EUR/USD

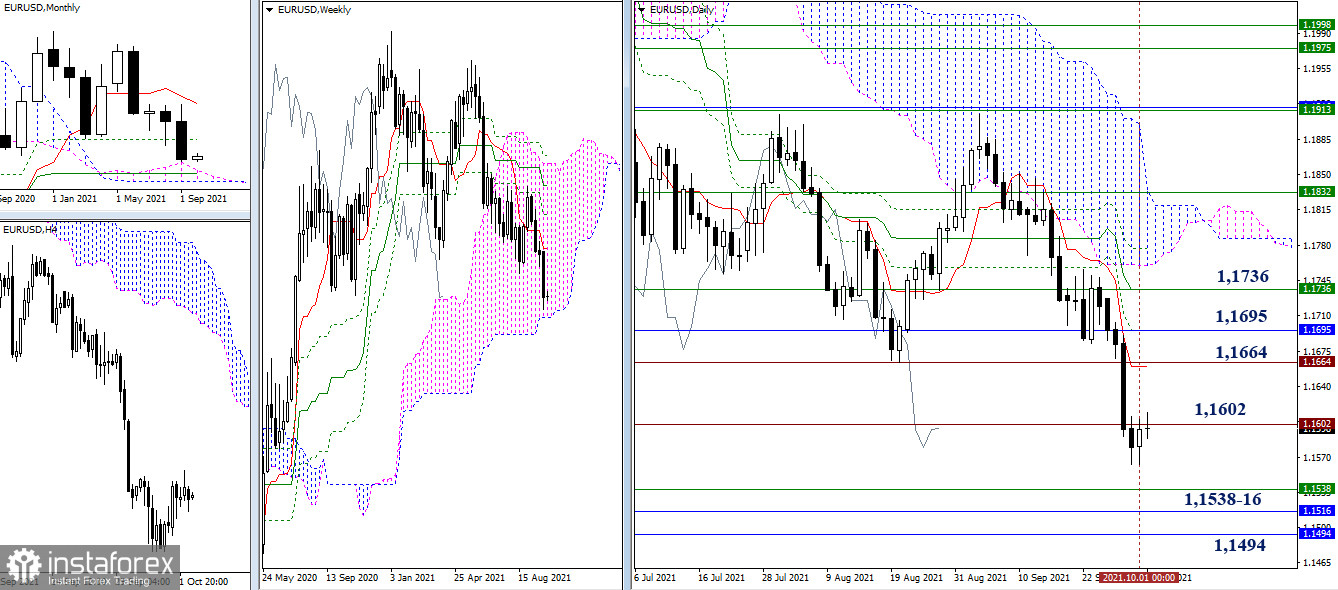

After ending September at the support of the monthly cloud (1.1561), the euro slowed down until the end of the previous week. Today, the situation can be re-evaluated by considering the current location of the main pivot points. At the moment, the border of the historical level of 1.1602 (the past minimum extreme) provided some attraction. The levels broken earlier are currently forming a fairly wide resistance zone 1.1664 (daily Tenkan + extremum of the past) - 1.1695 (monthly Fibo Kijun + daily Fibo Kijun) - 1.1736 (weekly Tenkan + daily Kijun).

As the new month begins, the location of some levels of the monthly Ichimoku changed. As a result, the downward pivot points are combining their efforts in the area of 1.1538 - 1.1516 - 1.1494 (lower border of the weekly cloud + upper border of the monthly cloud + monthly medium-term trend).

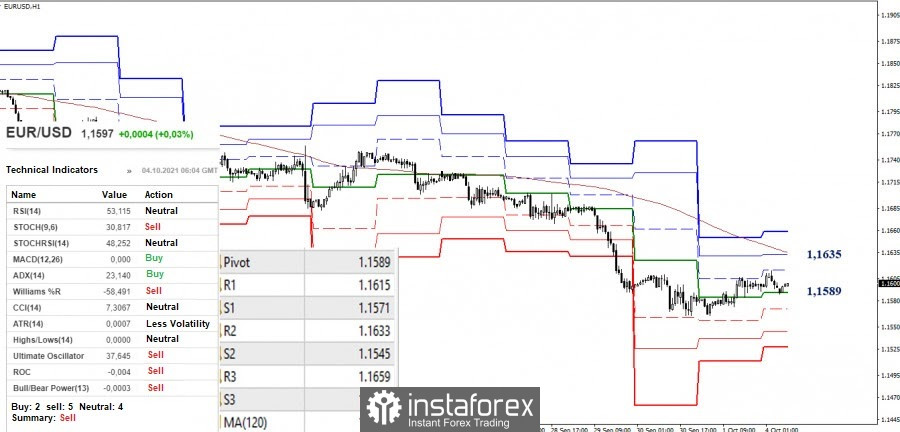

An upward correction is developing in the smaller timeframes, although the overall advantage continues to be on the bears' side. The balance of forces acting on the hourly chart may change only by breaking through the weekly long-term trend, which is the level of 1.1635. Consolidating the pair above and reversing the moving average will help strengthen the bullish positions and the emergence of new prospects. The current central pivot level acts as support, helping bulls to keep the level of 1.1589. But if bearish mood and activity return to the market, the relevance will return to the supports of the classic pivot levels set at 1.1571 - 1.1545 - 1.1527.

