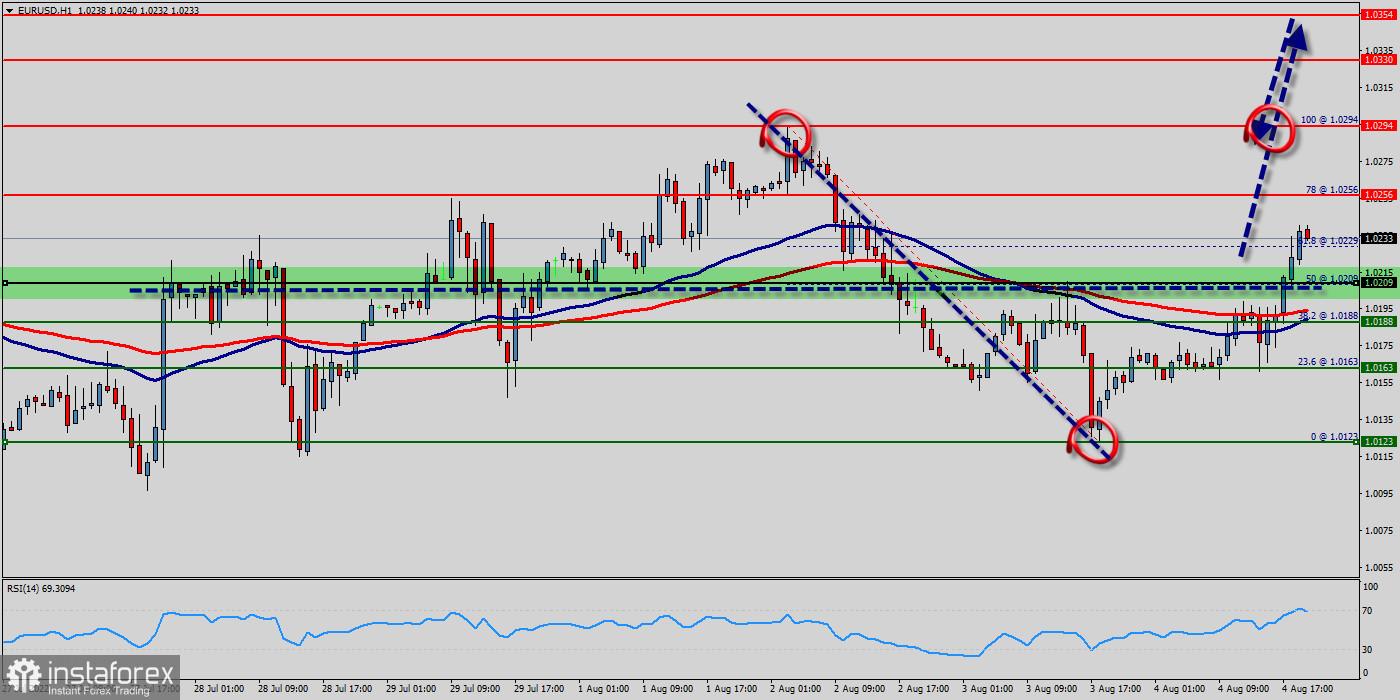

The Euro remained above the levels of 1.0209, 1.0188 and 1.0163, not far from the key 1.0209 evenness mark as more data is pointing out that a recession is looming. Final PMI figures confirmed the Euro Area private sector activity contracted for the first time since last week.

Intraday bias in the EUR/USD pair remains upwards for the moment. Further rise is in favor with 1.0209 minor support intact. Rebound from 1.0163 will target 1.0209 resistance turned support . Break there will target channel resistance at 1.0256 (78% of Fibonacci retracement levels).

Further close above the high end may cause a rally towards 1.0256. Nonetheless, the weekly resistance level and zone should be considered.

Today, the EUR/USD pair has broken resistance at the level of 1.0209 which acts as support now. Thus, the pair has already formed minor support at 1.0209.

The strong support is seen at the level of 1.0163 because it represents the weekly support 1. Equally important, the RSI and the moving average (100) are still calling for an uptrend.

Therefore, the market indicates a bullish opportunity at the level of 1.0209 in the H1 chart. Also, if the trend is buoyant, then the currency pair strength will be defined as following: EUR is in an uptrend and USD is in a downtrend.

Buy above the minor support of 1.0209 with the first target at 1.0256 (this price is coinciding with the ratio of 78% Fibonacci), and continue towards 1.0294 (the weekly resistance 1).

On the other hand, if the price closes below the minor support, the best location for the stop loss order is seen below 1.0188; hence, the price will fall into the bearish market in order to go further towards the strong support at 1.0163 to test it again. Furthermore, the level of 1.0123 will form a double bottom.