The bitcoin market has finally reached the stage where it managed to push the price beyond the narrow range of fluctuations of $42.5k-$43.8k. This was due to price stabilization and positive news, which contributed to the activation of investors. The coin has managed to confirm its predisposition to growth, and if the similar dynamics of price movement continue in October, then bitcoin will reach $100k in 2022. In the coming month, the cryptocurrency may well reach a historical maximum and create the prerequisites for a powerful rally in November-December.

Bitcoin was within a narrow range of fluctuations for most of the first of October, but later this day, the market intensified. As a result, over the past day, BTC has risen by 9% and as of 15:00 UTC, it is trading at $47.5k. At the same time, the positive dynamics of price movement in the two-hour chart remains, and daily trading volumes have reached $40.6 billion. The main reasons for the growth of the cryptocurrency, in addition to the stabilization of the exchange rate over the past week, are called sanctions relief from Iran.

However, the main catalyst for the growth of BTC was the statements of the US regulatory authorities: the chairman of the SEC announced the approval of a bitcoin ETF fund in the country. This is an extremely important event for the entire market, which is most likely to happen in the second half of autumn or winter of this year. The creation of such a fund can multiply the capitalization of the first cryptocurrency and the entire market. And the chairman of the Fed assured investors that no one is going to ban the cryptocurrency in the country.

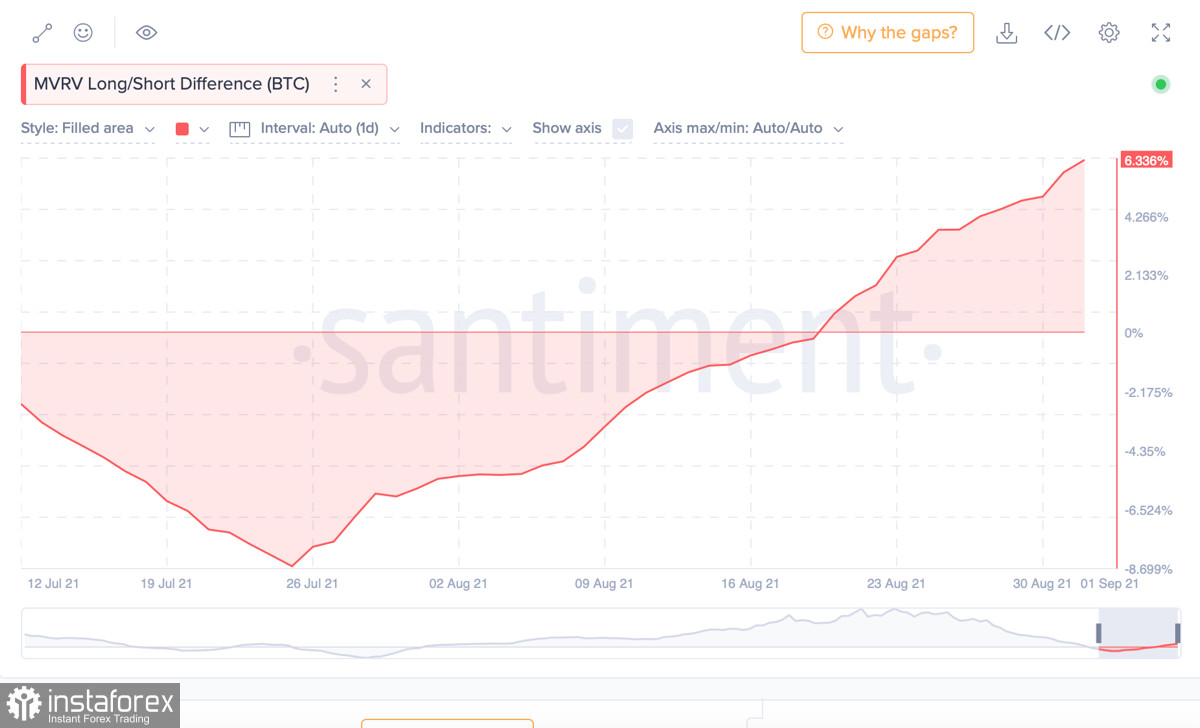

Taking into account the positive news and the resumption of mining in Iran, the market took heart and began to push the price up. The stabilization period allowed the coin to rise in price to $47.5k and pull the altcoin market with it. Despite this, the technical indicators of the cryptocurrency indicate the possibility of a short-term correction. This is due to the excessive activity of retailers and the formation of a bullish wedge on the four-hour chart. Despite this, there is no doubt that the market is starting to thaw after the fall on September 13. This suggests that most of the volumes sold during the collapse were bought up by investors. In addition, there is an increase in the number of longs relative to shorts in the spot and futures markets. This indicates the growth of the retail audience, but it can also become a manipulative tool in the hands of bears.

