EUR/USD

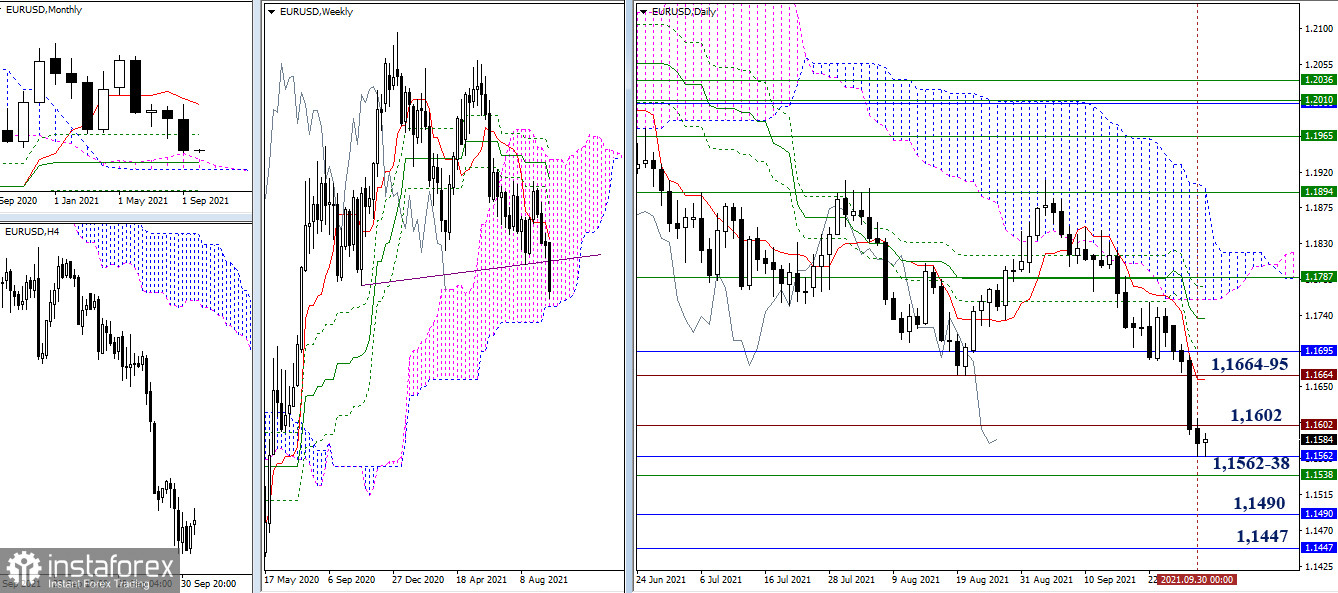

The euro closed the month of September with a bearish candlestick. The bears managed to test the support of the monthly cloud (1.1562) on the last day of the month, thereby defining the tasks for October. The preservation and implementation of the existing bearish potential involve further interaction with the encountered monthly Ichimoku cloud (1.1562 - 1.1447), which is currently strengthened by the monthly medium-term trend (1.1490). The cloud breakdown will form a new bearish target.

In addition to the situation in the monthly timeframe, it should be noted that the bears are close to testing the strength of the lower border of the weekly cloud (1.1538). Breaking through and consolidating in the bearish zone relative to the weekly cloud will also strengthen the bearish mood and lead to the formation of a new target.

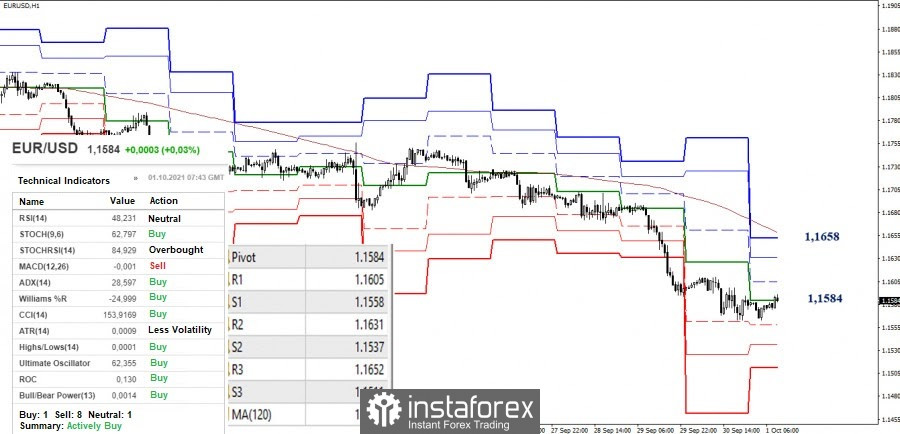

The pair is in the correction zone of the smaller timeframes. The central pivot level (1.1584) is currently being tested. The next key pivot point is set at 1.1658 (weekly long-term trend) and towards it, the nearest resistance levels of 1.1605 and 1.1631 (classic pivot levels) can be considered.

In turn, the formation of a rebound from the level of 1.1584 and the restoration of the downward trend (1.1563) will make the supports of the classic pivot levels (1.1558 - 1.1537 - 1.1511) relevant again.

