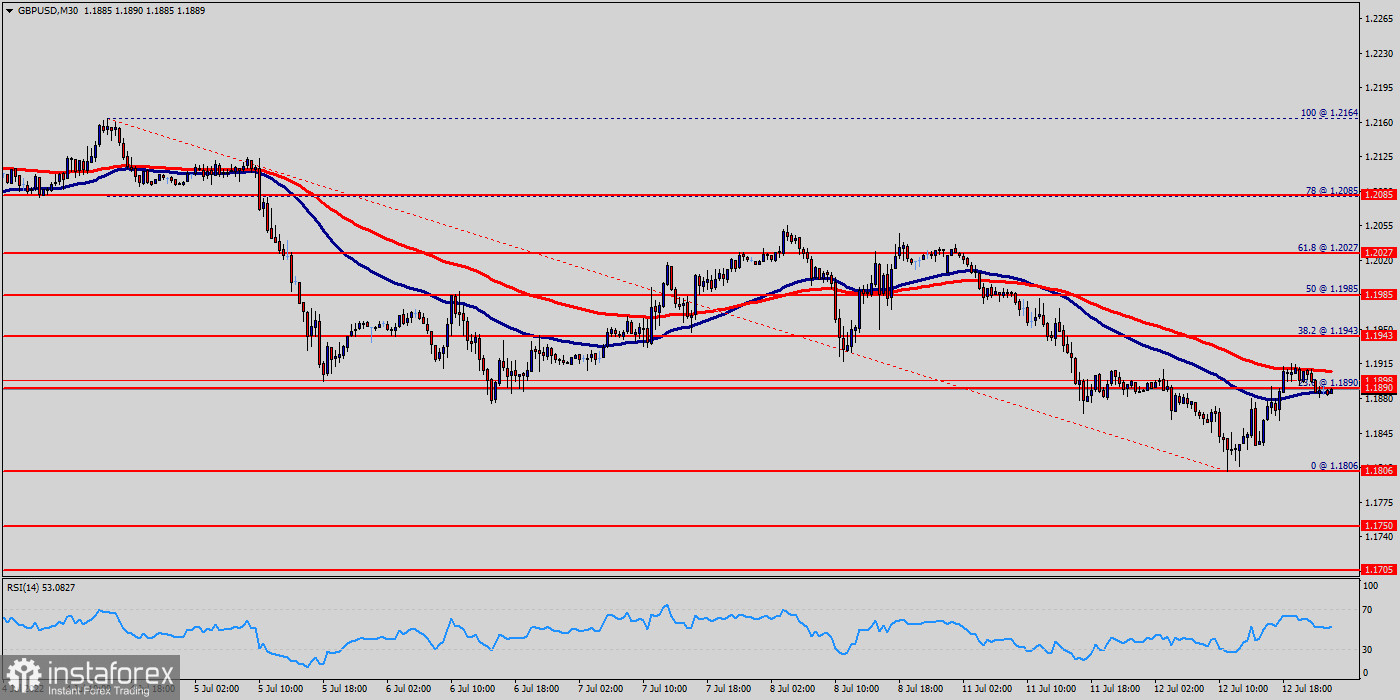

The GBP/USD pair continues to move downwards from the level of 1.1943.

Yesterday, the pair dropped from the level of 1.1943 to the bottom around 1.1806. But the pair has rebounded from the bottom of 1.1806 to close at 1.1890.

Today, the first support level is seen at 1.1806, the price is moving in a bearish channel now.

Furthermore, the price has been set below the strong resistance at the level of 1.1943, which coincides with the 38.2% Fibonacci retracement level.

This resistance has been rejected several times confirming the veracity of a downtrend. Additionally, the RSI starts signaling a downward trend.

As a result, if the GBP/USD pair is able to break out the first support at 1.1806, the market will decline further to 1.1750 in order to test the weekly support 2.

Consequently, the market is likely to show signs of a bearish trend.

So, it will be good to sell below the level of 1.1943 with the first target at 1.1806 and further to 1.1750.

in case a continuousion takes place and the GBP/USD pair breaks through the support level of 1.1750, a further decline to 1.1705 can occur which would indicate a bearish market.

However, stop loss is to be placed above the level of 1.1985.

Upside outlook :

If the trend is able to break out through the first resistance level at 1.1985, we should see the pair climbing towards the double top (1.2085) to test it. Therefore, buy above the level of 1.1985 with the first target at 1.2085 in order to test the daily resistance 1 and further to 1.2164. Also, it might be noted that the level of 1.0077 is a good place to take profit because it will form a double top.