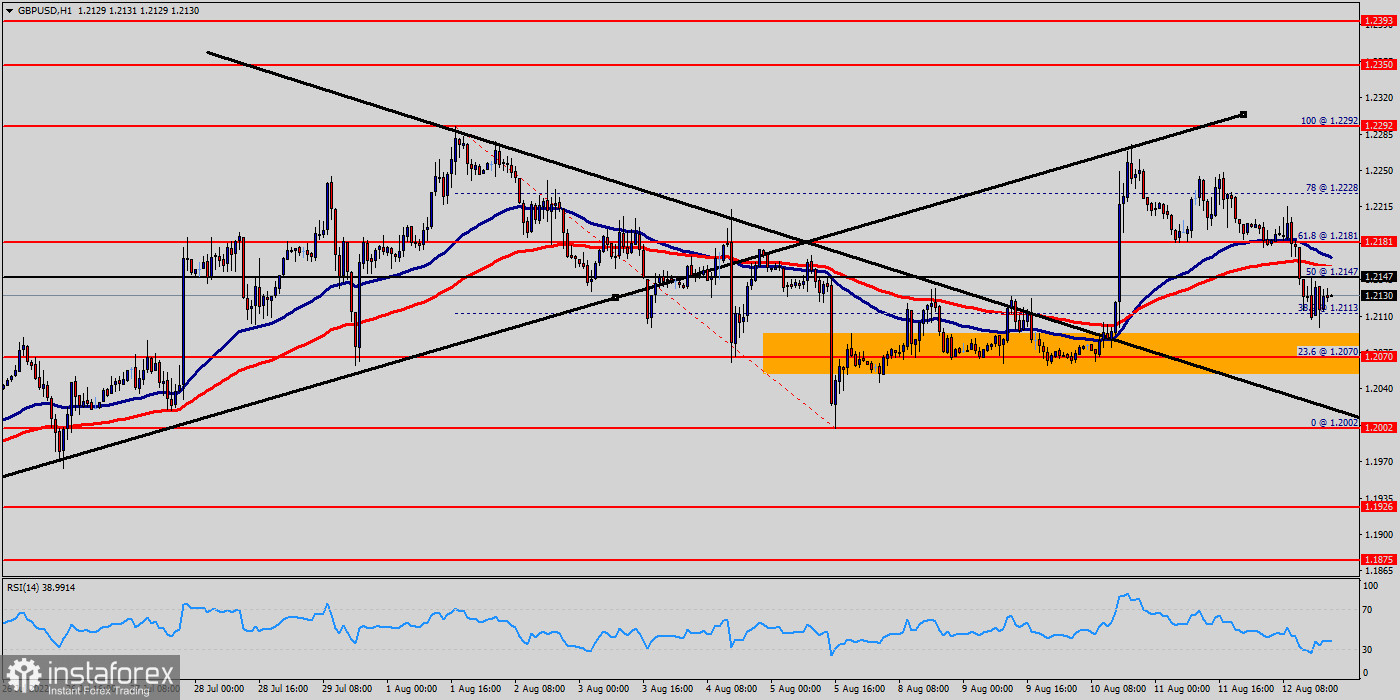

The GBP/USD pair will continue to rise from the level of 1.2070 in the long term. It should be noted that the support is established at the level of 1.2070 which represents the daily pivot point on the H1 chart.

The price is likely to form a double bottom in the same time frame. Accordingly, the GBP/USD pair is showing signs of strength following a breakout of the highest level of 1.2147.

So, buy above the level of 1.2147 with the first target at 1.2181 in order to test the daily resistance 1. The level of 1.2292 is a good place to take profits because it will test the double top.

Moreover, the RSI is still signaling that the trend is upward as it remains strong above the moving average (100). This suggests that the pair will probably go up in coming hours.

If the trend is able to break the level of 1.2292, then the market will call for a strong bullish market towards the objective of 1.2350 today.

On the other hand, in case a reversal takes place and the GBP/USD pair breaks through the support level of 1.2070, a further decline to 1.2002 can occur.

It would indicate a bearish market. According to the previous events the price is expected to remain between 1.2070 and 1.2350 levels.

Buy-deals are recommended above 1.2070 with the first target seen at 1.2181. The movement is likely to resume to the point 1.2292 and further to the point 1.2350. The descending movement is likely to begin from the level 1.2070 with 1.2030 and 1.2002 seen as targets.