GBP/USD

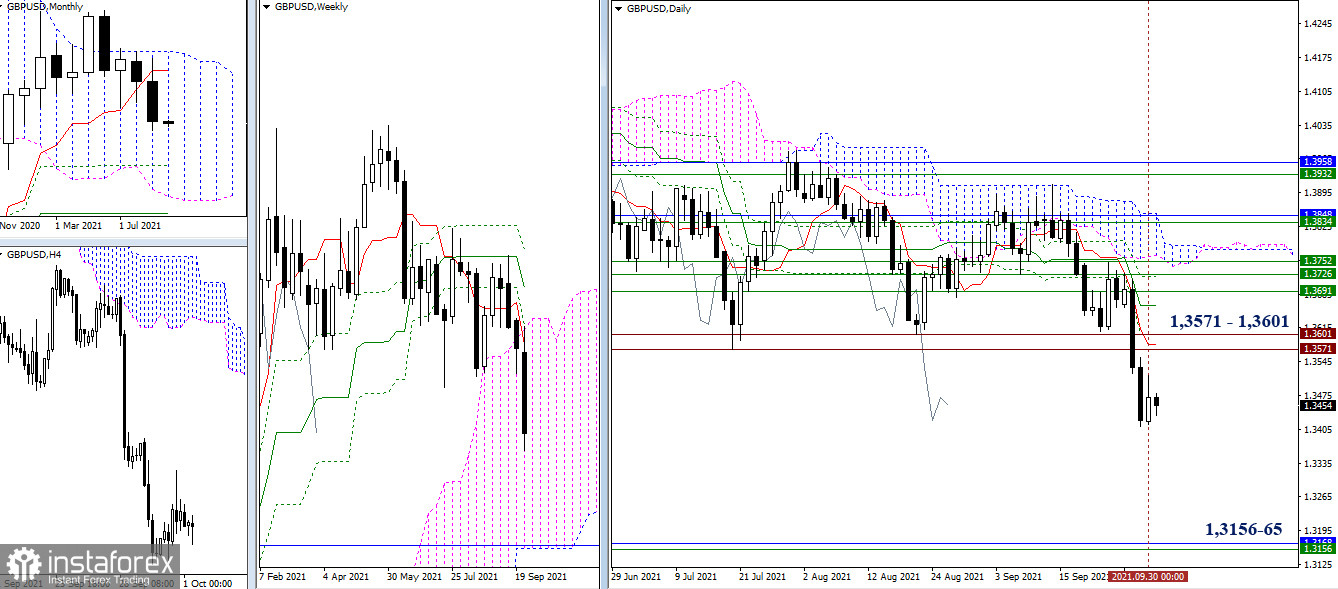

Despite yesterday's slowdown, the bears managed to maintain their bearish character and priority at September's closing. If the decline continues, the bearish interests will be directed to the area of 1.3156 - 1.3165 (lower border of the weekly cloud + monthly Fibo Kijun). The combination of the levels overcome earlier 1.3571 - 1.3601 (historical extremes + daily short-term trend) will act as the nearest resistances levels.

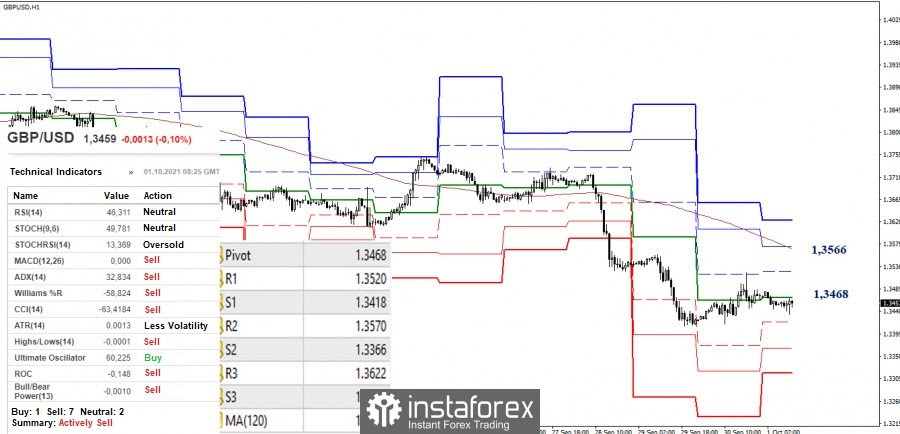

The main advantage in the smaller timeframe continues to be on the bears' side, but this pair has been in the correction zone for a long time. The bulls are fighting for the central pivot level set at 1.3468 on the second day. It should be noted that a consolidation above it could strengthen the bullish positions so much that they want to test the next important level – the weekly long-term trend (1.3566). The closest resistance along the way can be noted at 1.3520 (R1). Meanwhile, the interests of the bears today are represented by the supports of the classic pivot levels at 1.3418 - 1.3366 - 1.3316.

***

Ichimoku Kinko Hyo (9.26.52) and Kijun-sen levels in the higher time frames, as well as classic Pivot Points and Moving Average (120) on the H1 chart, are used in the technical analysis of the trading instruments.