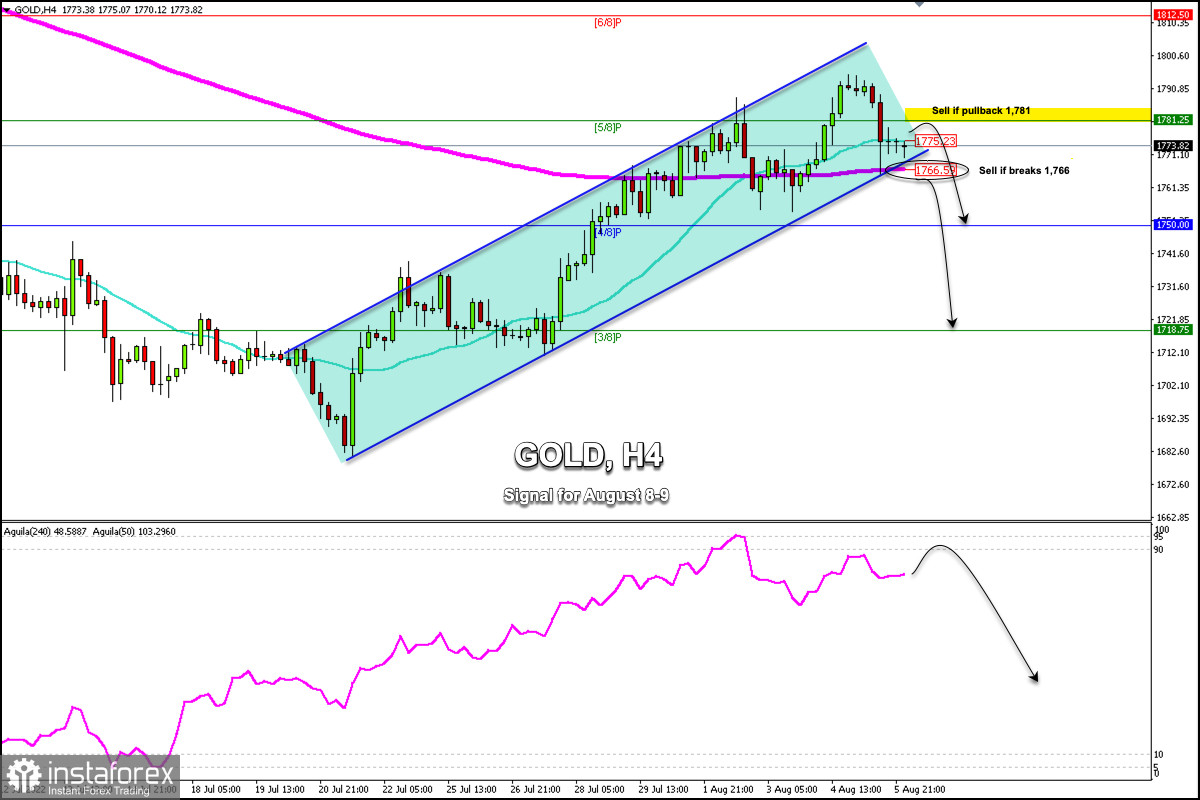

Gold (XAU/USD) fell below 5/8 Murray (1,781) on Friday, after hitting 1,793 earlier in the American session. The asset closed the day at 1,774. The factor that exerted downward pressure was the nonfarm payrolls which rose by 528,000 against the 250,000 in the market consensus.

Gold failed to reach the psychological level of 1,800 being strongly overbought and due to strong resistance at around 1,795. Gold is currently trading above the 200 EMA (1,766) and below the 21 SMA (1,775).

If XAU/USD manages to consolidate above 5/8 Murray (1,781) in the next few hours, we could expect a continuation of the upward movement and the price could reach 1,795, the psychological level of 1,800, and 6/8 Murray at 1,812.

On the other hand, the tensions between the US and China, which resurfaced as a result of the trip of House of Representatives Speaker Nancy Pelosi to Taiwan, could make investors take refuge in gold.

In case gold resumes its uptrend, it is expected to trade above 1,781 and consolidate above the psychological level of 1,800. Conversely, if gold trades below these levels, it is likely to be vulnerable to strong selling pressure.

According to the 4-hour chart, we can see that gold keeps the uptrend channel intact. In the next few hours, gold is expected to consolidate in a narrow range of around 1,766-1,781.

A sharp break of the uptrend channel and a close on daily charts below 1,766 could mean a bearish acceleration, so the price could drop towards 4/8 Murray at 1,750 and even 3/8 Murray at 1,718.

On the contrary, with a daily close and return above 1,782, we could expect a move towards the psychological level of 1,802 and up to 6/8 of Murray at 1,812.

Since the 1st of August, the eagle indicator has been giving an overbought signal and this technical bounce is likely to be seen as an opportunity to sell only if gold consolidates below 1,780.

Our trading plan for the next few hours is to sell if there is a pullback towards 1,781 or sell below 1,775. Besides, we could sell if there is a break below 1,766 (200 EMA). Our target for this bearish strategy can be placed at 1,750, 1,735, and 1,718.