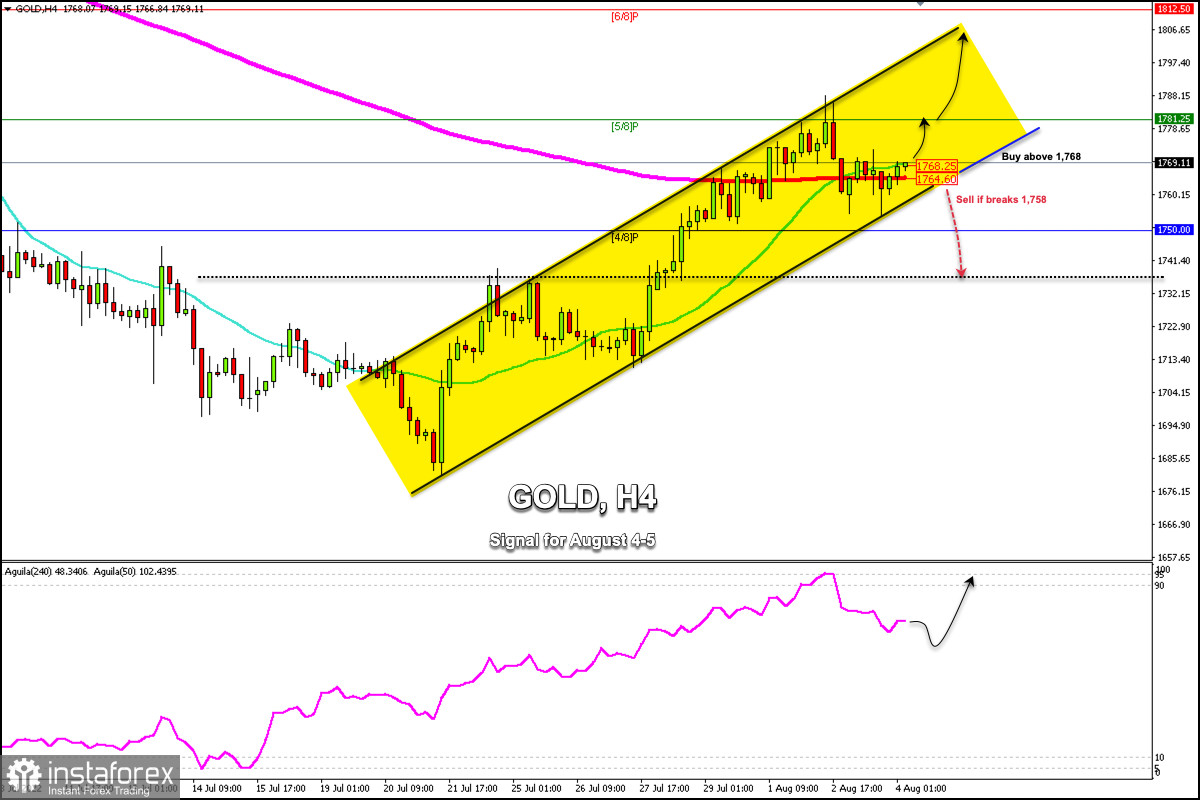

XAU/USD pulled away from its weekly high of 1,787.90 and fell as low as 1,754.19. This low tested the bottom of the uptrend channel. From there, it is bouncing back and is now above the 200 EMA and above the 21 SMA.

On the 4-hour chart, we can see that XAU/USD has been bouncing back above 1,760 which could offer some bullish outlook in the short term. Furthermore, the metal is still trading inside the uptrend channel formed on July 21.

However, the chart above shows that XAU/USD is trading above the 200 EMA and above the 4/8 Murray which offers good support for the asset.

Yesterday, US Treasury yields rose, moving away from June's low. The US 10-year Treasury bond yield is trading at 2.801%. If this trend continues, it may limit the advance of gold and it could resume the main downtrend. For this, we should wait for confirmation below 1,758.

At the opening of the American session, the Bank of England will publish its interest rate. An increase of 0.50% is expected. This policy decision could give strong volatility to gold and its price could gyrate. Therefore, we should be attentive to this news which will give us an opportunity to trade.

According to the 4-hour chart, gold keeps the uptrend intact. Only a sharp break and a daily close below 1,758 could accelerate the bearish move and the price could drop to 4/8 Murray at 1,750.

Additionally, if gold settles below 4/8 at around 1,750, it is likely to resume the main bearish move and it could reach 1,735, and even fall to the psychological level of 1,700.

Conversely, as long as it trades above the 200 EMA and above the 21 SMA located at 1,768, gold is expected to continue its rise and could reach 5/8 Murray at 1,781. A daily close above 1,780 could accelerate the bullish move and reach the psychological level of 1,800 and the top of the bullish channel of around 1,812 (6/8 Murray).

On August, 1 when gold reached the level of 1,787, the eagle indicator entered the overbought zone. Thereafter, it made a strong technical correction. The uptrend is likely to resume if it consolidates above 1,760. However, it could again enter overbought levels.

Our trading plan for the next few hours is to buy above 1,768 with targets at 1,781 and 1,800. Conversely, a sharp break below 1,758 and a break of the uptrend channel could confirm the signal to sell with targets at 1,750 (4/8 Murray) and 1,735.