The USD/JPY pair rallied in the short term as the Dollar Index edged higher while the Japanese Yen Futures crashed. It was trading at 138.72 at the time of writing and it is challenging near-term upside obstacles.

The JPY depreciated, even though the Tokyo Core CPI came in better than expected on Friday. The indicator registered a 2.6% growth versus the 2.5% forecasted. Tomorrow, the Japanese Unemployment Rate is expected to remain at 2.6%.

On the other hand, the US CB Consumer Confidence could jump from 95.7 points to 97.4 points, while JOLTS Job Openings could be reported at 10.43M. Better-than-expected US data could lift the USD.

USD/JPY Strong Buyers!

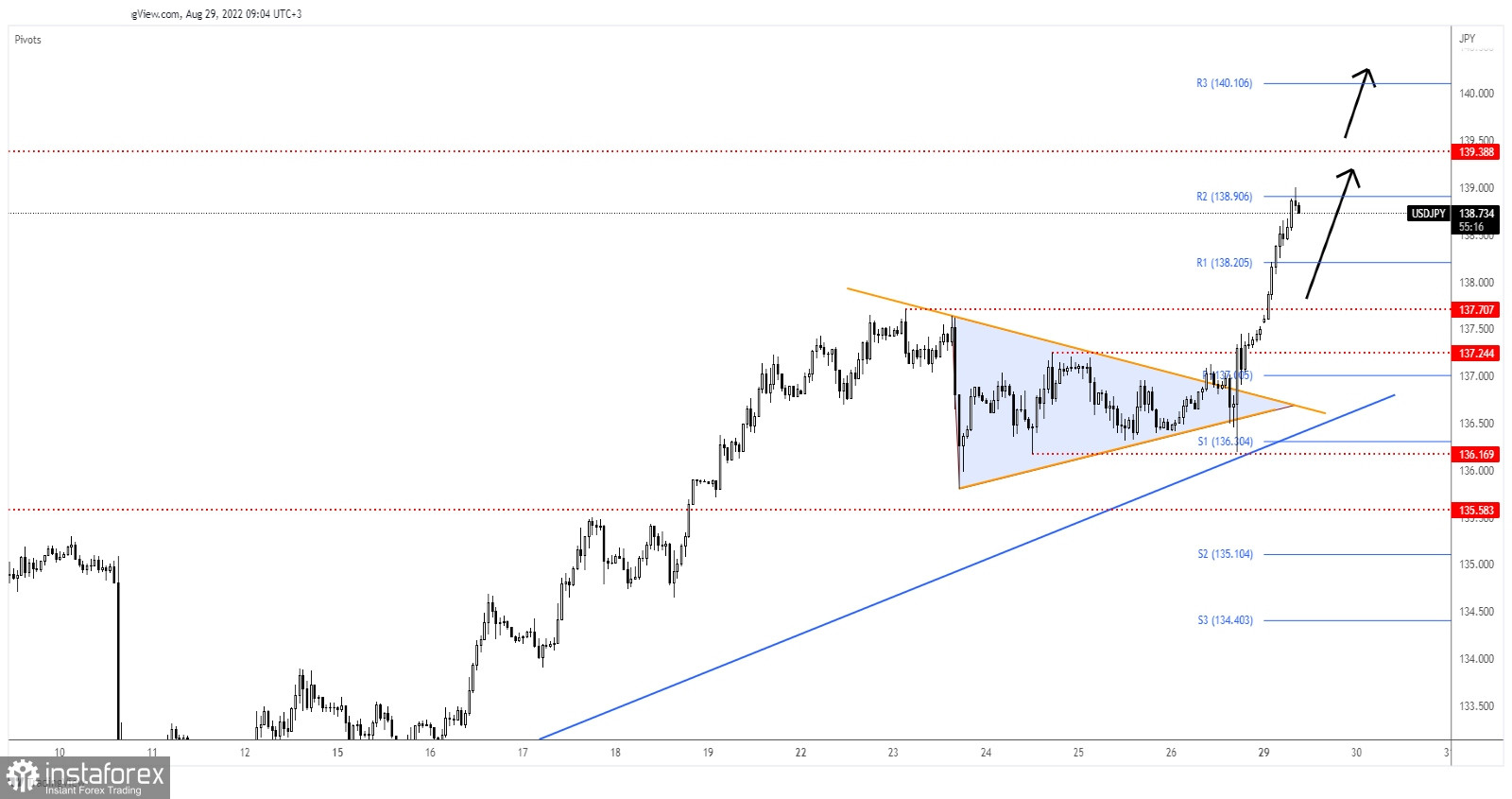

The USD/JPY pair resumed its growth after escaping from the triangle pattern. It has registered only a false breakdown with great separation below the triangle's downside line signaling strong upside pressure.

Failing to retest the uptrend line confirmed strong buyers and an upside continuation. Still, after its strong rally, we cannot exclude a minor retreat. The price could come back to test and retest the near-term support levels before resuming its growth.

USD/JPY Forecast

USD/JPY reached the weekly R2 (138.90) which represents an upside target and obstacle. The weekly R1 (138.20) is seen as immediate support. Coming back to test and retest the R1 or the 137.70 support could bring new long opportunities.

Closing above the R2 (138.90) may signal further growth at least towards the 139.38 key level. A larger upside movement, an upside continuation could be activated by a valid breakout above this level.