The USD/CAD pair is falling like a rock in the short term. It was traded at 1.2864 at the time of writing and it seems determined to approach and reach new lows. After its strong rally, a temporary retreat was expected.

Fundamentally, the Canadian inflation figures brought high volatility and sharp movements. The CPI rose by 0.1% matching expectations, while the Core CPI increased by 0.5% versus 0.3% in the previous reporting period. On the other hand, the US economic data came in mixed.

USD/CAD Natural Retreat

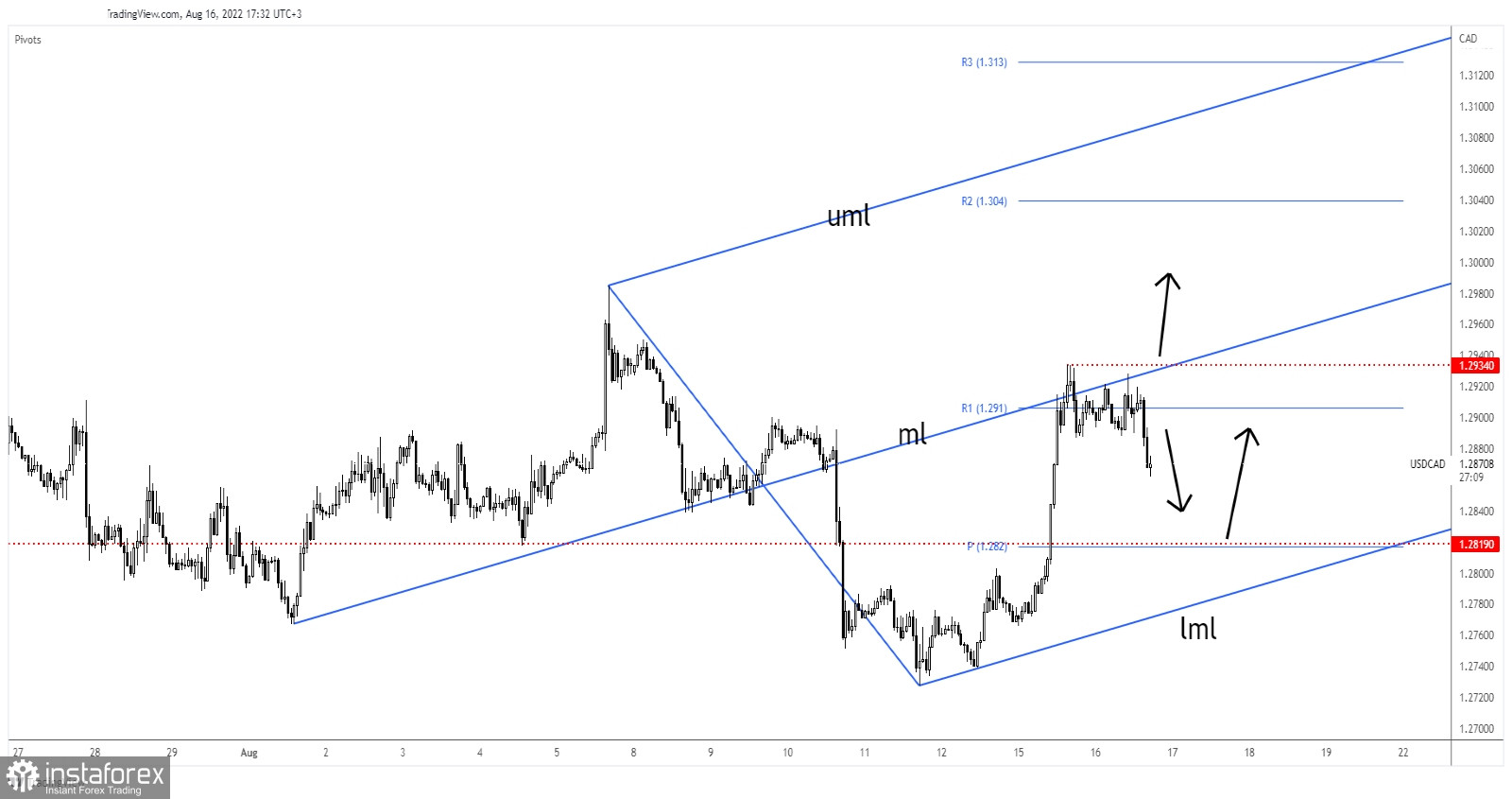

From the technical point of view, the USD/CAD pair registered a strong rally in the short term, but the bullish momentum was stopped by the median line (ml). Its false breakouts above this dynamic resistance and failing to stay above the R1 (1.2910) signaled exhausted buyers.

The price dropped, but the retreat could be only temporary. It could come back down to test and retest the 1.2819 level before trying to develop a new leg higher. The lower median line (lml) stands as dynamic support.

USD/CAD Forecast

Testing and retesting the 1.2819 level could bring new long opportunities. Consolidation above this level could announce a new leg higher.

Also, a new higher high and jumping and closing above 1.2934 could signal further growth and could bring new buying opportunities.