Last week bitcoin hit the local low, completed the consolidation phase and managed to go beyond the narrow range of fluctuations. BTC closed Friday at $47,500, and the weekend might have been both a powerful catalyst for growth and a reason for another decline. The cryptocurrency managed to continue its gain due to the lack of additional pressure of classical markets. It resulted in the asset's possibility to close a new week near $60.000. This view is indicated by fundamental factors and significantly increased activity of the crypto-asset market audience.

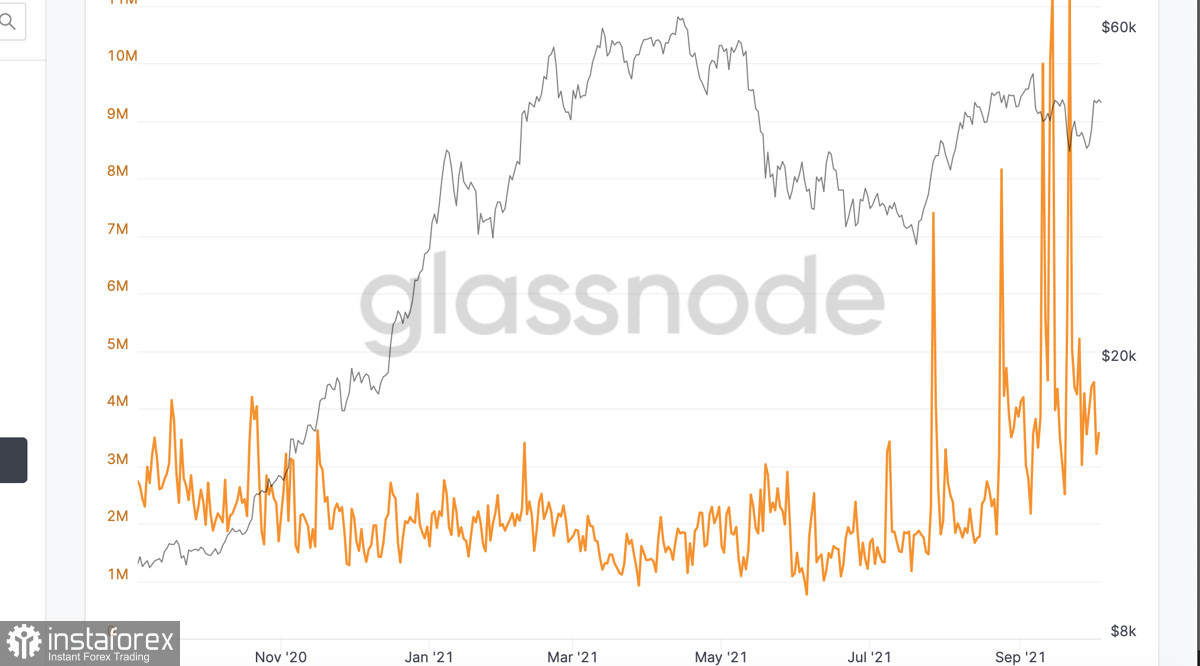

During the previous day BTC remained stable as the current range of $47,000-$50,000 has exerted increasing pressure on the price. Consequently, bitcoin needs time to stabilize the price and accumulate the volumes essential for moving in this zone. This situation was predicted at the end of last week with technical indicators declining near $48,000. Despite the break, there are reasons to believe that the cryptocurrency will move through this range without difficulties during the week. Both crypto's on-chain metrics and technical charts confirm this fact. The main reason for optimism was a sharp boom of transaction volumes in BTC. It surged from $13 billion to $16 billion at the end of September. Consequently, bitcoin's transaction volumes reached the indicators of April 2021, when the coin hit an all-time high of $64,400.

Moreover, huge bitcoin holders became active. According to Whalemap, they have been buying up BTC since September 24 and resuming this trend. A surge of whale activity suggests that the accumulation phase is coming to an end and the market is trying to level out the pressure from the coins in circulation as soon as possible. It is also a clear signal to enter the bull market.

Another extremely significant difference between the current state of bitcoin's audience and previous growth attempts is the lack of divergence between the number of unique addresses and the asset price. This fact suggests that both retail traders and large capital are interested in the cryptocurrency's further growth by October 4. It makes the chance of price manipulation by big capital lower and the support zones stronger. In other words, the BTC on-chain activity is ready for long-term growth.

The daily bitcoin chart shows fluctuations and lack of a single direction of price movement. Buyers faced increased resistance from the bears and the market is in the stage of local accumulation to start moving through this range. A temporary break is also marked by technical indicators, which began to decline after a prolonged rally since Friday. This suggests the completion of the upward impulse: MACD indicator formed a bullish cross. However, it was not possible to finish the impulse, and the line resumed declining. Stochastic oscillator reached 80 and started falling after it formed a bearish cross, and the RSI indicator climbed 60 and started declining. The daily chart demonstrates a clear sideways movement and hints of a quick correction after a long rally.

On the 4-hour timeframe, BTC technical indicators have already reached the local low and started to rebound. The RSI fell to 60 and began a sideways movement. Besides, the stochastic declined to 30. However, it started rebounding and may soon form a bullish cross. Meanwhile, MACD indicates a continuation of the downward trend and no visible impulse for growth. Overall, the situation with bitcoin suggests further growth after price stabilization and technical indicators that signal a local correction. Notably, it is possible to assume that by the end of the current week bitcoin may reach $60,000 due to increasing whale and retail audience activity.