Gold rallied in the short term and was trading at the 1,747 level at the time of writing. After its massive drop, a temporary rebound was natural. Still, a larger throwback needs confirmation.

Fundamentally, XAU/USD rallied in the short term only because USD depreciated after poor US economic data. The Flash Services PMI dropped from 47.3 to 44.1 points, signaling a strong contraction. Specialists expected a potential growth from 47.3 to 49.8 points. Furthermore, the Manufacturing PMI and the New Home Sales came in worse than expected as well.

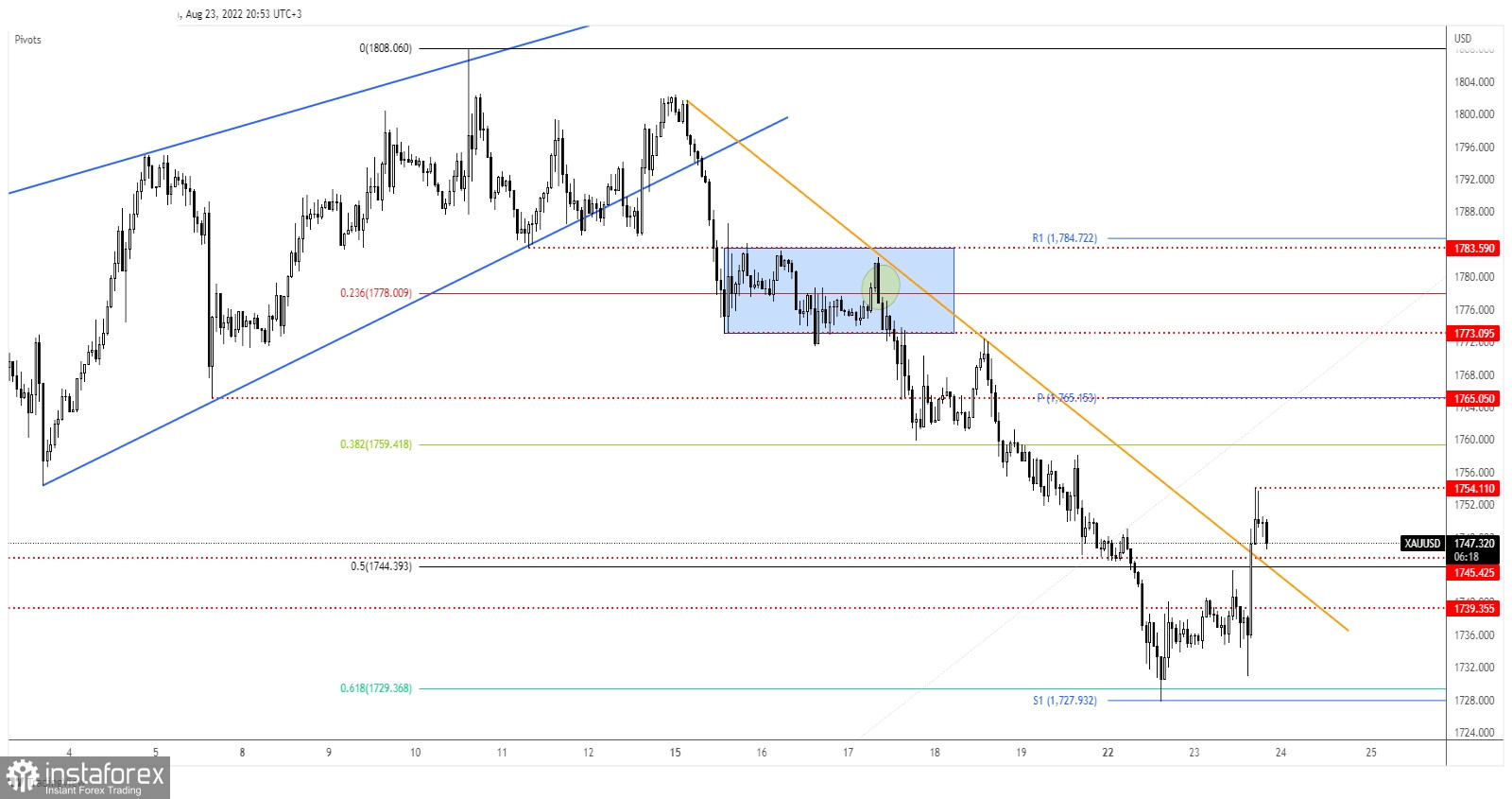

XAU/USD Retests Buyers

XAU/USD found support at the 61.8% retracement level and at the weekly S1 (1,727). Now, it has managed to jump above the 1,745 level and above the downtrend line which represented upside obstacles.

The 1,754 level represents an upside obstacle. In the short term, the price could come back down to test and retest the near-term downside obstacles, the broken levels, before jumping higher.

XAU/USD Forecast

Staying above the broken downtrend line and making a new higher high as well as jumping and closing above 1,754 may activate further growth and could bring long opportunities.