Despite this, the crypto asset looks confident on the daily chart and continues to consolidate at the foot of $47.5k. The MACD indicator came out of the red zone and formed a bullish intersection, and the stochastic reached 80 after forming a bullish intersection. The current position of the oscillator also signals a possible correction, so it's too early to accelerate. At the same time, the RSI indicator remains near 60, but continues to grow. The maximum program for BTC will be the completion of the trading day above the $47.5k mark. In this case, the price may break through the $48k mark and get close to $50k on the weekend.

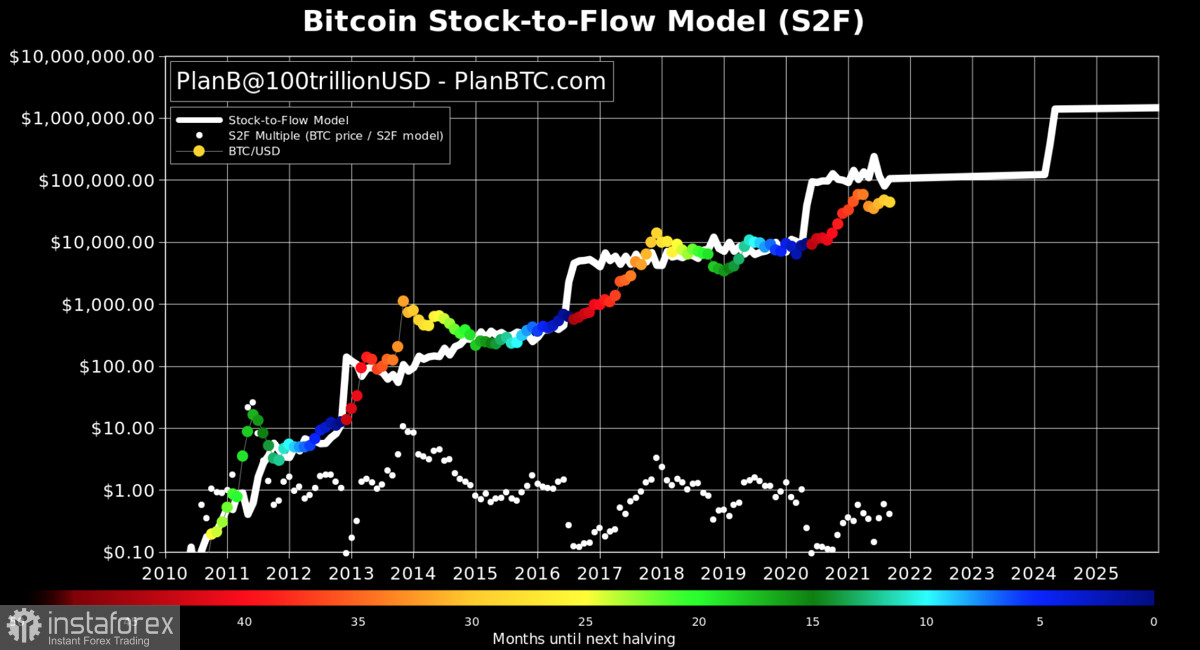

In the long term, there is another extremely important factor that is still working like clockwork. We are talking about the crypto analyst PlanB, who predicted bitcoin at $100k by the end of 2021. An important argument in favor of the algorithm was the end of September at the level of $43k. According to the forecast, the next stop of Bitcoin in October will be the level of $63k. That is, we should not expect the establishment of a new historical record from bitcoin in October, but according to calculations, the cryptocurrency will cost $98k in November, and $135k by December. The probability of such a calculation still causes skepticism, but the S2F model won the first autumn victory, and October will be the final test for investors before a large-scale purchase.