September's final week has fully shown how fears are growing in the markets. Contrary to the Fed's plans, investors are waiting for a period of uncertainty about the prospects for the implementation of these plans.

The previous month was named as an "unsuccessful" month for buying stocks, which was confirmed only once in 2020 over the past two years. It can be recalled that stock markets, primarily in America, were growing in 2019 and 2018. Therefore, we treat such interpretations with some skepticism. We believe that the reasons for the decline in demand for company shares this year and last year were the situation with the COVID-19 pandemic that swept the whole world, which resulted in the collapse of the global economy, as well as the Fed's forced decision this year to start the process of normalizing monetary policy.

What can be expect in the markets from the beginning of October now that September is over?

We believe that high volatility will continue this week and the main reason for this will be the publication of economic statistics primarily from the US. In view of the imbalance between the need to reduce the flow of dollar liquidity into the financial system through asset repurchases, and then a prospective increase in interest rates due to high inflation over the past 13 years, and the weakness of the labor market situation, investors do not understand what position the American regulator will take.

Earlier, Fed Chairman J. Powell informed the markets about the importance of stimulating employment in the country, on which economic growth depends. But at the same time, he also talked about high inflation, which seems to linger near current levels for an indefinite period of time, and the bank's decision to begin reducing the volume of asset repurchases, which should end by the middle of next year. This is where the paradoxical nature of this whole picture is noted. Improving the state of the labor market requires stimulating businesses to create more new jobs, but high inflation forces them to reduce these incentives, which is a movement in the opposite direction. It seems that this situation is the reason for the growth of volatility in the markets amid uncertain prospects.

We expect that this factor will dominate next week, which means that high volatility in the markets will continue with all the ensuing consequences. It is worth noting that the resumption of growth in Treasury yields clearly shows the increased impact of this uncertainty.

The important components of US inflation, namely the values of the basic price index for personal consumption, will be published today. It is expected to show the continuation of the growth rate of 3.6% in annual terms, while the August figures will show a decrease from 0.3% a month earlier to 0.2% in monthly terms. If the data of this indicator turns out to be below the forecast, and this primarily refers to the value for August, then this may give the markets a wave of temporary optimism and support the demand for risky assets. Naturally, the growth of the index above the forecast will lead to a new wave of sales and a local appreciation of the US dollar.

Forecast of the day:

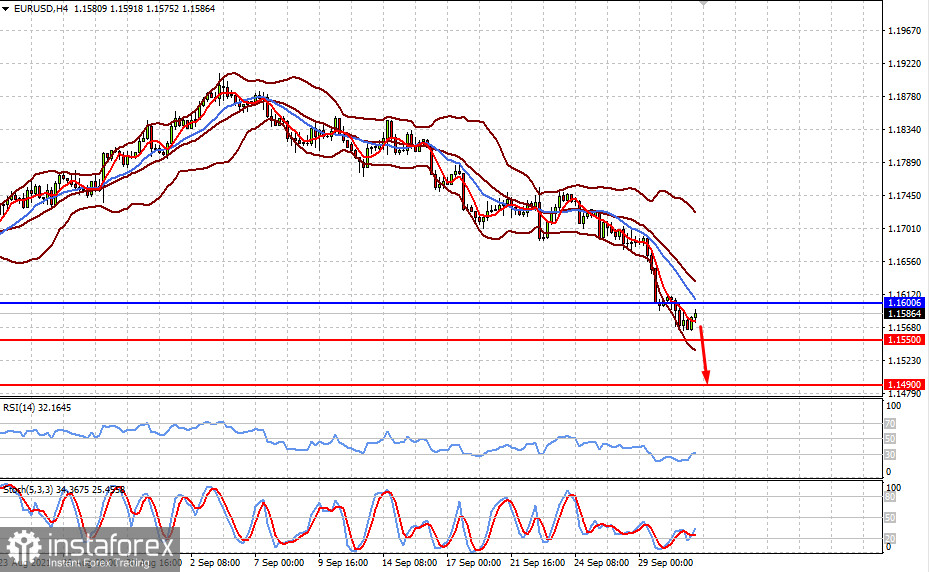

The EUR/USD pair remains under pressure. It is trading below the level of 1.1600 and is expected to further fall to 1.1550, and then to 1.1490 if the data on consumer inflation components grow.

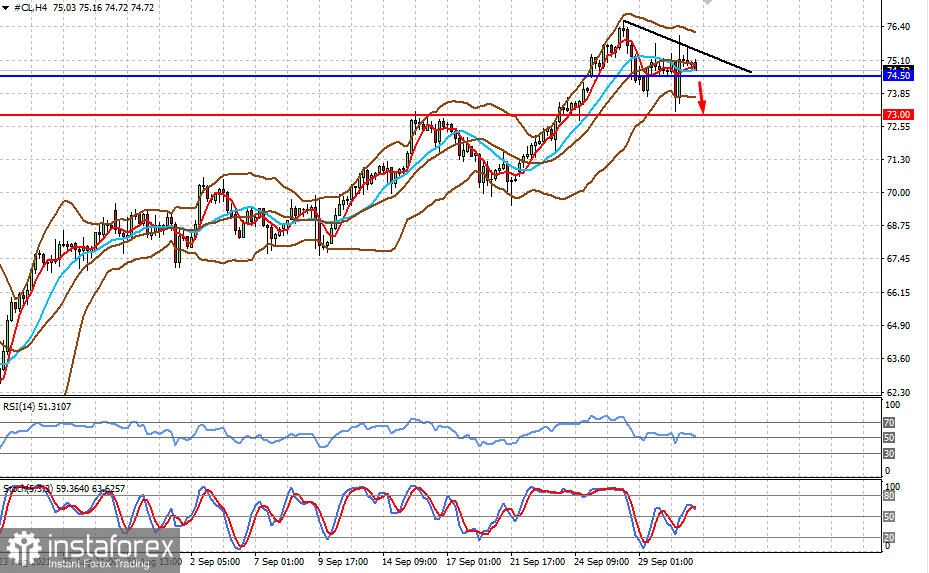

WTI crude oil prices may continue to decline if OPEC + decides to increase production. On this wave, a price decline below 74.50 will lead to its further drop to 73.00.