Crypto Industry News:

In July, temperatures were well above 100 degrees Fahrenheit in many parts of Texas. As a result, many cryptocurrency miners have suspended their activities, waiting for the state power grid to be able to meet the demand for electricity.

The Electric Reliability Council of Texas (ERCOT) called on Sunday residents and businesses in Texas to save electricity with "record high electricity demand". According to an ERCOT forecast, Texas' electricity demand - partly due to the operation of air conditioners in extreme heat - could exceed available supply. The forecast showed that demand could reach a record 79,615 megawatts (MW).

Many cryptocurrency miners in the state have announced that they have already curtailed or suspended their activities in anticipation of the end of the heatwave and greater electricity supplies. In a Twitter post on Monday, Core Scientific said it had shut down all of its ASICs in the state until further notice, "to provide relief for Texas residents."

Technical Market Outlook:

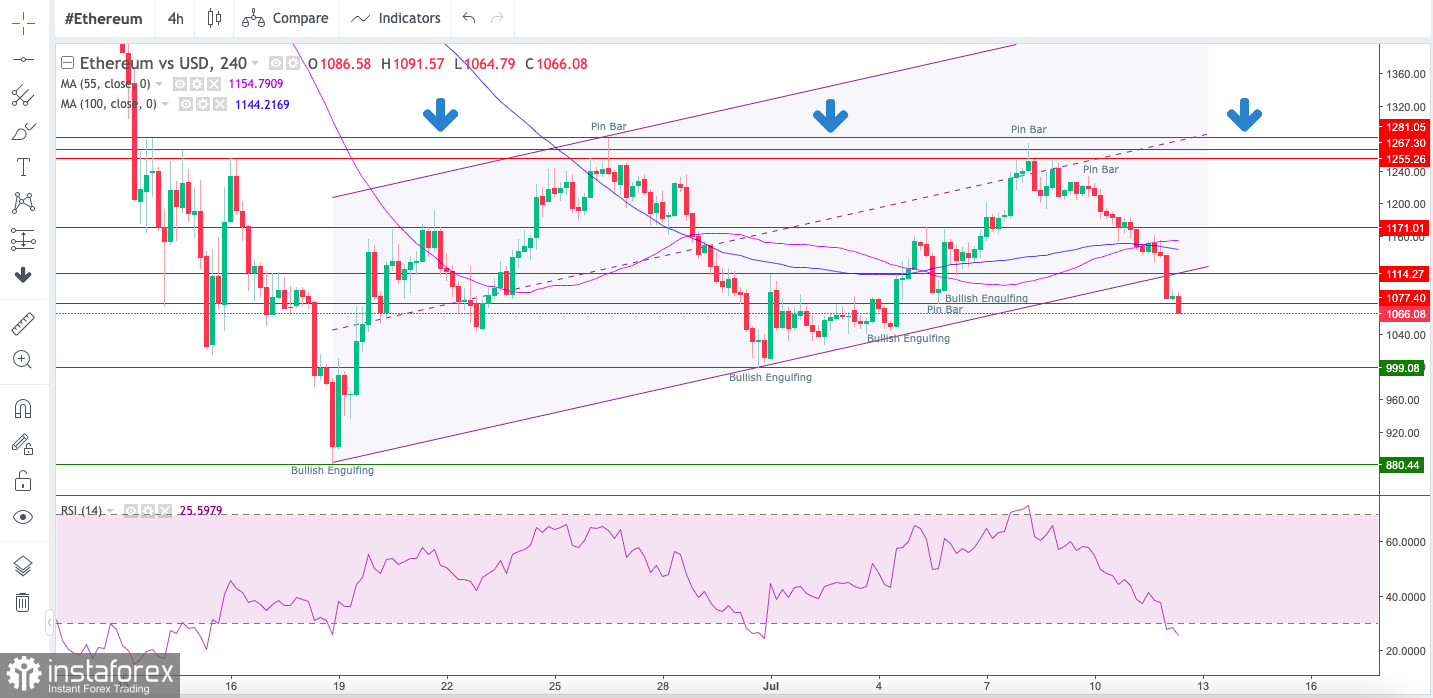

The ETH/USD pair has broken out of the ascending channel lower trend line support and made a new local low at the level of $1,063 (at the time of writing the analysis). The intraday technical supports are seen on the levels of $1,042, $1,026 and $999. The larger time frame trend remains down and as long as the key short-term technical resistance, located at the level of $1,280, is not clearly violated, the outlook remains bearish.

Weekly Pivot Points:

WR3 - $1,466

WR2 - $1,412

WR1 - $1,321

Weekly Pivot - $1,181

WS1 - $1,090

WS2 - $950

WS3 - $718

Trading Outlook:

The down trend on the H4, Daily and Weekly time frames had broken below the key long term technical support seen at the level of $1,420 and bears continue to make new lower lows with no problem whatsoever. So far every bounce and attempt to rally is being used to sell Ethereum for a better price by the market participants, so the bearish pressure is still high. The next target for bears is located at the levels below $1,000, like the last swing low seen at $880. Please notice, the down trend is being continued for the 12th consecutive week now.