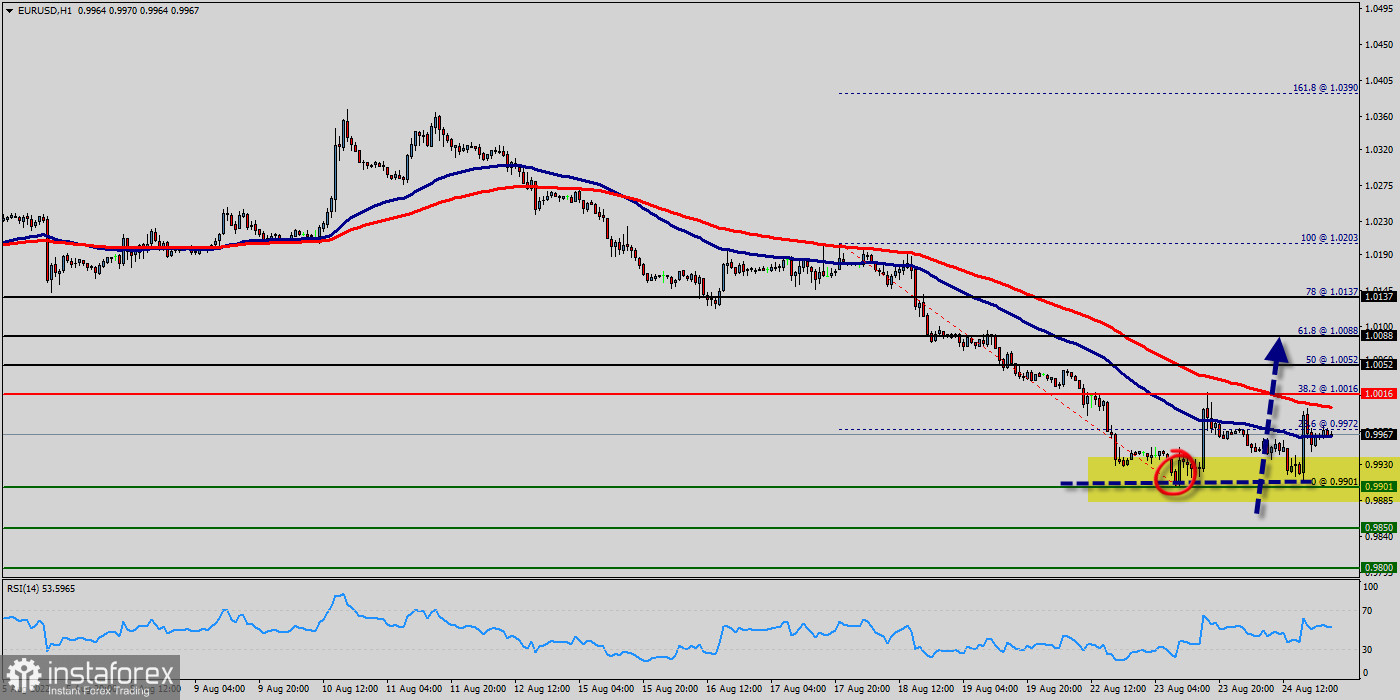

The EUR/USD pair faced a minor resistance at the level of 1.0016, while major resistance is seen at 1.0137. Support is found at the levels of 0.9901 and 0.9850.

Also, it should be noted that a daily pivot point has already set at the level of 1.0016. Equally important, the EUR/USD pair is still moving around the key level at 1.0016, which represents a daily top in the H1 time frame at the moment.

The EUR/USD pair will continue rising from the level of 0.9901 in the long term. It should be noted that the support is established at the level of 1.0016 which represents the daily pivot point.

Yesterday, the EUR/USD pair continued to move upwards from the level of 0.9901. The pair rose from the level of 0.9901 to the top around 0.9972.

The level of 0.9901 is expected to act as major support today. According to the previous events, the EUR/USD pair is still moving between the levels of 0.9901 and 1.0137.

Therefore, we expect a range of 236 pips in coming two days. The trend is still above the 100 EMA for that the bullish outlook remains the same as long as the 100 EMA is headed to the upside.

But, the price spot of 0.9901 remains a significant support zone. Since the trend is above the last bearish wave, the market is still in an uptrend.

Overall, we still prefer the bullish scenario. Consequently, there is a possibility that the EUR/USD pair will moveupside.

The structure of scaling does not look corrective. In order to indicate a bullish opportunity above the area of 0.9901, buy above the price of 0.9901 with the first target at 1.0016 (pivot). Besides, the weekly support 2 is seen at the level of 1.0052 .

However, traders should watch for any sign of a bullish rejection that occurs around 1.0088 . The level of 1.0137 coincides with 78% of Fibonacci, which is expected to act as a major resistance today.