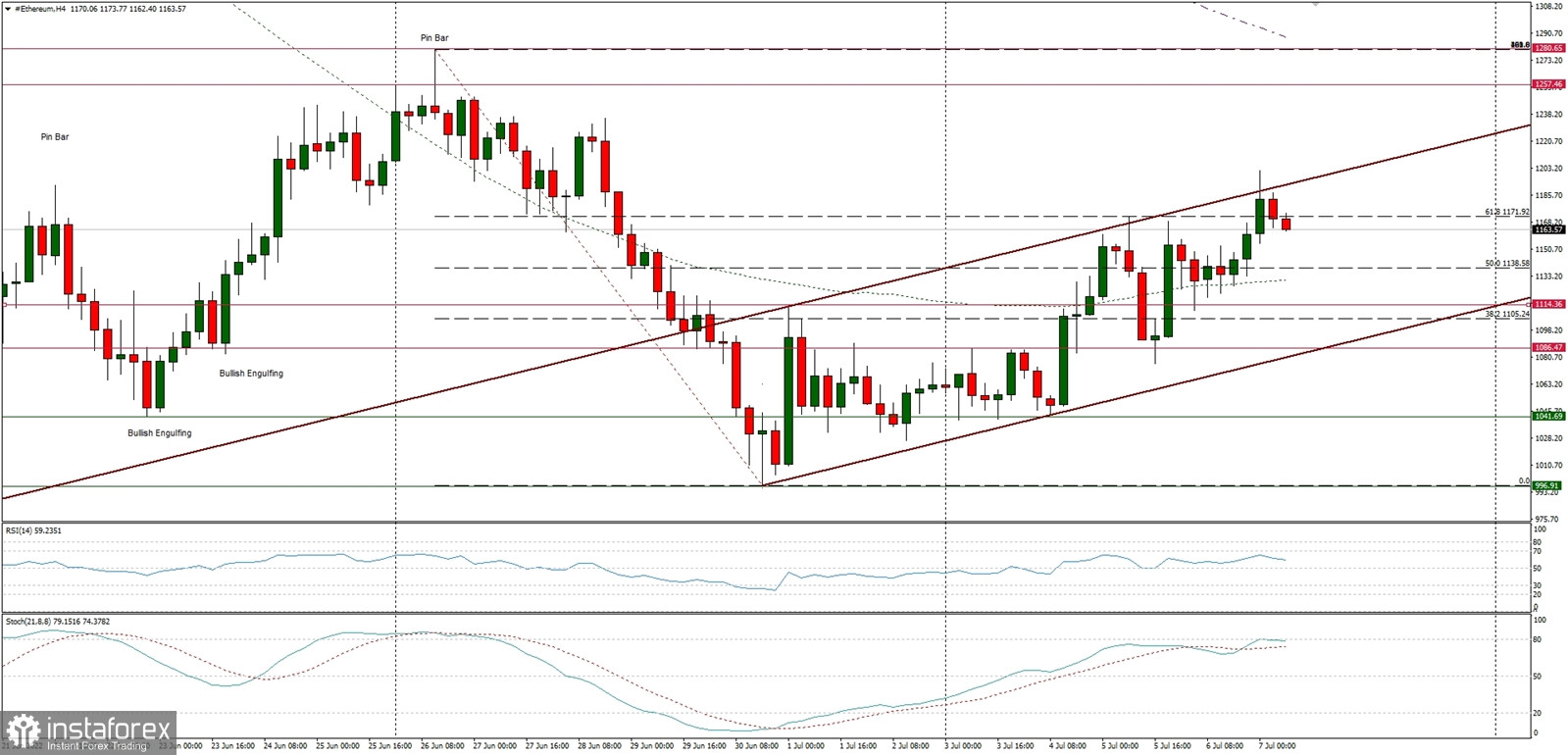

The ETH/USD pair has broken above the 61% retracement of the last wave down and made a new local high at the level of $1,201 (at the time of writing the article). The next target for bulls are seen at $1,229 and at the swing high located at $1,280. The technical supports are seen on the levels of $1,114 and $1,086. The larger time frame chart trend remains down and as long as the key short-term technical resistance, located at the level of $1,280, is not clearly violated, the outlook remains bearish.

Weekly Pivot Points:

WR3 - $1,452

WR2 - $1,340

WR1 - $1,207

Weekly Pivot - $1,098

WS1 - $957

WS2 - $839

WS3 - $701

Trading Outlook:

The down trend on the H4, Daily and Weekly time frames had broken below the key long term technical support seen at the level of $1,420 and bears continue to make new lower lows with no problem whatsoever. So far every bounce and attempt to rally is being used to sell Ethereum for a better price by the market participants, so the bearish pressure is still high. The next target for bears is located at the levels below $1,000, like the last swing low seen at $880. Please notice, the down trend is being continued for the 11th consecutive week now.