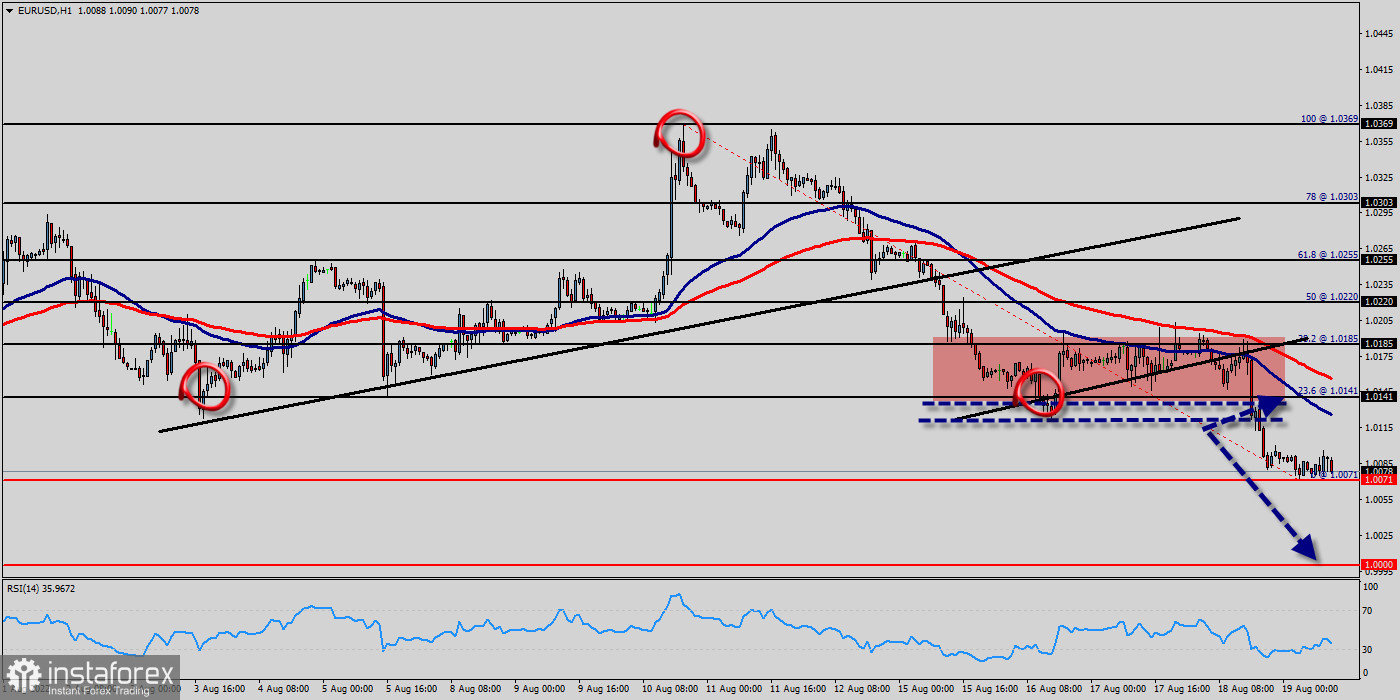

Yesterday, the EUR/USD pair dropped sharply from the level of 1.0185 towards 1.0071. Now, the price is set at 1.0071. On the hourly chart, the resistance of EUR/USD pair is seen at the level of 1.0185 and 1.0220.

The trend is still below the 100 EMA for that the bearish outlook remains the same as long as the 100 EMA is headed to the downside. Hence, the price zone of 1.0185 remains a significant resistance zone.

It should be noted that volatility is very high for that the EUR/USD pair is still moving between 1.0185 and 1.0000 in coming hours.

The EUR/USD pair has broken support at the level of 1.0185 which acts as a resistance now. According to the previous events, the EUR/USD pair is still moving between the levels of 1.0185 and 1.0000. Therefore, we expect a range of 185 pips in coming two days or three.

Also, it should be noticed that resistance 1 is seen at the level of 1.0185 which coincides the daily pivot point. Moreover, the price spot of 1.0185 remains a significant resistance zone.

Therefore, there is a possibility that the EUR/USD pair will move downside and the structure of a fall does not look corrective.

However, the price area of 1.0185 remains a significant resistance zone. Thus, the trend is still bearish as long as the level of 1.0185 is not breached.

Consequently, there is a possibility that the EUR/USD pair will move downside. The structure of a fall does not look corrective.

In order to indicate the bearish opportunity below 1.0185, sell below 1.0185 with the first target at 1.0000.

Additionally, if the EUR/USD pair is able to break out the first support at 1.0000, the market will decline further to 0.9950 in order to test the weekly support 2.

On the other hand, , stop loss should always be taken into account, accordingly, it will be of beneficial to set the stop loss above the last bullish wave at the level of 1.0220.

Traders should watch for any sign of a bullish rejection that occurs around 1.0185. The level of 1.0185 coincides with 38.2% of Fibonacci, which is expected to act as a major resistance today. Since the trend is below the 38.2% Fibonacci level, the market is still in a downtrend. Overall, we still prefer the bearish scenario.

Forecast:

The volatility is very high for that the EUR/USD is still trading between 1.0185 and $1 in coming hours. Consequently, the market is likely to show signs of a bearish trend again. As a result, it is gainful to sell below this price of 1.0185 with targets at $1 and 0.9950. Otherwise, the bullish trend is still expected for the upcoming days as long as the price is above $1. The EUR/USD pair trading is subject to high market risk. My analysis will make the best efforts to choose high-quality of my forecast, but will not be responsible for your trading losses. Please trade with caution.