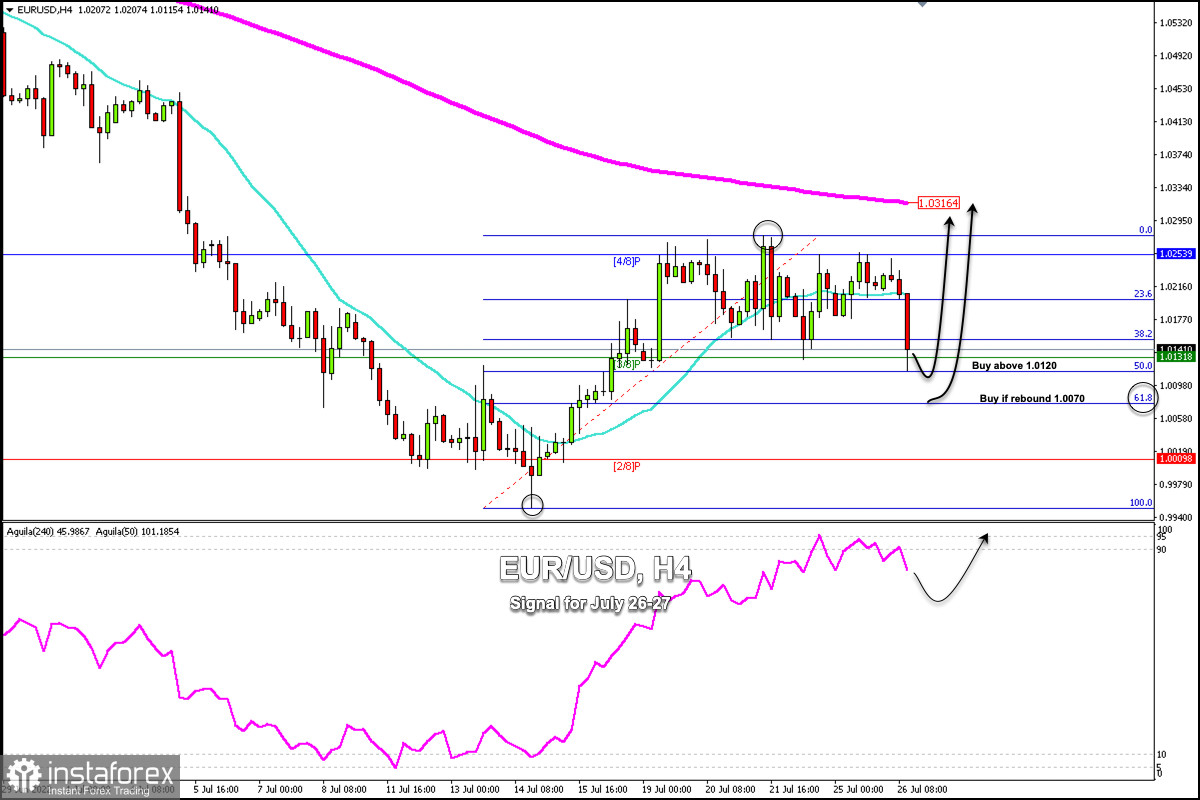

EUR/USD is trading at its lowest level in a week and close to the 50.0% retracement projection of 0.9952 - 1.0277. The 61.8% Fibonacci retracement will provide good support at around 1.0070.

This occurs in the context of cautious market sentiment and a strengthening dollar. Investors are uncertain about the outcome of the two-day FOMC meeting, which starts on Tuesday. On Wednesday, the announcement of a rise of 0.75% is expected.

EUR/USD could consolidate around the 1.0120 zone (50%). In case of a sharp break, it is expected to fall to the zone of 1.0070 (61.8%). If EUR/USD returns above the 21 SMA located at 1.0205, it could offer relief and could resume its bullish cycle.

Technically, the 4-hour chart shows that the pair accelerated its decline after a few failed attempts to break above 4/8 Murray at 1.0253. The technical indicators have resumed their declines showing negative levels. The eagle indicator is at overbought levels. Hence, the downward pressure is likely to continue in the coming days.

On the chart, we can see that the euro is bouncing around the 50% retracement zone (1.0120). If it manages to bounce back and break above the 23.6% Fibonacci level again (1.0190), we could expect the euro to reach 1.0253 (4/ 8 Murray) and it could even go as far as the 200 EMA at 1.0316.

On the other hand, if the downward pressure continues, the euro is likely to find good support at around the 61.8% Fibonacci, the level which could offer a buying opportunity with targets at 1.0170 and 1.0253. A daily close below the 61.8% Fibonacci will be considered a negative sign and the euro is likely to return to the 2/8 Murray level at 1.0009.