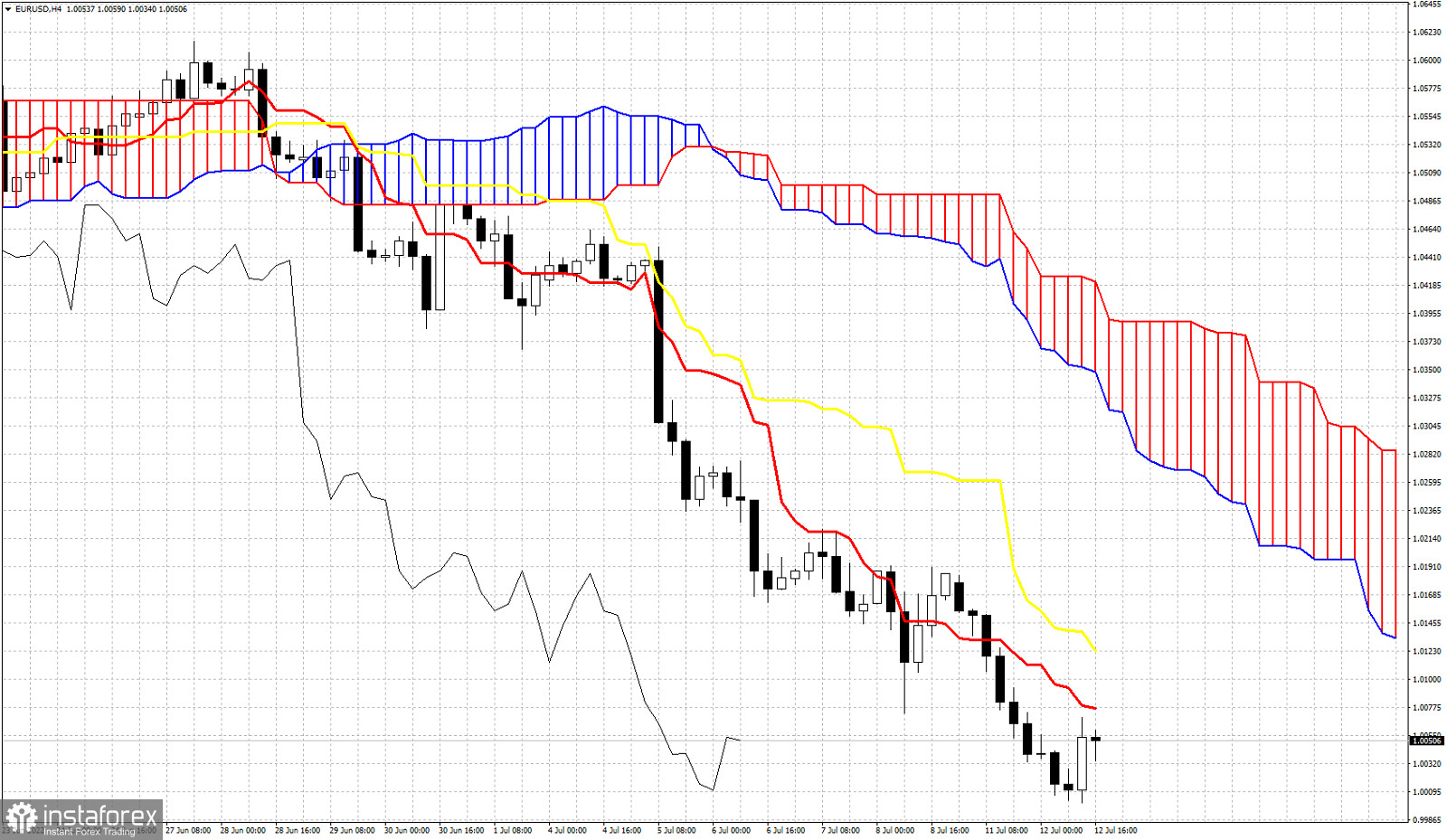

According to the Ichimoku cloud indicator EURUSD remains in a bearish trend. Technically EURUSD also is in a bearish trend as price continues making lower lows and lower highs. Today EURUSD reached parity against the Dollar, price level that has not seen for several years. We use the Ichimoku cloud indicator in order to identify key short-term price levels that could signal a trend reversal. So far we have only seen warnings by technical indicators that the downtrend is weakening. We have not seen any reversal signal yet. The tenkan-sen (Red line indiccator) is at 1.0080 and this is the first important short-term resistance. Next we find the kijun-sen (yellow line indicator) at 1.0120. A break above the kijun-sen will most probably push price towards the Kumo (cloud) at 1.0270. As long as price is below the 4 hour Kumo (1.03-1.04) trend in the short-term will remain bearish. The Chikou span (black line indicator) remains below the candlestick pattern confirming we are in a bearish trend. The Chikou span shows that resistance is also found at 1.0170.