Crypto Industry News:

Leading Chinese cryptocurrency mining maker Canaan has no problems with a local cryptocurrency ban as the company's overall performance continues to grow in 2022.

Canaan officially announced its financial results for the second quarter of 2022, posting a 117% increase in gross profit for the same period of 2021. According to the company, Q2 profit was almost $ 139.

The company's net profit for the second quarter was $ 91 million, an increase of 149% compared to the same period last year. Canaan noted that the second quarter foreign currency translation adjustment was income compared to the previous losses due to the appreciation of the US dollar against the RMB in the second quarter.

"Despite significant gains, Canaan found the second quarter a difficult period with Bitcoin falling below $ 20,000 in June because off the lowered demand for our AI chips" - said CEO Nangeng Zhang.

Zhang mentioned that Canaan is expanding its global presence by establishing an international headquarters in Singapore. The company is also working on scaling up its mining activities, generating more Bitcoins thanks to the improved power supply.

Technical Market Outlook:

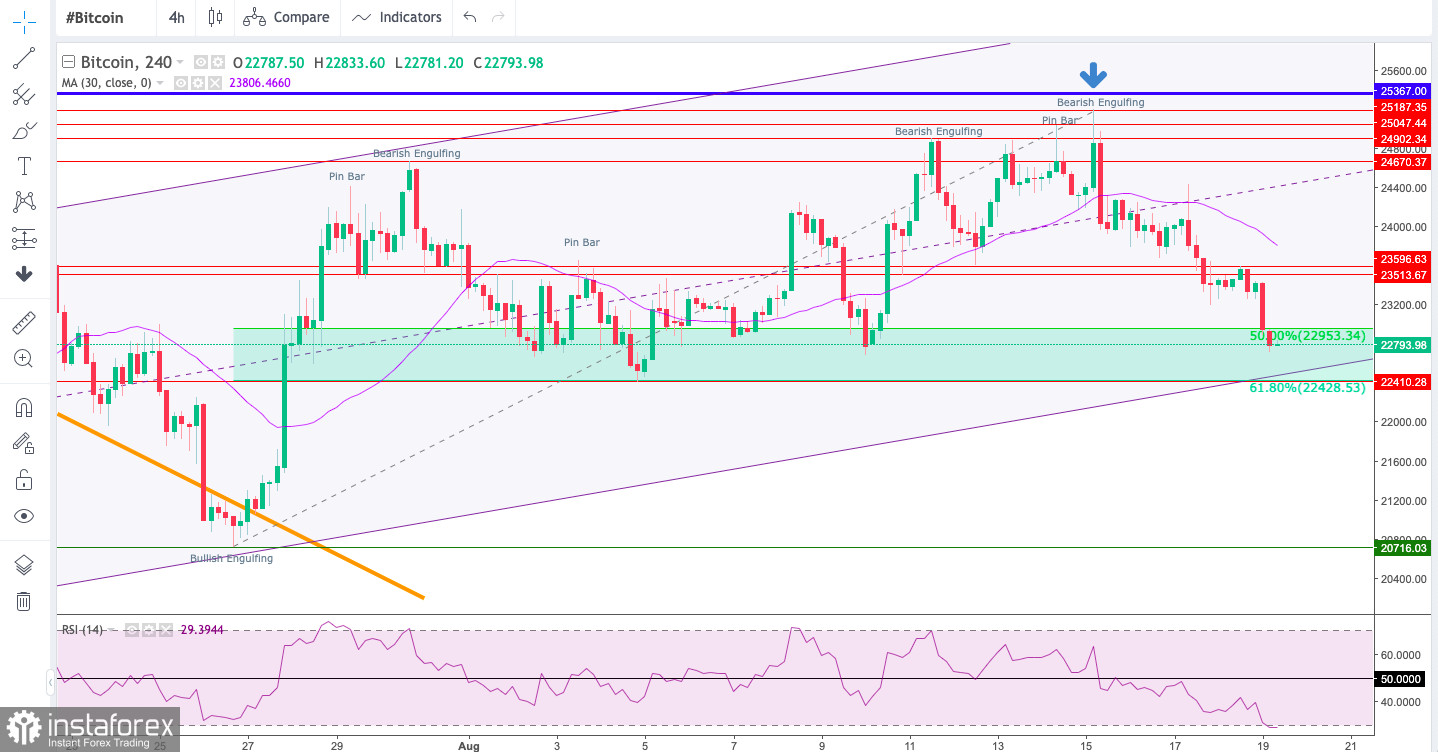

The BTC/USD pair had broken below the 50% Fibonacci retracement level of the last wave up seen at $22,953. The momentum is still weak and negative on the H4 time frame chart, so a deeper correction towards the level of $22,428 (61% Fibonacci retracement level) is possible as well. Please notice, the Bitcoin market keeps moving inside the ascending channel, so the bullish impulsive wave scenario to the upside is now invalidated. If there is no sustained breakout from the channel, the bears might accelerate the sell-off and test the swing low seen at the level of $17,600 again.

Weekly Pivot Points:

WR3 - $22,662

WR2 - $25,629

WR1 - $25,067

Weekly Pivot - $24,597

WS1 - $24,035

WS2 - $23,564

WS3 - $22,532

Trading Outlook:

The down trend on the H4, Daily and Weekly time frames continues without any indication of a trend termination or reversal. So far every bounce and attempt to rally is being used to sell Bitcoin for a better price by the market participants, so the bearish pressure is still high. The key long term technical support at the psychological level of $20,000 had been violated, the new swing low was made at $17,600 and if this level is violated, then the next long-term target for bulls is seen at $13,712. On the other hand, the gamechanging level for bulls is located at $25,367 and it must be clearly violated for a valid breakout.