GBP/USD

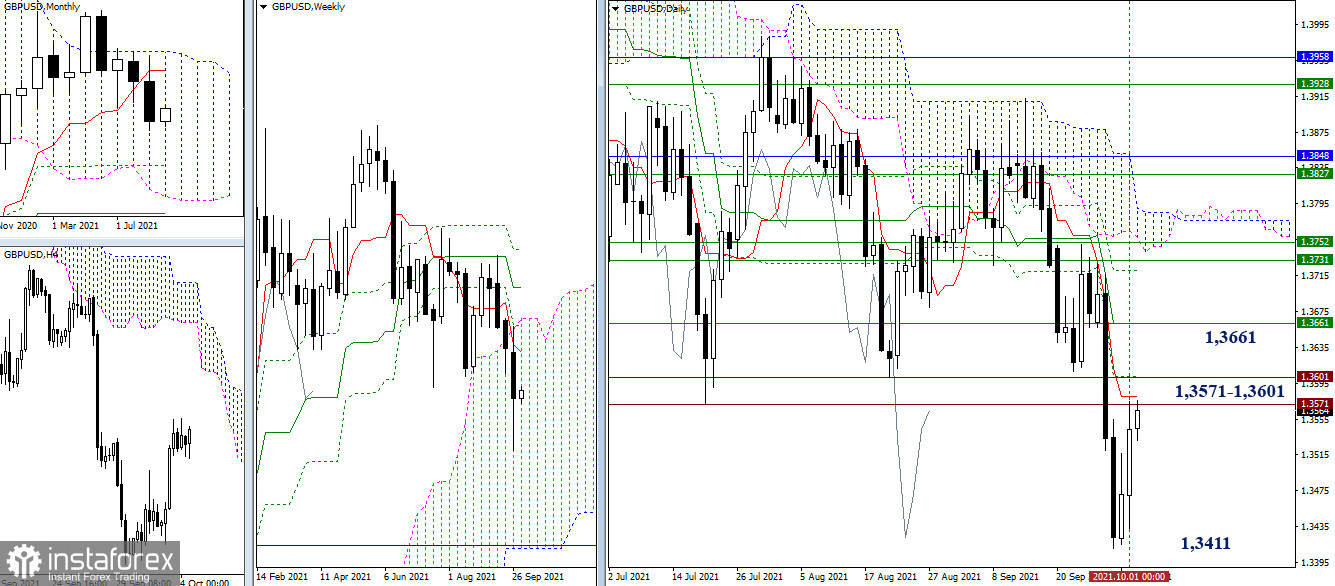

Bearish traders were more convincing at September's close than at last week's close. The formation of a long lower shadow from the recent weeks returned the pound to the area of the levels 1.3601-1.3571 passed the day before (extremes of the past + daily levels). In case of consolidation above these resistances, the interests of the bulls will shift to the level of 1.3661 (daily Kijun + weekly Tenkan). As for the bears, their main task now is to decline and update last week and September's low of 1.3411.

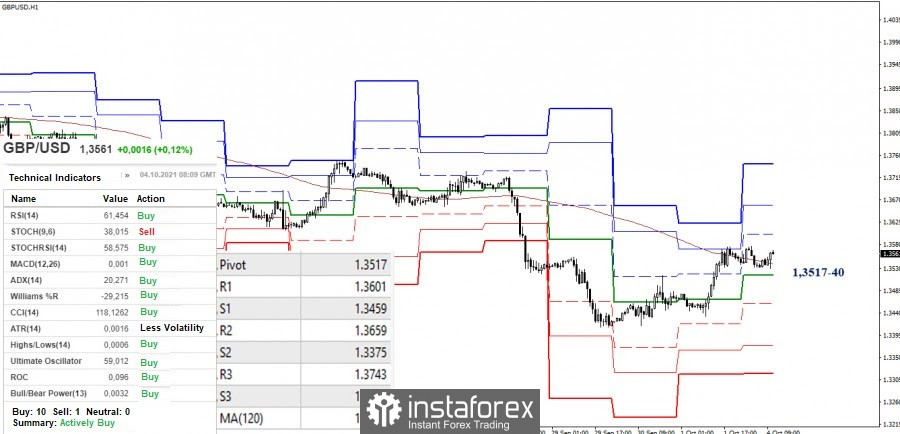

At the moment, there is a struggle for key levels in the smaller timeframes, which uniting their efforts in the area of 1.3517-40 (central pivot level + weekly long-term trend). A consolidation above and reversal of moving averages will change the current balance of forces in favor of the bulls. If so, the resistances of the classic pivot levels will become the upward pivot points. They are located at 1.3601 - 1.3659 - 1.3743.

On the contrary, the breakdown of the area of 1.3514-40 and consolidation below will allow us to consider a decline and restoration of bearish positions. The downward pivot points are the support of the classic pivot levels and the minimum extremum of 1.3459 - 1.3411 - 1.3375 - 1.3317.

***

Ichimoku Kinko Hyo (9.26.52) and Kijun-sen levels in the higher time frames, as well as classic Pivot Points and Moving Average (120) on the H1 chart, are used in the technical analysis of the trading instruments.