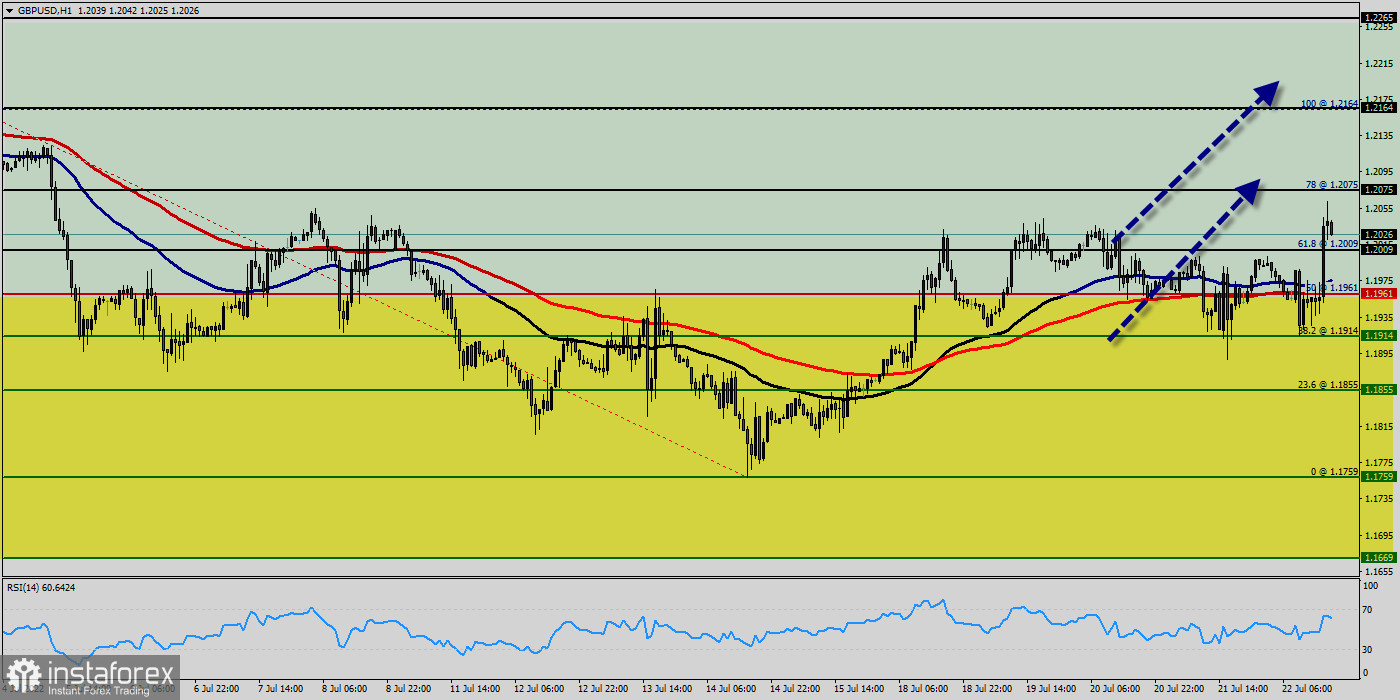

The GBP/USD pair broke resistance which turned to strong support at the level of 1.1961 yesterday.

The level of 1.1961 coincides with a golden ratio (61.8% of Fibonacci), which is expected to act as major support today.

The Relative Strength Index (RSI) is considered overbought because it is above 60. The RSI is still signaling that the trend is upward as it is still strong above the moving average (100).

Currently, the price is in a bullish channel. This is confirmed by the RSI indicator signaling that we are still in a bullish trending market.

This suggests the pair will probably go up in coming hours. Accordingly, the market is likely to show signs of a bullish trend.

On the one-hour chart, the GBP/USD pair continues moving in a bullish trend from the support levels of 1.1961 and 1.2009.

As the price is still above the moving average (100), immediate support is seen at 1.1961, which coincides with a golden ratio (61.8% of Fibonacci).

Consequently, the first support is set at the level of 1.1961. So, the market is likely to show signs of a bullish trend around the spot of 1.1961 and 1.2009.

In other words, buy orders are recommended above the golden ratio (1.1961) with the first target at the level of 1.2075

. Furthermore, if the trend is able to breakout through the first resistance level of 1.2075. We should see the pair climbing towards the double top (1.2164) to test it.

However, the stop loss should always be taken into account, for that it will be reasonable to set your stop loss at the level of 1.1914.